You are here

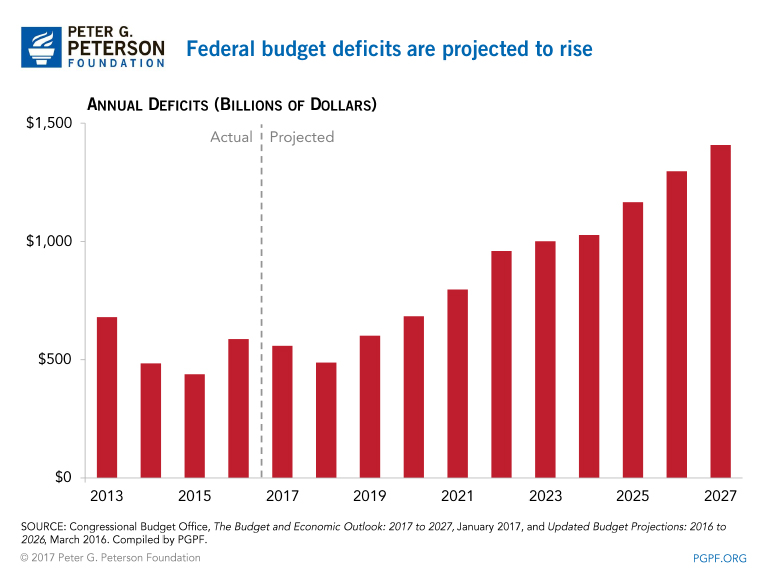

CBO Warns: Deficits Will Reach $1 Trillion In 2023

Highlights

As the new president and Congress prepare their policy agenda for 2017, the nonpartisan Congressional Budget Office (CBO) reports that America continues to face serious fiscal and budgetary challenges. CBO projects that, on our current path, deficits will reach $1 trillion by 2023 and total $9.4 trillion over the next ten years.

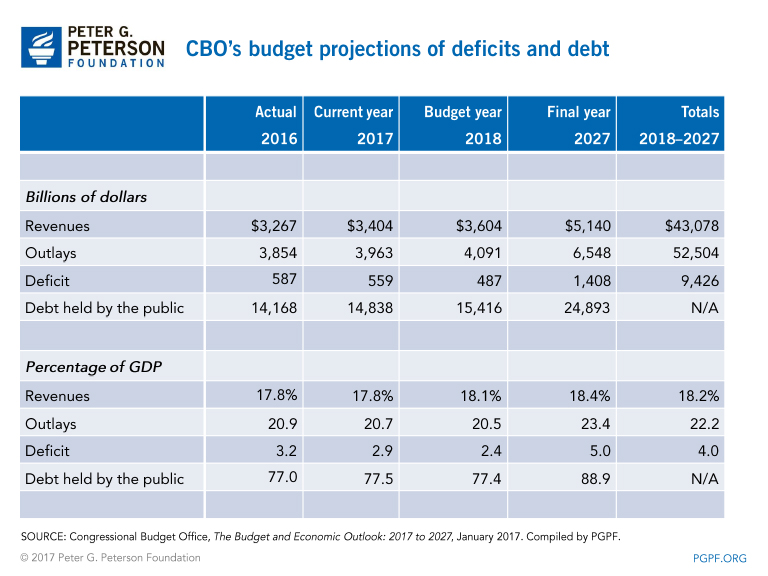

The nation’s budget deficit stems from a structural mismatch between revenues and spending. Over the next ten years, CBO projects that revenues will grow by $1.7 trillion, while spending will grow by $2.6 trillion, due primarily to increases in spending on mandatory programs and interest costs.

In the new report, CBO projects that:

- The budget deficit will total $559 billion this year — $120 billion higher than it was just two years ago.

