You are here

Understanding

the Budget

The federal budget is one of the most important policy instruments of our government. Through their budget decisions, our elected leaders fulfill their constitutional responsibilities, signal their policy priorities, and manage the federal purse. The budget reflects decisions to tax and spend, to borrow and lend, and to consume and invest. Those decisions define the size of the federal government and its role in the national economy.

Policymakers use the federal budget process to establish spending priorities and identify revenues to pay for those activities. The size and scope of those decisions make the budget process one of the most important and complex exercises in public policy making.

Budget Process

The formulation of the budget is an annual process that involves the Congress, the White House, and virtually all federal agencies. From start to finish, the process of formulating, legislating, executing, and auditing the budget is complex and lasts over a period of four fiscal years.

Spending

Each year, lawmakers determine how much the federal government will spend and where the money will be allocated among 15 cabinet departments and dozens of independent agencies and commissions. But the budget is more than just a tally of numbers. It also expresses the policy priorities of our government — and country. In 2023, total federal spending was $6.1 trillion — almost one quarter of the economy and about $18,300 for each person living in the United States. That spending is often divided into three categories:

- Discretionary spending, which is determined on an annual basis by the Congress and the President through enactment of appropriations;

- Mandatory spending, which consists of programs that are governed by permanent laws; and

- Interest on the national debt.

Revenues

The federal government finances its operations with revenues, including taxes, fees, and other receipts collected from many different sectors of the economy. In 2023, total federal receipts were $4.4 trillion, about 16.5 percent of gross domestic product. The largest sources of revenues are the individual income tax and payroll taxes, followed by the corporate income tax, customs duties, and excise taxes. To cover any shortfalls between revenues and spending, the government issues debt.

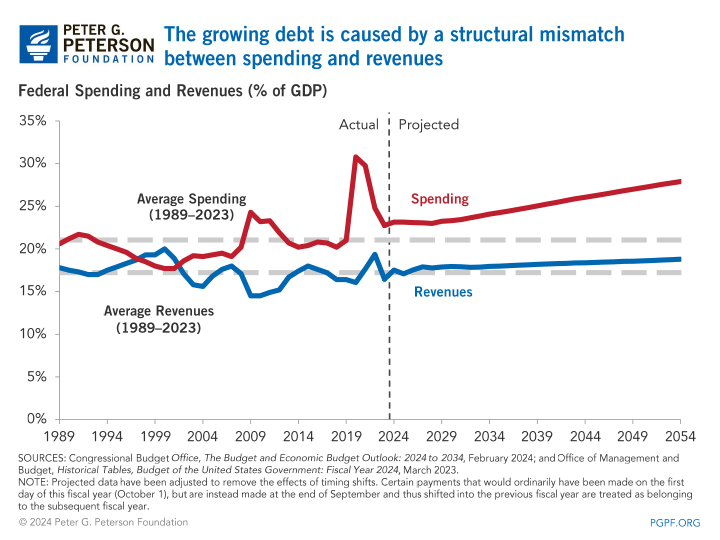

The COVID-19 pandemic exacerbated the nation’s fiscal trajectory, but the underlying structural mismatch between revenues and spending will be the driver of growing deficits in the future. That mismatch poses significant challenges for our budget as well as our political system. Politically, it is always easier to cut taxes and increase spending than it is to raise taxes and cut spending. Yet addressing our growing debt will require policymakers to face those choices, and delay will make them even more difficult.