You are here

Budget Basics: Spending

The budget is more than just a tally of numbers. It also expresses the policy priorities of our government. Each year, the President and Congress have the opportunity to set priorities for the federal government, determining how much to spend through appropriations for annually funded programs as well as reviewing entitlement programs and the tax code.

In 2023, federal spending is projected to total $6.1 trillion — almost one-fourth of the economy and $19,100 for each person living in the United States. That spending can be divided into three categories: mandatory, discretionary, and interest.

Mandatory Spending

Programs governed by provisions of permanent law are referred to as “mandatory.” Put another way, spending on most mandatory programs is essentially on “autopilot” unless policymakers change the laws governing the program.

Many programs that provide benefits to individuals are classified as mandatory spending, such as Social Security, Medicare, and Medicaid. Those programs are also often referred to as "entitlements" because individuals who meet the program's eligibility requirements are "entitled" to benefits.

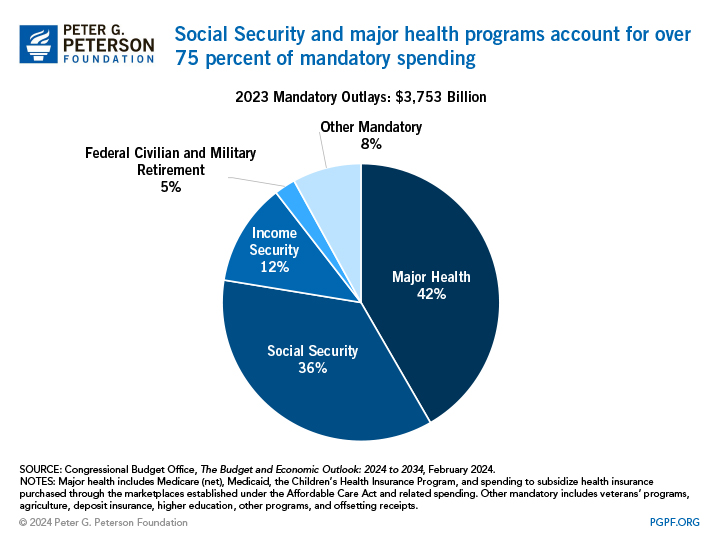

Mandatory spending covers programs in six major areas:

- Major Health Programs refers to four programs: Medicare (for seniors and disabled people); Medicaid (generally for lower-income beneficiaries); premium tax credits and related spending (for low- and moderate-income people); and the Children’s Health Insurance Program (for low-income children and parents).

- Social Security provides payments to retired and disabled workers, as well as to their spouses, dependent children, and survivors.

- Income Security Programs make payments to individuals based on their income through programs such as the following: earned income, child, and other tax credits (refundable tax credits for the working poor); the Supplemental Nutrition Assistance Program (formerly known as food stamps); Supplemental Security Income (payments to disabled children and adults with limited incomes); unemployment compensation (time-limited payments for people who become unemployed); family support and foster care; and child nutrition.

- Federal Retirement Programs for federal civilian and military retirees.

- Veterans’ Programs that provide pensions, income support, and other benefits for those who previously served in the military.

- Other Programs consist of a diverse group of activities, including those that provide agricultural subsidies, student loan subsidies, healthcare benefits for retirees of the uniformed services, and deposit insurance.

Lawmakers do not provide specific funding levels for mandatory spending. Instead, they specify who is eligible for benefits as well as the type and level of benefits that each person can receive. For example, the unemployment insurance program has eligibility criteria that, once met, allow an individual to receive a certain level of benefits. Total spending on the program depends on the number of people who file for unemployment, not on a fixed amount of funding set by lawmakers.

The term "mandatory" doesn’t mean that lawmakers are powerless to alter this spending. Elected officials can at any time adjust the eligibility criteria and benefit formulas that determine spending on mandatory programs, as they did with Social Security in 1983. However, if Congress and the President take no action, the current formulas and criteria for benefits generally remain in place year after year, and the spending flows as specified by law without interruption.