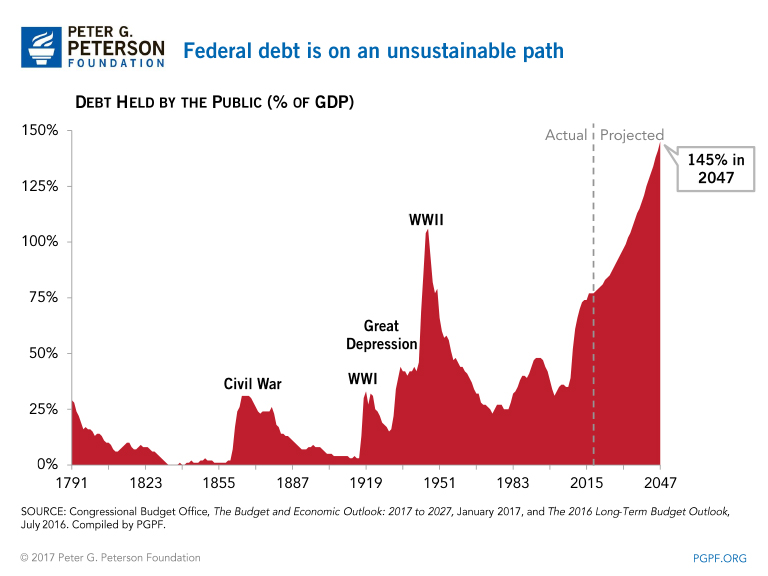

- The national debt will climb significantly over the next ten years, reaching 89 percent of gross domestic product (GDP) in 2027 — more than double the 50-year historical average of approximately 40 percent.

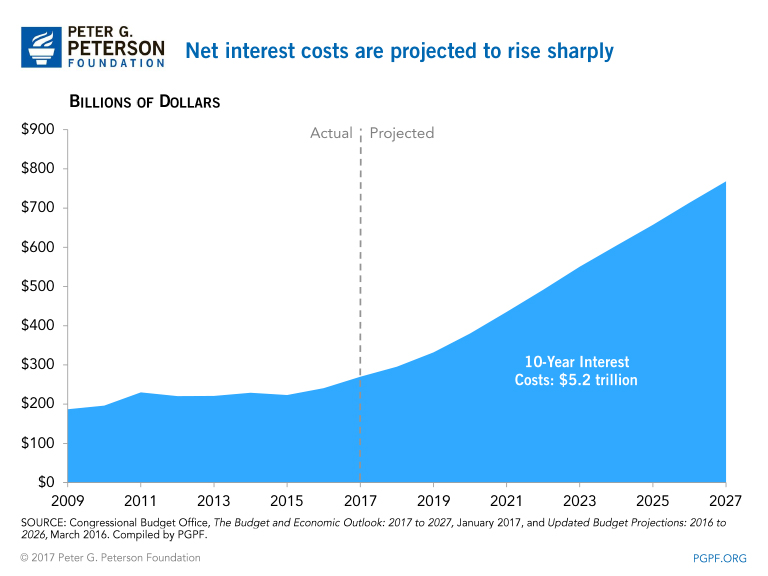

- Interest costs on the debt will rise sharply. Over the next ten years, net interest will total $5.2 trillion.

CBO warns that our structural fiscal imbalance puts our economy at risk over the long-term:

“Such high and rising debt would have significant consequences, both for the economy and for the federal budget. In particular:

- Federal spending on interest payments would increase substantially as a result of rising interest rates, such as those projected to occur over the next few years.

- Because federal borrowing reduces national saving over time, the nation’s capital stock ultimately would be smaller, and productivity and income would be lower than would be the case if the debt was smaller.

- Lawmakers would have less flexibility to use tax and spending policies to respond to unexpected challenges, such as significant economic downturns or financial crises.

- The likelihood of a fiscal crisis in the United States would increase.”

The federal deficit will grow significantly over the next ten years

CBO projects that the budget deficit will climb from $559 billion in 2017 to $1.4 trillion in 2027, resulting in a cumulative 10-year deficit of $9.4 trillion. Although deficits are projected to decline temporarily during the next two years, that decline stems “in large part because of shifts in the timing of some payments that affected outlays in 2016 and will do so again in 2017 and 2018,” according to CBO. The overall trend in the deficit is unmistakable — it rises sharply over the next decade.

