You are here

Economic Growth Slowed Significantly in Second Quarter — and Is Projected to be Lower This Year Than Last

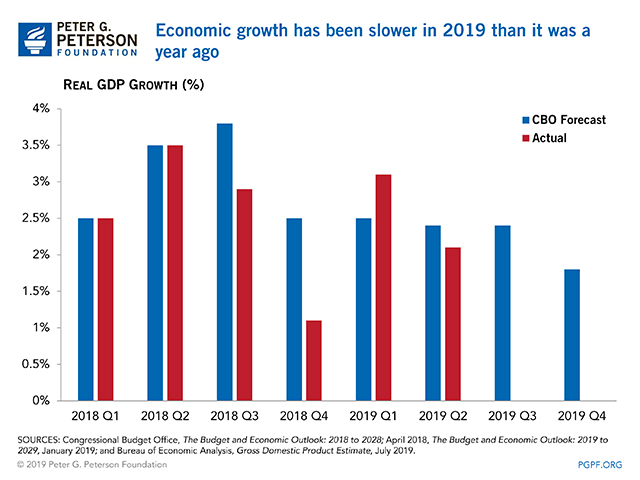

Real (inflation-adjusted) gross domestic product (GDP) grew by 2.1 percent in the 2nd quarter of 2019, according to last week’s announcement by the Bureau of Economic Analysis. Compared to 3.1 percent growth in the first quarter of 2019, second quarter growth is a significant slow-down.

Growth is forecasted to slow in 2019

While growth in 2019 has exceeded expectations so far, growth rates largely have conformed to forecasts, and many economists expect growth to remain lower in 2019 than in 2018. This is the result of the fading effects of economic stimulus from the Tax Cuts and Jobs Act (TCJA) and from the additional appropriations enacted in early 2018. Meanwhile, a strong job market and consumer spending are balancing the negative effects of trade tensions and a slowing global economy.

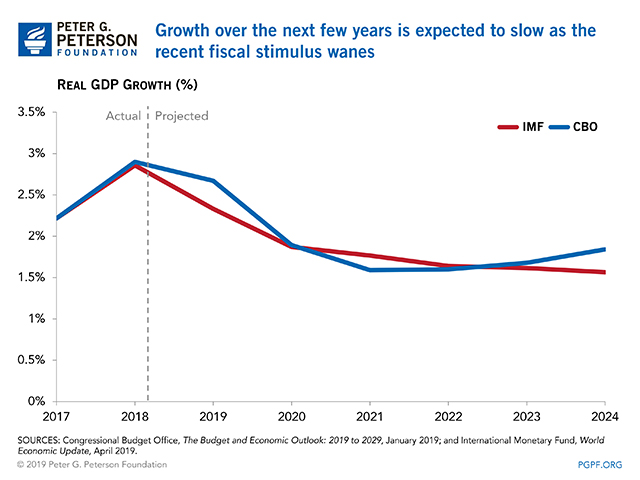

Growth rates will ebb over the next decade

Looking further into the future, forecasters believe that growth rates will continue to ebb as the GDP-boosting effects of the TCJA and increased appropriations continue to fade. The International Monetary Fund’s (IMF) forecast for growth in 2019 was revised upward earlier this month to 2.6 percent, due to stronger than expected first-quarter performance. It continues to expect growth to soften to 1.9 percent in 2020.

Those projections are echoed by the Congressional Budget Office (CBO), whose most recent economic report projects annual GDP to grow by 2.7 percent in calendar year 2019 and by 1.9 percent in 2020. By 2023, CBO projects that GDP growth will drop to 1.7 percent, while the IMF projects growth of 1.6 percent.

The Deficit is Rising During a Period of Strong Economic Growth

Normally, rapid growth in GDP would lead to a reduction in the deficit as revenues increase and spending for programs such as unemployment compensation decreases. However, despite the current economic expansion and low unemployment, our fiscal outlook is worsening — a highly unusual occurrence during a time of economic expansion. This is happening because the positive fiscal effects of economic growth have been more than offset by legislative changes that have widened the gap between revenues and spending. For example, just this week, the Bipartisan Budget Act of 2019 was passed by the House; if enacted, the legislation is expected to increase debt by $1.7 trillion over 10 years.

Both CBO and IMF expect that economic growth has cooled but will remain steady, as slow expansion of the labor force and levels of productivity similar to historical averages will limit GDP growth in the future. Now, while the economy is strong, lawmakers should take advantage of the opportunity to get our fiscal house in order. There’s no reason to be piling debt onto future generations — especially during a strong economy — and there is no shortage of options to pay for priorities while improving our fiscal sustainability.

Related: What Is The National Debt Costing Us?

Image credit: Photo by George Frey/Getty Images