You are here

Interest Costs on the National Debt Projected to Nearly Triple over the Next Decade

The rising national debt carries substantial costs today and poses an even greater toll on America’s future.

Earlier this month, the Congressional Budget Office (CBO) released its first report to incorporate the effects of the American Rescue Plan, providing an important survey of our nation’s budgetary and economic outlook as we emerge from the pandemic. A key part of that outlook is the growing relevance of interest costs, which are a primary way to measure our fiscal condition. As the national debt grows, not only can net interest costs crowd out opportunities to invest in other areas of the economy, but they can also inhibit our ability to support priorities within the budget.

Despite current low rates, interest will soon become the fastest-growing category of the budget. More broadly, interest on the debt is among the main drivers of our structural deficit, along with an aging population, high healthcare costs, and an inadequate revenue system.

Despite Low Rates, Interest Costs on the National Debt to Nearly Triple in Next Decade

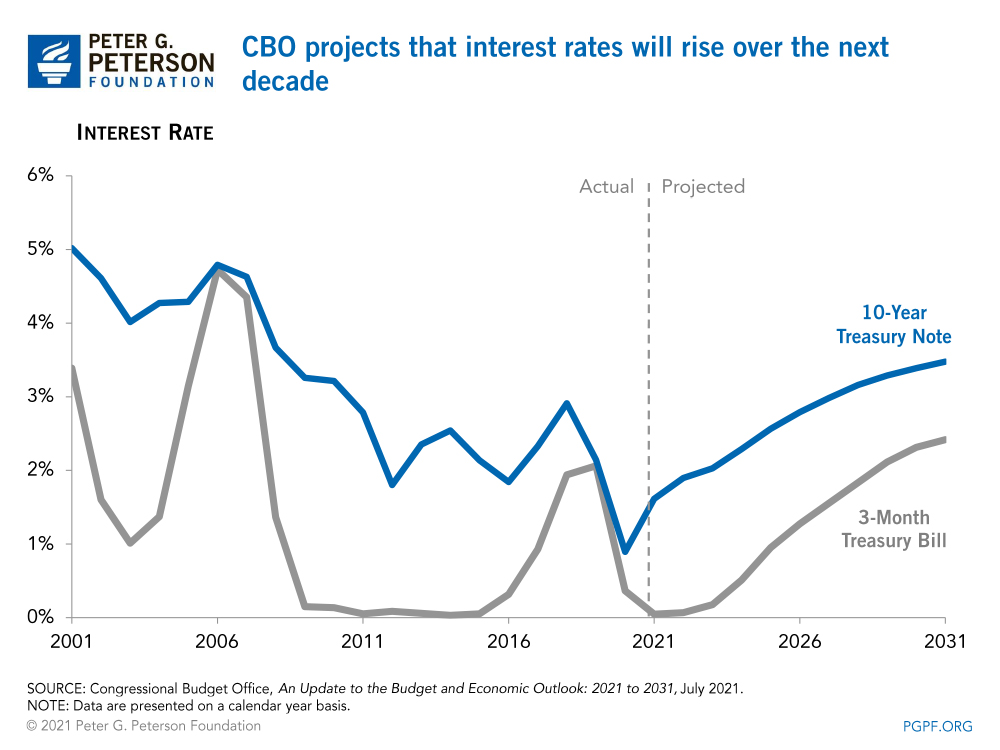

The United States has borrowed nearly $6 trillion in the past two years, in large part because of the pandemic and the response to it. The cost of that debt, as paid in interest, has actually declined during that period because maturing debt has often rolled over at lower interest rates.