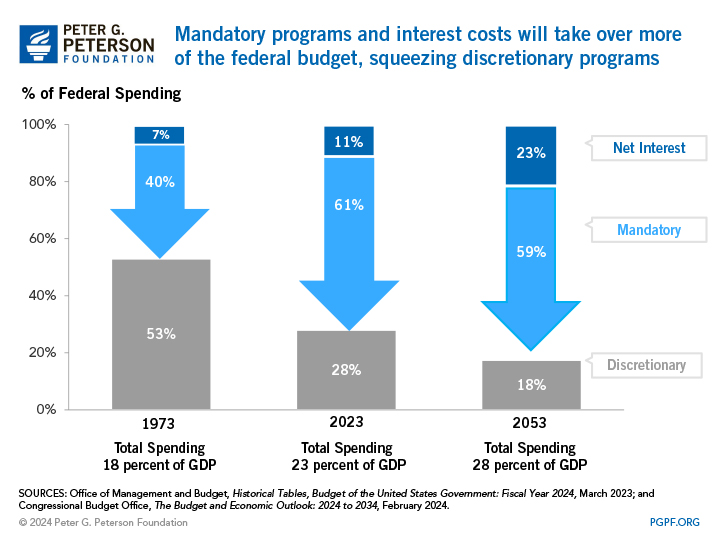

Over time, spending for mandatory programs has increased more quickly than most other programs — primarily because of growth in Social Security, Medicare, and Medicaid. In 1973, only 40 percent of the federal budget was spent on mandatory programs, while the rest funded an array of discretionary programs and net interest. In 2023, 61 percent of federal spending went to mandatory programs and that share is projected to remain around those levels throughout the following decades, according to the Congressional Budget Office (CBO).

Discretionary Spending

Discretionary spending is determined on an annual basis by Congress and the President through the enactment of appropriations. As opposed to the "automatic" nature of mandatory spending, discretionary spending must be revisited each year.

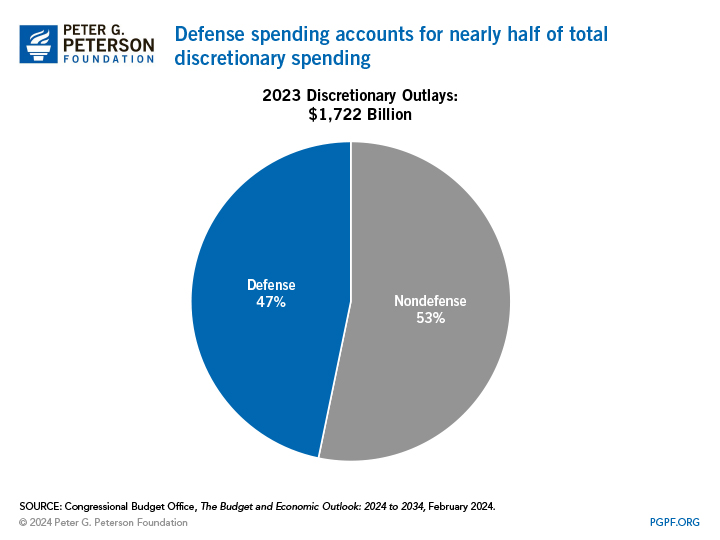

There are 12 separate appropriation bills that are supposed to be shepherded annually through Congress by the appropriations committees. Defense spending represents nearly half of all discretionary spending. Other major activities funded through appropriations include homeland security, education, transportation, research, food safety, science and space programs, disaster assistance, environmental protection, public housing, and federal law enforcement.

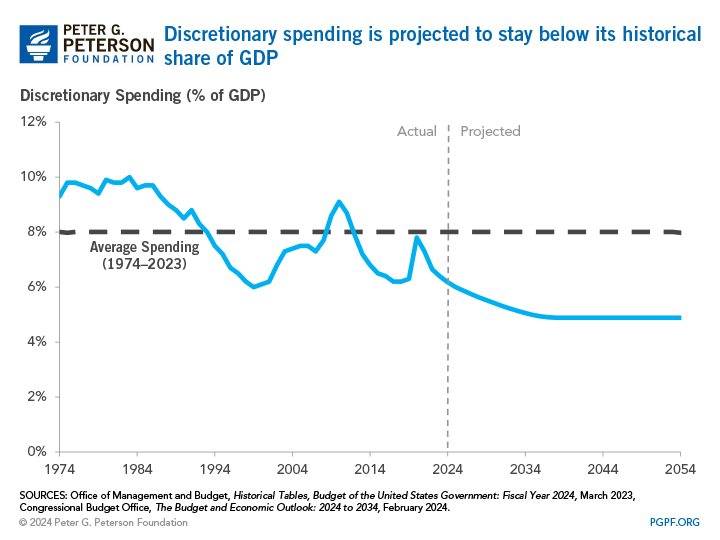

In the 1960s, two-thirds of total federal spending went to fund discretionary programs. In 2023, discretionary spending accounted for 28 percent of the budget. Over the next decade, it will decrease to a historically low level relative to the size of our national economy.

Net Interest

The third major category of spending is interest on the national debt. Interest rates have been low for more than a decade but have recently spiked as a result of high inflation. As a result, interest costs are the fastest-growing “program” in the federal budget — exceeding the rate of growth of both Social Security and Medicare. Under current law, CBO projects that net interest costs will grow from 14 percent of the budget in 2024, to 16 percent in 2034, and to 23 percent in 2054. As a share of the economy, that equates to 3.1 percent of gross domestic product in 2024, 3.9 percent in 2034, and 6.5 percent in 2054.