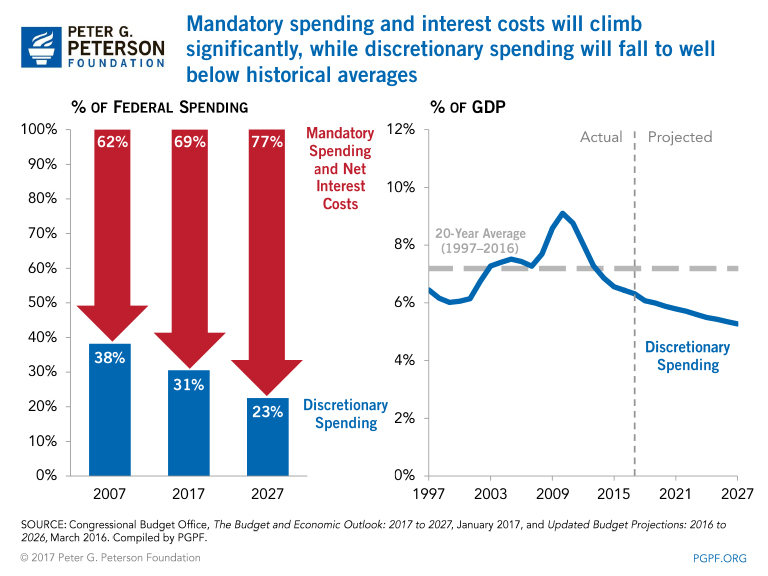

The rising deficits stem from a growing structural mismatch between the federal government’s spending and revenues. Over the next 10 years, CBO estimates that revenues will rise slightly from 17.8 percent of GDP in 2017 to 18.4 percent of GDP in 2027. Spending, however, is expected to rise significantly over the same period, increasing form 20.7 percent of GDP in 2017 to 23.4 percent in 2027. CBO projects that total federal spending will equal $52.5 trillion over the next 10 years, while total federal revenues will total only $43.1 trillion. Over the long term, this gap will continue to widen even further.

Federal debt reaches historically high levels

CBO projects that federal debt will climb to 89 percent of GDP in 2027. Historically, that is a very high level of debt. Since 1790, there have only been four years in which the debt was above 85 percent of GDP, and those were during and just after World War II. After the war, debt began to fall sharply as a share of GDP as the economy grew and some debt was paid down. Today, the budget outlook is much more worrisome because projections show a more permanent and dramatic increase in debt not because of war but because of growing spending on mandatory programs and interest, coupled with inadequate revenues.

Interest costs are projected to climb due to growing debt and rising interest rates

As debt continues to accumulate and interest rates increase, net interest costs are projected to more than double over the decade, increasing from $270 billion in 2017 to $768 billion in 2027. Over the next 10 years, interest costs will total $5.2 trillion. As they grow, interest costs will crowd out important investments in our future that fuel economic growth, such as infrastructure, R&D, and education.

The Federal Reserve has recently tightened monetary policy by raising interest rates. The Fed increased its benchmark interest rate on federal funds by 25 basis points in December 2016, its second increase since the financial crisis. Using calendar years, CBO forecasts that the interest rate on 3-month Treasury bills will climb from 0.7 percent in calendar year (CY) 2017 to 2.8 percent in CY 2027. Interest rates on 10-year Treasury notes are projected to increase from 2.3 percent in CY 2017 to 3.6 percent in CY 2027.

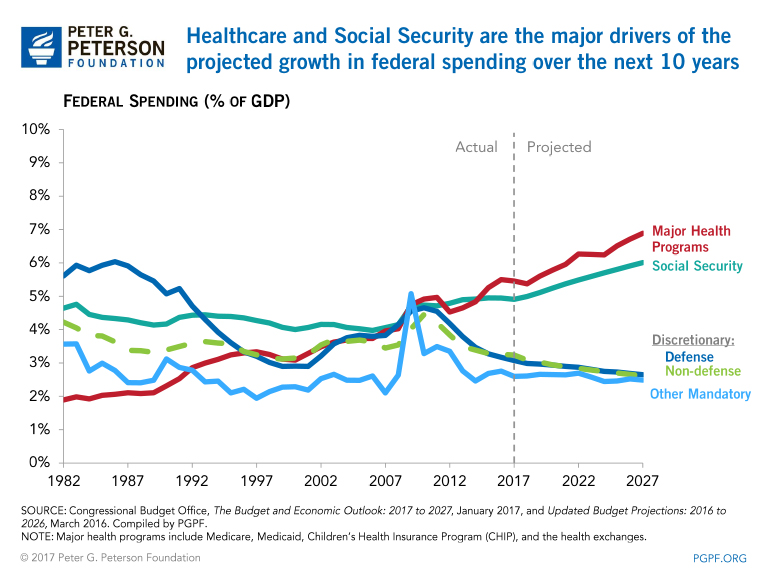

Mandatory spending is projected to climb in the coming years

Mandatory spending (excluding net interest) is projected to increase from $2.5 trillion in 2017 to $4.3 trillion in 2027.

