You are here

The Federal Government’s Support for Low-Income Housing Expanded during the Pandemic

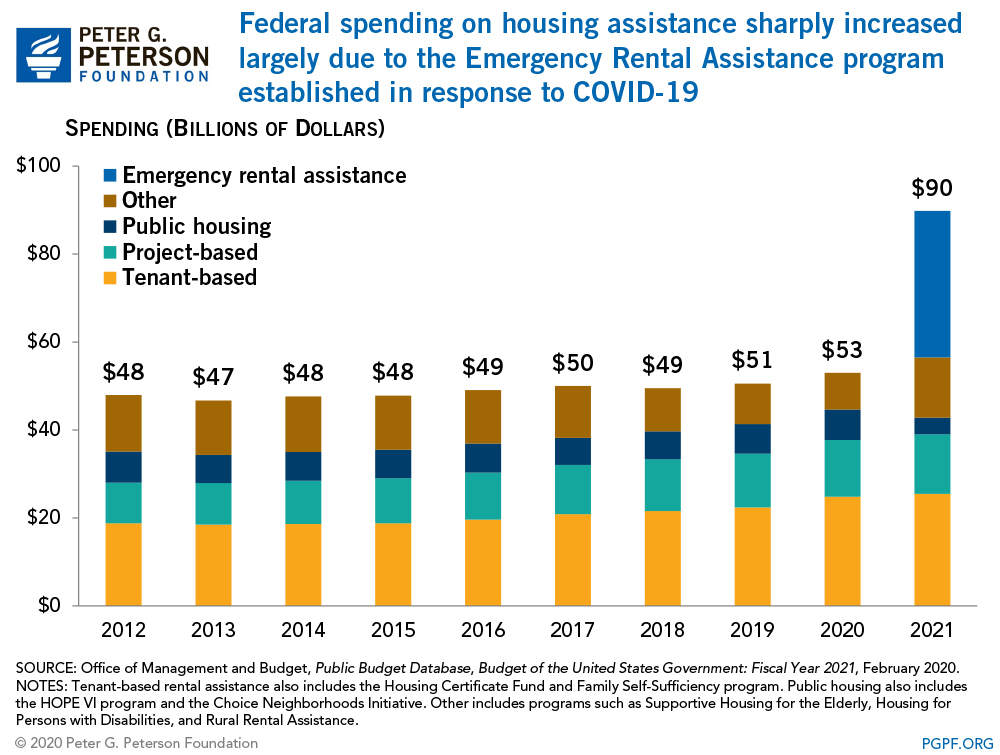

The federal government spent $90 billion on housing assistance 2021, an increase of almost 70 percent from the preceding year, largely due to legislation enacted in response to the coronavirus (COVID-19) pandemic. Four programs that provided rental assistance to low-income households accounted for 85 percent of the spending ($76 billion). Here are some details on those four programs and the individuals served by them:

- Emergency Rental Assistance (ERA) Program ($33 billion). A short-term program established in response to the COVID-19 pandemic that makes funding available to assist households unable to pay rent or utilities. The funds are provided directly to states, U.S. territories, local governments, and Indian tribes, who then use it to assist eligible households.

- Tenant-based rental assistance ($25 billion). Low-income households receive a voucher that allows them to choose housing in the private market while paying 30 percent of their income toward rent. The voucher, administered by local public housing authorities (PHAs), covers the remainder of the rent.

- Project-based rental assistance ($14 billion). The Department of Housing and Urban Development (HUD) enters into contracts with property owners who have agreed to rent their units to low-income households. The households pay 30 percent of their income toward the rent and HUD makes up the difference. HUD has allowed such contracts to expire gradually over time and has been switching households to tenant-based assistance.

- Public housing ($4 billion). In this arrangement, PHAs own and operate housing units and rent them directly to low-income households, who pay 30 percent of their income. HUD provides regulatory oversight and allocates funding to PHAs to support operating costs and capital improvements.

Aside from the four programs above, the federal government spent an additional $14 billion in 2021 on other programs including those targeted to the elderly, people with disabilities, and rural renters.

Who Is Eligible For Rental Assistance?

Households must have incomes below certain levels — 50 percent of the local median income for tenant-based assistance and 80 percent of the local median income for project-based assistance, public housing, and the ERA program. Under ERA though, priority is given to households below 50 percent of the local median income or those who have been unemployed for 90 days. For the other three large programs, a certain amount of support is reserved for extremely low-income households, which are defined as those earning less than 30 percent of the local median income. However, rental assistance is not an entitlement program, meaning that meeting the eligibility requirements does not guarantee that a household will receive benefits.

Who Receives Rental Assistance from the Federal Government?

Congress provided assistance for the ERA program through two different laws passed in December 2020 and March 2021. A total of 3.8 million payments were made to eligible households in 2021 with some households receiving assistance from both ERA1 and ERA2. The other three main rental assistance programs served 4.4 million households. Tenant-based assistance served 2.4 million households, project-based assistance served 1.2 million, and 825,000 households were in public housing.

The demographic profile of those households differs from that of the U.S. population as a whole. For example, while two-thirds of U.S. households are categorized as “White, not Hispanic”, only one-third of rental assistance households (excluding ERA) fall into that category. In addition, while only 10 percent of U.S. households are composed of a single father or mother, almost one-third of rental assistance households (excluding ERA) have only one adult living with children.

How Robust are Housing Benefits?

The rental assistance programs provide much-needed benefits to low-income families. For example, the average household that receives tenant-based assistance pays $395 per month toward a total rent of $1,278. However, that assistance does not necessarily solve housing-related difficulties. The total income for those families is about $1,300 per month, on average, which leaves them with just $905 for all other expenses each month. Moreover, those households spent an average of over two years on a waiting list (much higher in places like New York) before receiving any benefits and often live in a housing unit with no bedrooms or one bedroom.

Rental Assistance is a Key Part of the Safety Net

The four largest rental assistance programs help to ensure that millions of households can afford adequate housing rather than face homelessness due to paying rent that exceeds their income. The ERA alone made a total of 3.8 million payments to eligible households in 2021 with over 80 percent of its assistance delivered to very low-income households earning 50 percent of area median income or below.

Funding for housing nearly doubled in response to the pandemic to reach an all-time high of $90 billion. Still, this represents a relatively small part of the annual budget and serves some of the most economically vulnerable Americans. Unlike other parts of the safety net, funding for these major housing programs is not set in permanent law and is therefore subject to the annual appropriation process. That fact requires lawmakers to make a continual commitment and annual judgement about the appropriate level of funding by weighing the merits of the programs against other budgetary priorities, as well as our growing national debt.

Related: What is SNAP? An Overview of the Largest Federal Anti-Hunger Program

Image credit: Photo by Getty Images