You are here

Pandemic Fuels Record-Breaking Deficits — and Other Key Takeaways from the Latest CBO Report

The Congressional Budget Office (CBO) released new baseline projections today, which show that the nation will face daunting fiscal challenges over the next decade resulting from the existing structural mismatch between revenues and outlays as well as the enormous amount of borrowing necessary to address the pandemic and its economic effects. The agency’s projections include all COVID-19 relief bills that have been enacted thus far, but don’t account for any pandemic relief currently being considered.

Here are the key takeaways from those projections:

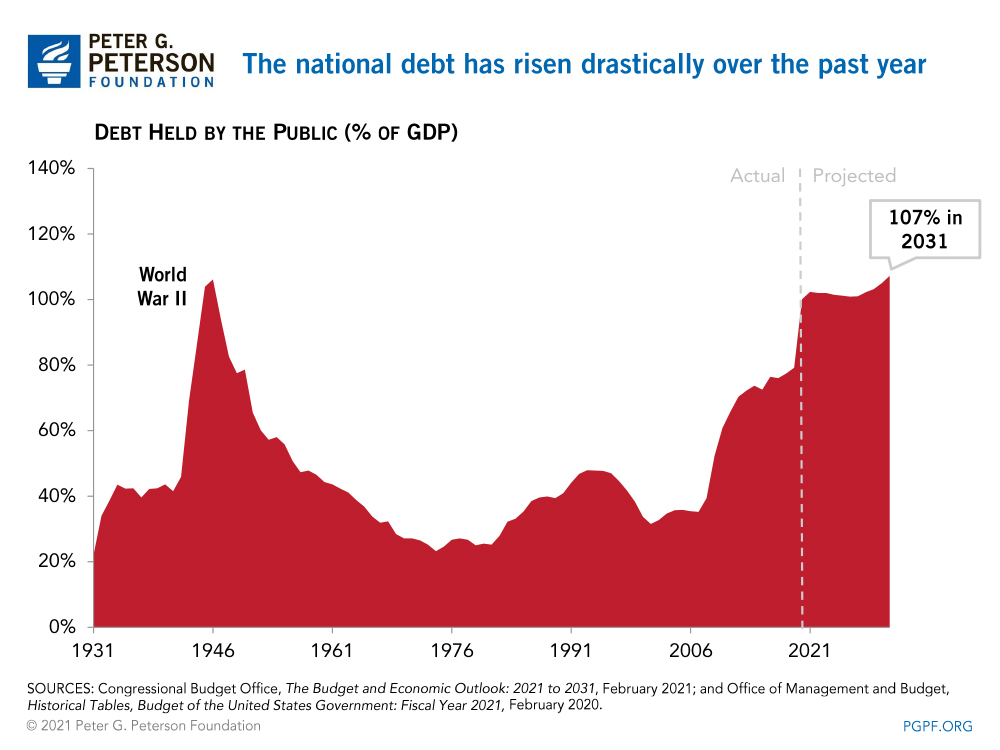

- The national debt will continue to grow, reaching the highest point in the nation’s history by 2031. Debt held by the public equaled the size of the economy in fiscal year 2020, and CBO expects that it will continue to climb over the next decade — from 102 percent of gross domestic product (GDP) in 2021 to 107 percent in 2031.

