You are here

What Is the SALT Cap?

The deduction of state and local tax payments (known as SALT) from federal income taxes has been a subject of debate among economists and policymakers over the past few years — with significant implications for the nation’s budget and fiscal outlook. The 2017 Tax Cuts and Jobs Act (TCJA) put a limit on SALT deductions. However, that limit, known as the SALT “cap” expires at the end of 2025, prompting debate on whether lawmakers should renew or modify the cap. Here, we examine the tax rules behind the SALT cap as well as its implications for tax fairness and fiscal policy at all levels of government.

What Is the SALT Deduction?

Each year, taxpayers filing federal returns can either claim the standard deduction or itemize their deductions. Those who choose to itemize can deduct state and local taxes from their federal tax liability. The SALT deduction has existed since 1913 when the 16th Amendment made a federal income tax constitutional. Over the years, lawmakers changed which state and local taxes are deductible, narrowing allowable deductions over time. Currently, taxpayers can deduct either state and local income taxes or general sales taxes; in addition, they can deduct certain state and local property taxes.

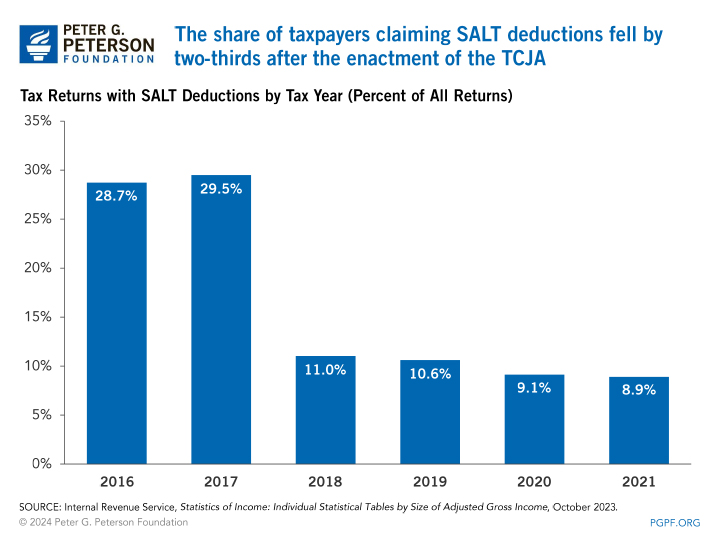

In 2017, the Tax Cuts and Jobs Act (TCJA) placed a limit on the total amount that taxpayers can deduct for state and local taxes. That “cap” was set to $10,000 for both single taxpayers and those filing jointly starting in tax year 2018 and expiring at the end of 2025. The cap on SALT deductions, in addition to other tax provisions implemented in the TCJA, contributed to a decline in the share of taxpayers claiming that deduction. Prior to the cap, about 30 percent of taxpayers claimed the SALT deduction; that number fell by about two-thirds after the TCJA was implemented, reaching 11 percent in 2018. The average SALT deduction benefit fell by 80 percent over that period.

Who Benefits from the SALT Deduction?

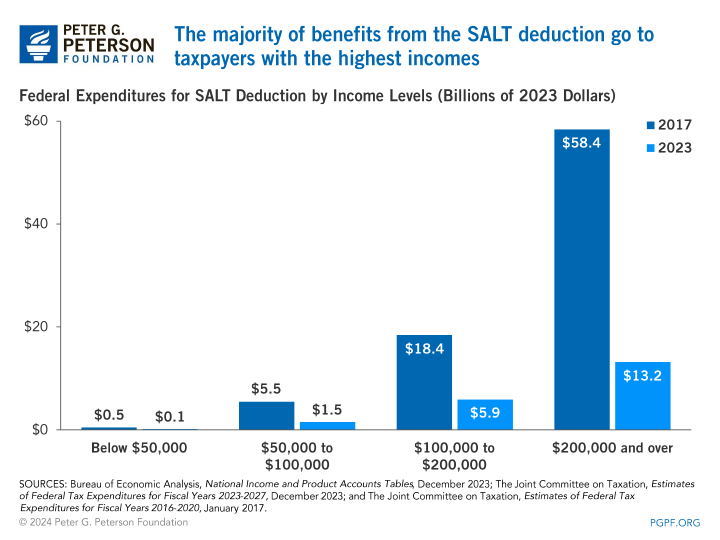

While the SALT cap limited the amount that taxpayers can receive from the deduction, most of the benefits from the SALT deduction go to the highest income taxpayers due to the deduction’s regressive design. The SALT deduction allows those with the largest tax liability, which are often those with high incomes, to deduct larger amounts and receive greater tax breaks — up to $10,000 with the current cap. In 2017, the last year before the cap was implemented, 71 percent of the benefit for the SALT deduction — or $58 billion — went to taxpayers with incomes over $200,000. Even with the SALT cap, most of the benefits of the SALT deduction go to such taxpayers — 64 percent in 2023.

In addition to those with higher incomes, taxpayers in jurisdictions with higher state and local tax rates have a greater opportunity to benefit from the deduction because they tend have larger tax liabilities. For example, in 2020, the Washington, D.C.-Baltimore Area had the highest rate of SALT deductions at 20.8 percent of taxpayers. By contrast, the Brownsville, Texas area had the lowest claim rate at 1.6 percent. That year, the District of Columbia had one of the highest top marginal income tax rates while Texas had no state income tax. Furthermore, the Washington, D.C.-Baltimore Area had one of the highest per capita personal income rates while the Brownsville Area had the second lowest.

Fiscal Implications of the SALT Deduction and Cap

The SALT deduction is costly for the federal government. In 2017, the year before the cap was implemented, the federal government lost $69 billion in tax revenues due to the SALT deduction. It was the fifth largest tax expenditure that year. In the years since the cap went into effect, foregone revenues (known as tax expenditures) for the SALT deduction have been comparatively low, totaling $21 billion in 2023. However, if the SALT cap is allowed to expire after 2025, the Joint Committee on Taxation projects that annual expenditures on the deduction will grow six-fold, from $23 billion in 2025 to $139 billion in 2026.

Federal rules for the SALT deduction also impact state and local tax policies. The SALT deduction lowers the after-tax cost of state and local taxes to taxpayers by offsetting a portion of those paid taxes with a reduced federal tax liability. By lowering the after-tax cost of state and local taxes, the SALT deduction can limit political and economic costs related to high tax rates. That makes it easier for states and localities to raise taxes on high-income taxpayers and, in turn, allows them to spend more on public services. In fact, research suggests that the SALT deduction is associated with increased revenues for state and local governments, essentially subsidized by a federal tax break.

The SALT Cap Going Forward

The SALT cap is currently set to expire at the end of 2025, giving lawmakers the opportunity to consider policy options that can balance priorities like fairness in the tax system, the interests of state and local governments, and improving federal fiscal health. Proposals range from allowing the cap on the SALT deduction to expire to completely eliminating the deduction itself. Other proposals would raise the cap or change how the cap applies to certain tax filers. As policymakers consider which policies to pursue before the cap expires, they will have to weigh the regressivity and cost of the SALT deduction against the benefit of the expenditure for state and local governments.

Related: The U.S. Corporate Tax System Explained

Image credit: Photo by Juan Silva / Getty Images