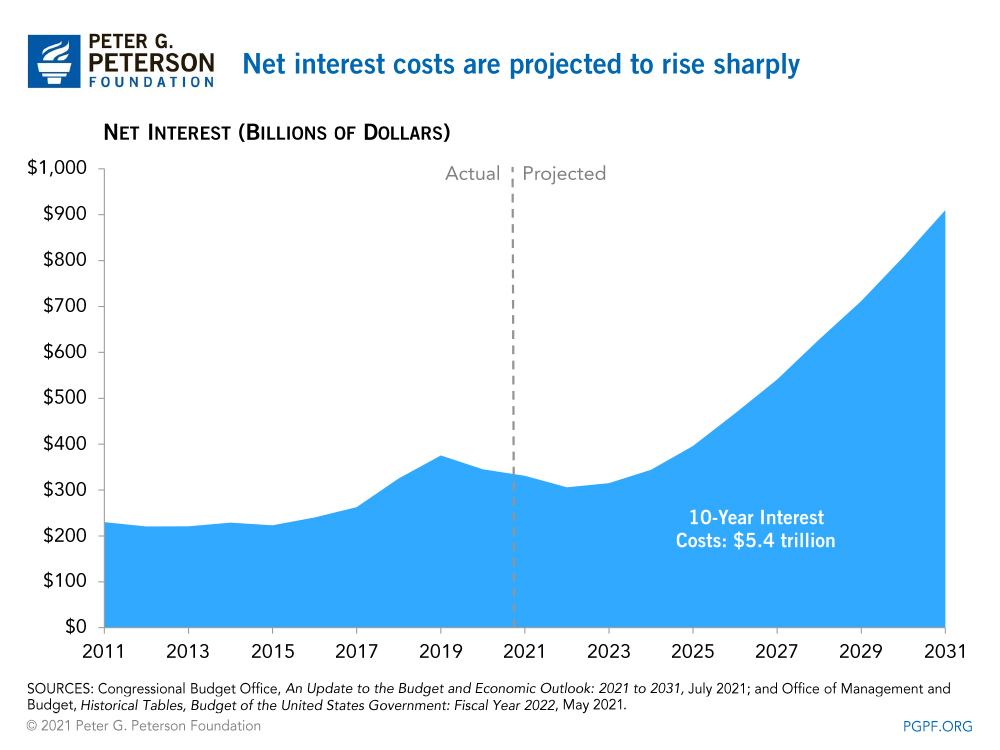

However, as interest rates creep up, interest costs will eventually rise. CBO projects that interest costs will grow from $331 billion this year to $910 billion in 2031 — a nearly threefold increase. This year’s interest payments work out to roughly $2,600 per household.

Over the next 10 years, without any changes in current policies, CBO estimates that net interest will total $5.4 trillion and become the fastest growing component of the federal budget. In 2031, interest costs would account for 12 percent of the entire federal budget.

Over the Next 30 Years, Interest Payments on the National Debt Will Total More than $60 Trillion

Looking further ahead, the growth in interest payments presents even more daunting challenges.

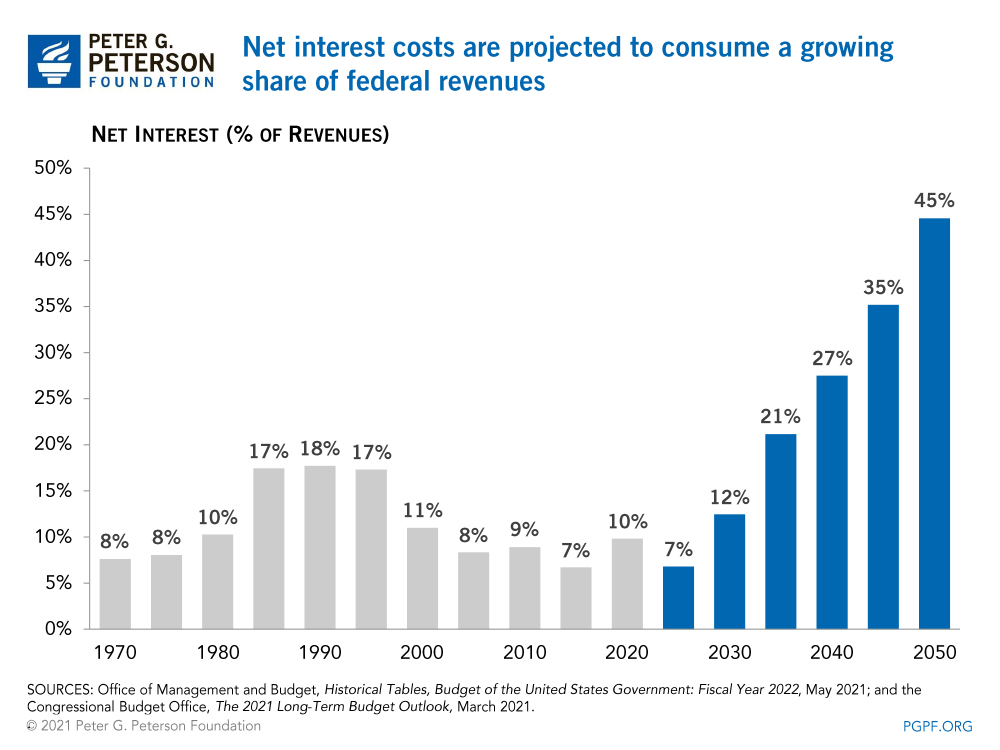

Over the next 30 years, the sum of net interest payments is projected to total more than $60 trillion; by 2051, that budget category would take up nearly half of all federal revenues and measure close to 9 percent of GDP, according to the CBO Long-Term Budget Outlook, released in March. Those levels would greatly exceed previous highs, as interest on the debt has never exceeded 19 percent of federal revenues or much more than 3 percent of GDP. (Available yearly data starts in 1940.)

Furthermore, net interest costs are projected to surpass spending on Social Security in 2045, Medicare in 2043, and all discretionary spending in 2043.

Interest Costs on the National Debt and Today’s Policy Choices

Our unsustainable fiscal outlook, including such rising interest costs, is critical context for lawmakers considering new policy proposals. If the debt weren’t so large, interest payments would be lower, our budget would be on a more sustainable path, and lawmakers would have a greater ability to invest in priorities for our future. As a comparison, the $5.4 trillion we are projected to spend on interest over the next decade vastly overshadows the price tag of either the original infrastructure package proposed by President Biden (at a cost of $2.6 trillion) or even the bipartisan infrastructure framework (at a cost of $579 billion). And if lawmakers do enact infrastructure legislation without offsetting it through new revenues or reductions in other spending, the size of future interest payments will be even greater going forward.

Conclusion

While interest rates — and, therefore, interest costs — remain relatively low in the near term, CBO’s new report makes clear that there is danger on the horizon. Interest costs are projected to rise sharply in the years ahead, placing significant burdens on the federal budget and potentially hindering our ability to invest in national priorities. As we emerge from the pandemic and the economy regains strength, lawmakers have an important opportunity to plan for our fiscal future and mitigate the growth in our interest burden.

Related: Here’s Everything Congress Has Done to Respond to the Coronavirus So Far

Image credit: Getty Images