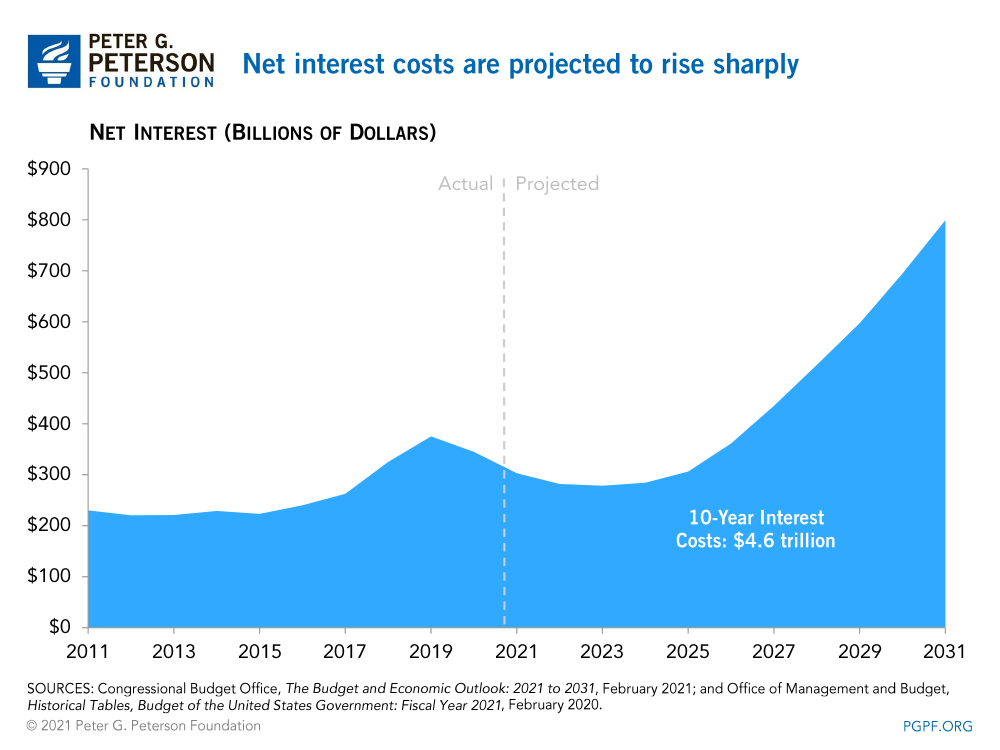

- Interest rates and net interest costs will rise over the next 10 years. Despite a $4 trillion increase in the national debt last year, interest costs were 8 percent lower than the year before — declining from $375 billion in fiscal year 2019 to $345 billion in 2020. That decrease stemmed from a decline in interest rates. CBO expects such rates to remain relatively low over the next few years, with short-term interest rates remaining near zero through mid-2024 and long-term rates gradually climbing from around 1 percent today to about 2 percent through the same time period. However, as the national debt continues to grow and interest rates begin to rise later in the projection period, the agency’s data reveals that interest costs will become the fastest growing component of the federal budget.

