CBO’s Latest Budget Projections: A Deteriorating Fiscal Outlook

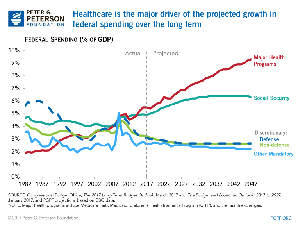

According to CBO, the fiscal condition of the United States has deteriorated since its last report issued in August.

https://www.pgpf.org/analysis/cbo%E2%80%99s-latest-budget-projections-a-deteriorating-fiscal-outlook