- Major Health Care Programs: CBO projects that net spending on the major health care programs will climb from $1 trillion in 2017 to $1.9 trillion in 2027. That increase reflects the growth of three major programs:

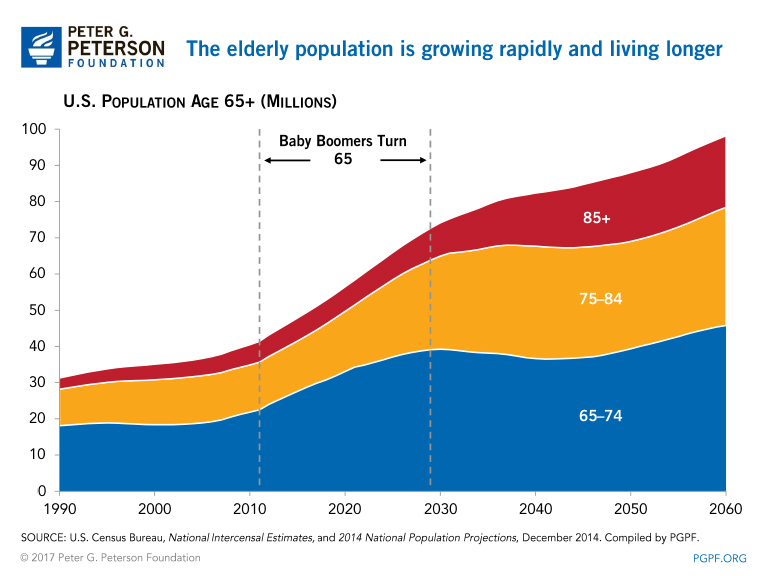

- Medicare: With the aging of the population and an increase in costs per beneficiary, net spending for Medicare will rise from $592 billion in 2017 to nearly $1.2 trillion in 2027.

- Medicaid: Medicaid spending is expected to rise from $389 billion in 2017 to $650 billion in 2027.

- Exchange Subsidies: Spending on subsidies to help people purchase health insurance on the exchanges created by the Affordable Care Act is projected to increase from $51 billion in 2017 to $106 billion in 2027.

- Social Security: Spending on Social Security, currently the largest federal program, will grow by 79 percent, rising from $940 billion in 2017 to $1.7 trillion in 2027, driven primarily by the retirement of the large baby boom generation.

Discretionary spending is projected to decline

As spending on mandatory programs and interest costs continues to rise, federal spending on discretionary programs such as education and national defense will decline from 6.3 percent of GDP in 2017 to 5.3 percent in 2027. This would be a historically low level of discretionary spending — 27 percent below its 20-year historical average. Discretionary spending funds a wide range of programs including research and development, infrastructure, and a host of other programs.

The time for policymakers to act is now

CBO’s recent report provides yet another stark warning that our nation’s fiscal outlook is unsustainable and dangerous. CBO warns that the unsustainable trajectory of our long-term debt threatens to restrain future economic growth. Over the long term, CBO projects that by 2047, debt held by the public will reach an unprecedented 145 percent of GDP. This growing debt reduces our ability to invest in the future, gives us less flexibility to respond to unexpected challenges, and increases the risk of a fiscal crisis.

The new Administration and Congress have a range of proposals across a number of policy areas that they will consider. At the same time, they have an important opportunity to enact sensible reforms that put our fiscal trajectory on a sustainable path. To ensure that reforms will be durable, lawmakers should work together and across party lines to build a strong fiscal foundation for our economy and for future generations of Americans.

Read the Statement from the Peterson Foundation on CBO’s Budget and Economic Outlook.