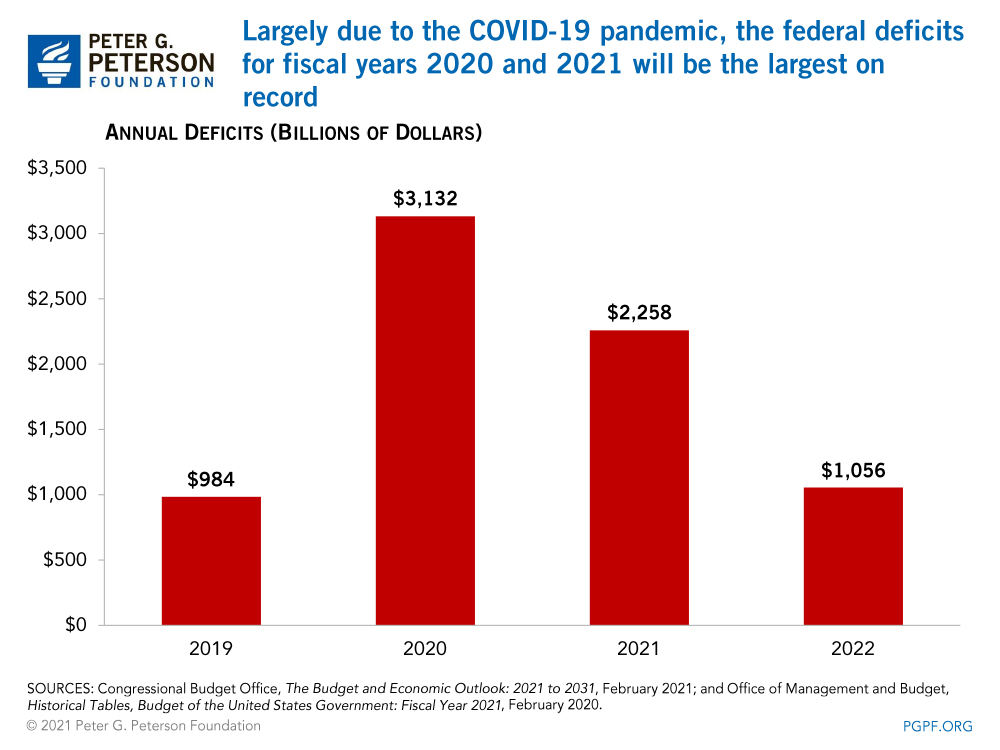

- In the absence of additional support related to the pandemic, the federal deficit would reach $2.3 trillion this year, the second highest amount ever. In fiscal year 2020, the federal deficit reached $3.1 trillion — the largest amount on record and more than triple the $980 billion deficit recorded in 2019 — primarily due to the legislation enacted to mitigate the economic and health effects of the COVID-19 pandemic. CBO anticipates that such legislation, including the relief package enacted in December 2020, will contribute to the large deficit this fiscal year as well.

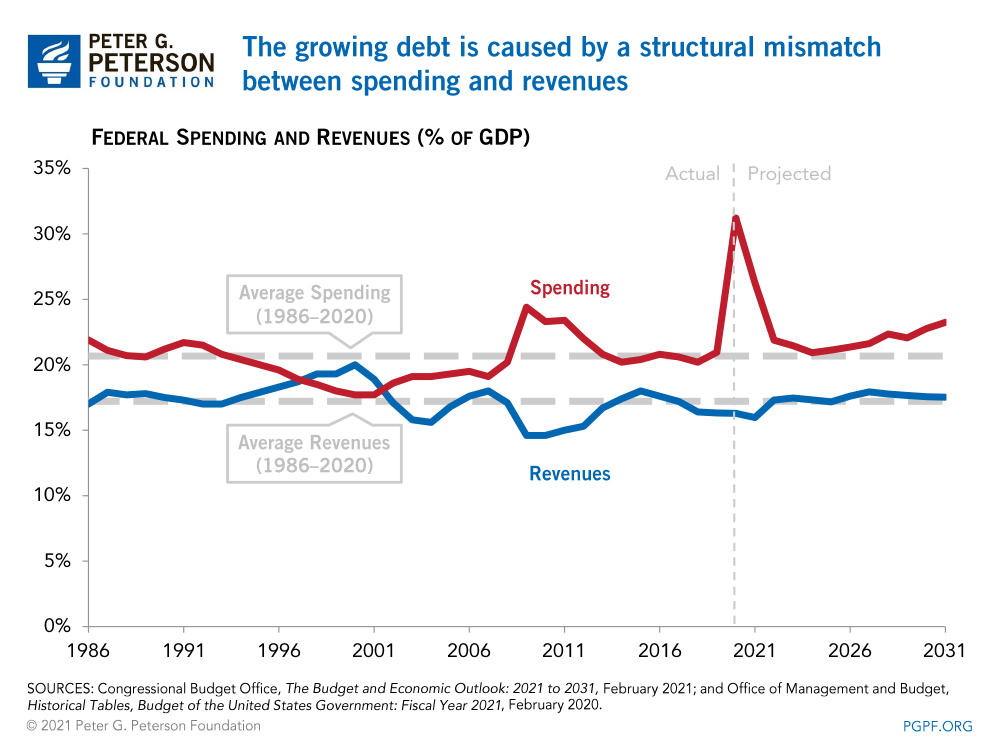

- The structural mismatch between spending and revenues will once again be the primary driver of large deficits once the pandemic has subsided. The large gap between spending and revenues existed before the COVID-19 pandemic and that situation is expected to continue once the pandemic subsides. Spending, which is expected to average 21.9 percent of GDP between 2022 and 2031, will be driven primarily by rising healthcare costs, an aging population, and rapidly growing interest costs. Revenues, on the other hand, are not anticipated to keep pace; CBO projects that they will average only 17.5 percent of GDP through the same time period.

