You are here

How Much Has Coronavirus Relief Helped Healthcare Providers?

This is the sixth and final entry in our series exploring the effectiveness of the fiscal response to the coronavirus pandemic.

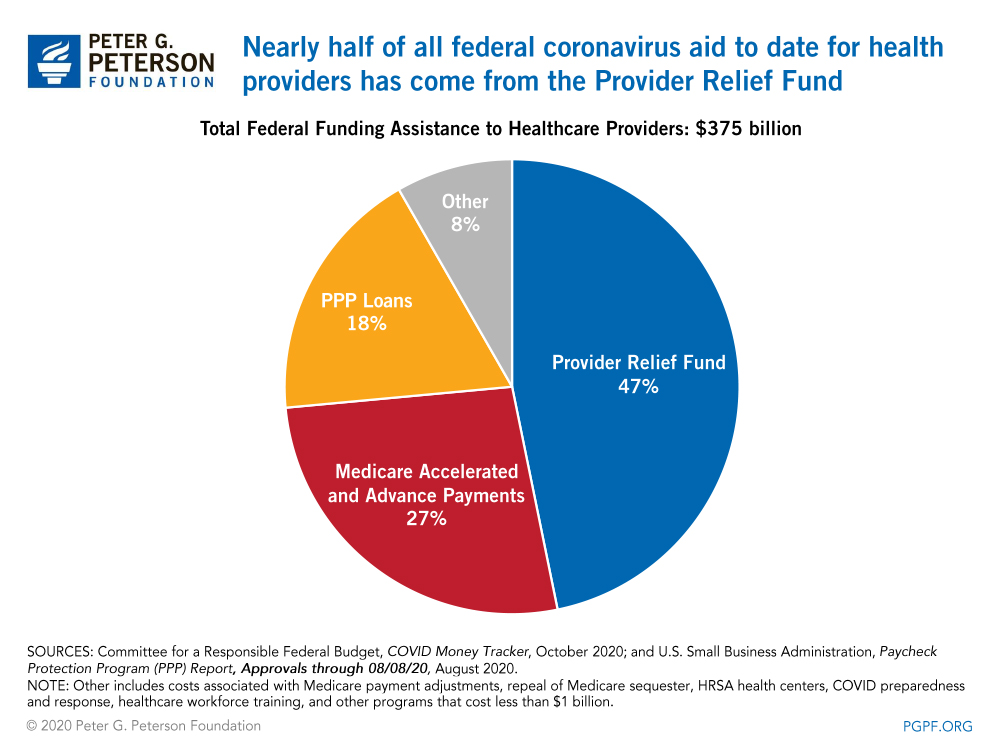

Hospitals, health providers, and healthcare workers have been on the front lines of the national effort to combat the coronavirus (COVID-19) pandemic since the onset of the virus. While some parts of the healthcare system have been overwhelmed caring for those affected by coronavirus, other parts of the system have seen reduced activity as people deferred or avoided care. That disruption in healthcare consumption has sharply reduced revenues for some parts of the healthcare system at the same time that providers have incurred higher costs to protect personnel and patients under their care. To assist with the unprecedented financial burdens facing many institutions, the federal government has provided roughly $375 billion in loans, grants, and other assistance to a diverse group of health providers. In this blog, the sixth and final in our series on the effectiveness of the nation’s fiscal response to the coronavirus pandemic, we evaluate the degree to which the federal assistance to hospitals and healthcare providers has helped one of the hardest hit sectors of the economy.

What Actions has the Federal Government Taken to Provide Financial Assistance to Healthcare Providers?

The coronavirus pandemic is placing a substantial strain on the finances of many organizations that provide healthcare. To mitigate the difficulties facing the healthcare sector, the federal government has enacted a number of grants, loans, and other programs:

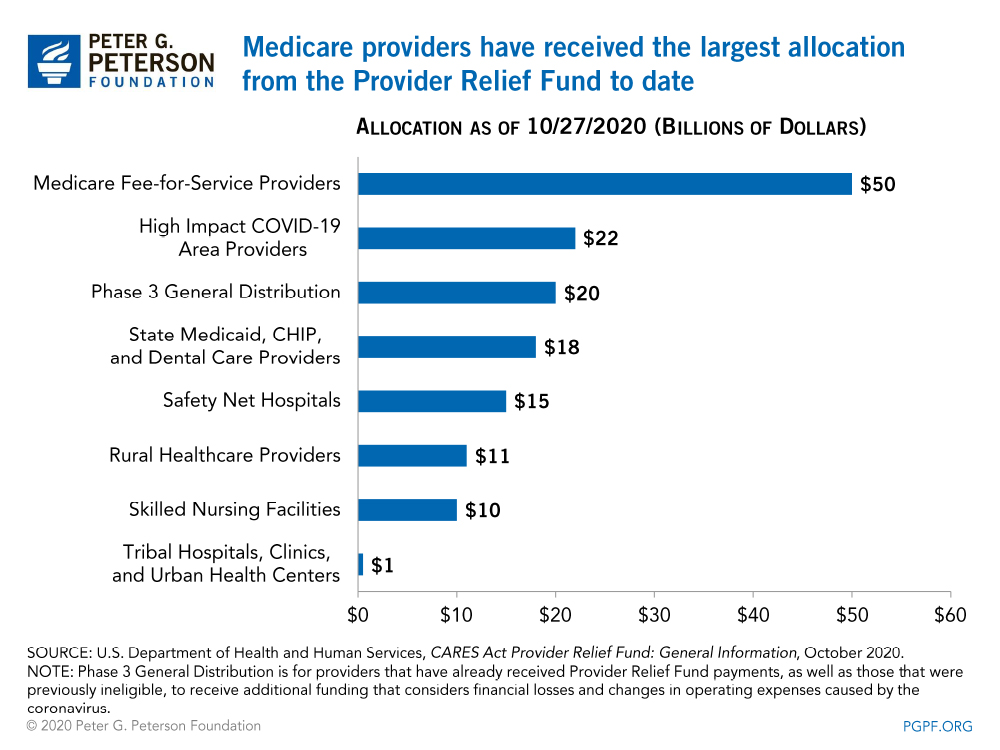

- The Provider Relief Fund, administered by the Department of Health and Human Services, is distributing $175 billion in federal grants to eligible healthcare providers to reimburse expenses or lost revenues that are attributable to the coronavirus pandemic. To date, roughly $147 billion has been allocated for specific purposes; about $96 billion of that amount has actually been disbursed to providers.