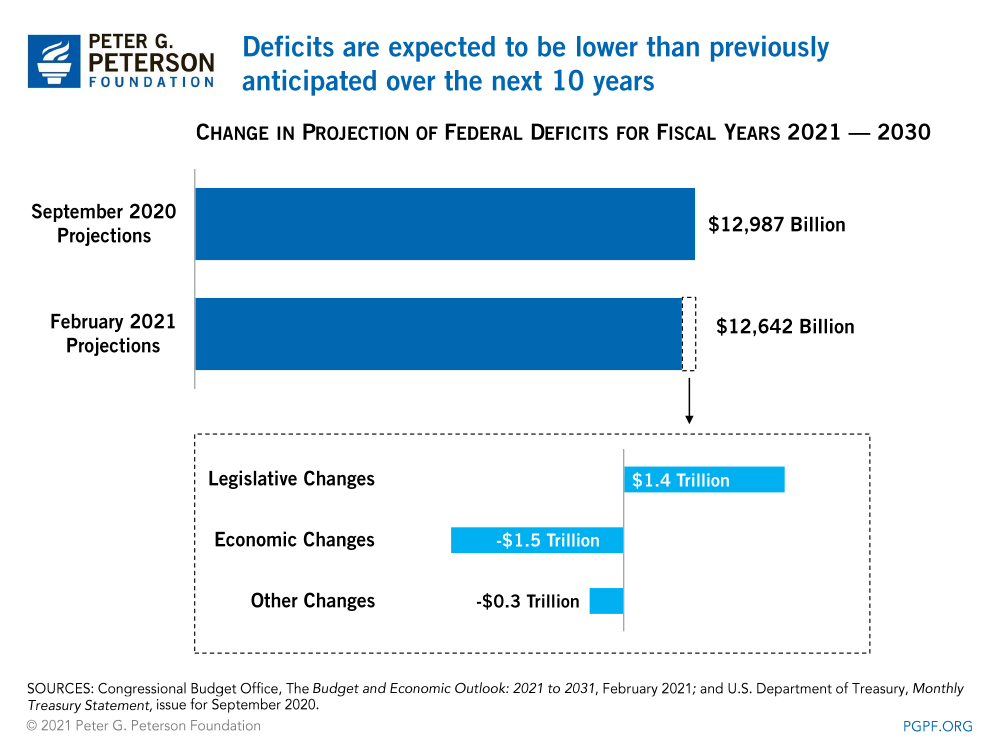

- CBO’s projections reflect a slight improvement in the nation’s fiscal path from their projections in September 2020. Last fall, CBO projected that deficits would total $13.0 trillion over the 2021 — 2030 period; in their latest projections, the agency now anticipates that such deficits will total $12.6 trillion over those 10 years. That $345 billion decrease is largely due to improvements in economic factors ($1.5 trillion), such as stronger economic growth, and technical changes ($300 billion), but is partially offset by higher spending as a result of the COVID-19 relief bill and appropriations enacted in December 2020 ($1.4 trillion).

While the nation’s economy continues to recover from the COVID-19 pandemic, CBO’s latest projections demonstrate how significantly the pandemic has affected the country’s fiscal outlook. It also underscores that, same as prior to the pandemic, the structural mismatch between spending and revenues will continue once the pandemic has subsided — further exacerbating the nation’s fiscal situation. Once we are able to overcome the detrimental effects of the pandemic, lawmakers will need to return to addressing our fiscal challenges to ensure a stronger economic future for all.

Related: Understanding the Coronavirus Crisis: Key Fiscal and Economic Indicators

Image credit: Photo by Mark Wilson/Getty Images