- Medicare Accelerated and Advance Payments Program provided $100 billion in loans to a broad set of hospitals, health professionals, and suppliers to cover cash shortfalls resulting from the pandemic; the recipients must begin repaying the loans in the spring of 2021.

- Small business loan programs, like the Paycheck Protection Program (PPP), distributed federally backed loans to qualified small businesses to help them maintain employees on the payroll and help cover rent and utilities. According to the Department of the Treasury, about $68 billion in PPP loans went to healthcare and social assistance providers.

- Other legislative actions include raising Medicare’s payment rate by 20 percent for inpatient admissions for patients diagnosed with COVID-19, repealing the automatic reductions in Medicare spending (“sequestration”) for fiscal years 2020 and 2021, financial aid to Health Resources and Services Administration (HRSA) testing and treatment centers, funding for coronavirus testing and vaccine research, and investments in HRSA workforce training. All other provisions account for $31 billion in federal assistance.

How Helpful has Federal Funding Assistance Been for Hospitals and Healthcare Providers?

The pandemic-related assistance to the healthcare sector has likely served as a financial lifeline for many providers, helping them cover foregone revenues and new coronavirus-related expenses while also maintaining employees on the payroll. What’s more, a substantial portion of that assistance has been targeted towards providers who serve the most vulnerable members of society. For example, the Kaiser Family Foundation (KFF) notes that over $90 billion of the loans in the Medicare Accelerated and Advance Payments Program went to providers that participate in Medicare Part A, which pays for critical functions for elderly recipients, such as inpatient hospital stays, skilled nursing facility stays, home health visits, and hospice care. The 20 percent increase to Medicare’s payment rate for coronavirus inpatient admissions also provided assistance to hospitals, who have treated more than 1 million patients in the program who had the virus.

The Provider Relief Fund also allocates funding to critical healthcare providers such as hospitals that serve a disproportionate share of low-income patients (also known as safety net hospitals), hospitals in rural areas, and providers in coronavirus hotspots. In addition to funding from the Provider Relief Fund, many struggling hospitals and healthcare providers were able to avoid furloughs and layoffs of workers because of PPP funding; the healthcare and social assistance industries received the highest percentage of PPP loan payments among all sectors of the economy. In the absence of such federal funding, many of those health providers might not have been able to sustain their operations throughout the public health crisis.

Although federal funding assistance to healthcare and social assistance providers has likely helped serve critical segments of the population, many analysts argue that the amount of federal assistance to the nation’s health systems has been insufficient. A report from the American Hospital Association (AHA), the trade association that represents hospitals, healthcare systems and networks, and other providers, estimates that between March 1 and December 31, 2020, America’s healthcare providers will incur a cumulative shortfall of at least $320 billion due to hospitalizations, costs associated with personal protective equipment, and support to hospital workers. In addition, according to the Centers for Disease Control and Prevention, an estimated 41 percent of U.S. adults had delayed or cancelled both emergency care and non-emergency procedures between March and June; the result has been a substantial loss in revenues because such activities typically represent about three-quarters of hospital admission spending. Worse yet, the public health crisis is showing no signs of abating, meaning the financial strain on hospitals and healthcare providers is likely to continue, possibly with more severity. For this reason, the AHA and other observers believe more federal funding may be critical throughout the remainder of the pandemic and into the recovery.

Some analysts also argue that the federal funding to providers could have been more effective. For instance, since the initial $50 billion allocated through the Provider Relief Fund was based on healthcare providers’ share of 2018 net patient revenue (known as the ‘General’ fund), that money was mostly directed to large, financially sound providers. An analysis by Health Affairs notes that the disbursement methodology shortchanged smaller, more vulnerable healthcare providers with limited cash on hand, many of which did not receive money through the Provider Relief Fund until months after the program was established. What’s more, KFF notes that because Medicare Accelerated and Advance Payment Program loans are an advance on reimbursement for fee-for-service Medicare only, health providers that predominantly serve the 24 million Americans enrolled in Medicare Advantage plans (which receive a monthly payment for the services that are provided to enrollees throughout the year) do not benefit from the program.

Conclusion

It is still too early to conclude definitively how effective federal assistance to hospital and healthcare providers has been. However, it is clear that the absence of such funding would have greatly exacerbated the difficulties facing the nation’s health systems, particularly smaller, rural, and independent providers that provide essential care to vulnerable members of society. As the global health crisis continues, it is likely that more federal aid to hospitals and healthcare providers — and by extension, the healthcare workers they employ — may prove critical to the nation’s overall efforts to combat the virus and keep Americans safe.

To learn more about federal coronavirus relief legislation, visit our coronavirus state tool, which breaks down the $1.8 trillion in funding that has been disbursed for loans and other federal programs for which state-level data is available.

Learn More: Interactive Tool: How Much Coronavirus Funding Has Gone to Your State?

Image credit: Photo by Drew Angerer / Getty Images