You are here

Infographic: How the U.S. Tax System Works

One issue that most lawmakers and voters agree on is that our tax system needs reform. It is confusing, complex, and favors some individuals and economic activities over others. Exactly how to improve the tax code, however, can be a hotly contested issue — which is further complicated by common misconceptions about how the current system works.

Many observers have called for simplifying the current tax code to reduce preferences and make it easier to understand. The Administration in its recent budget proposed tax reforms that would target higher-income taxpayers.

Before we can begin to assess the value of specific proposals, it helps to look at the big picture of how the system works. Check out the infographic below for an overview of the system and then test how much you have learned with our tax quiz.

Last updated 4/22/2022

Want to share this image on your site? Copy and paste the embed code below:

Feel free to share this infographic on Twitter.

Tweet: Individual income #taxes account for more than half of the federal government's revenue. https://ctt.ec/U8g1l+ via @pgpfoundation

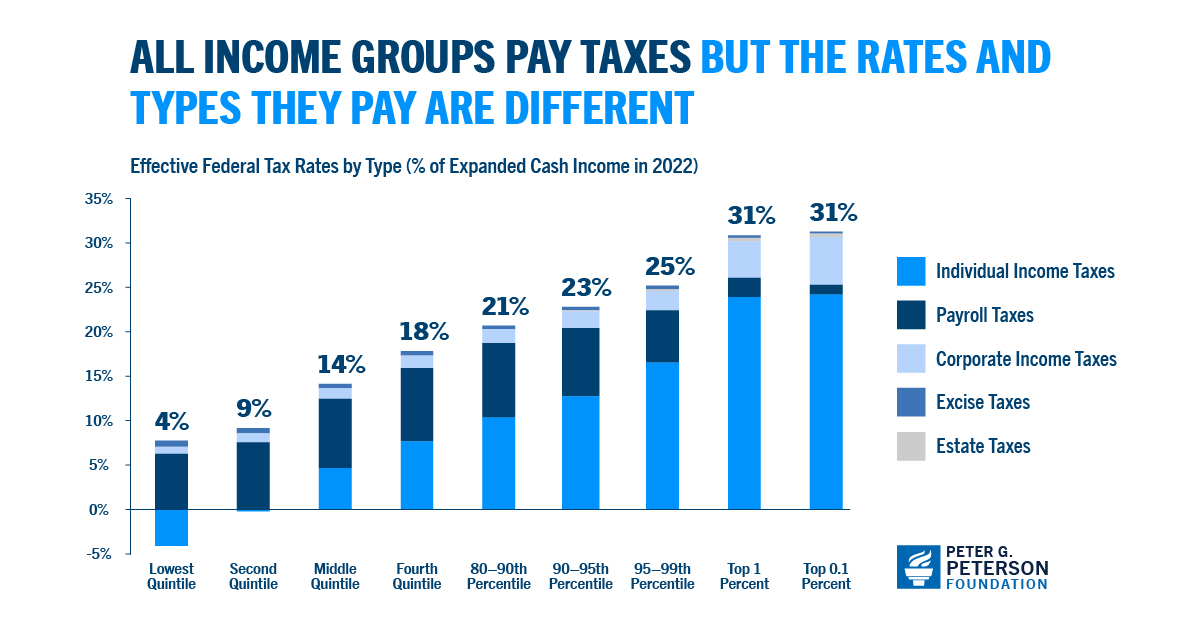

Tweet: Tax myth: Low-income earners don't pay any federal #taxes. https://ctt.ec/W3MdS+ via @pgpfoundation

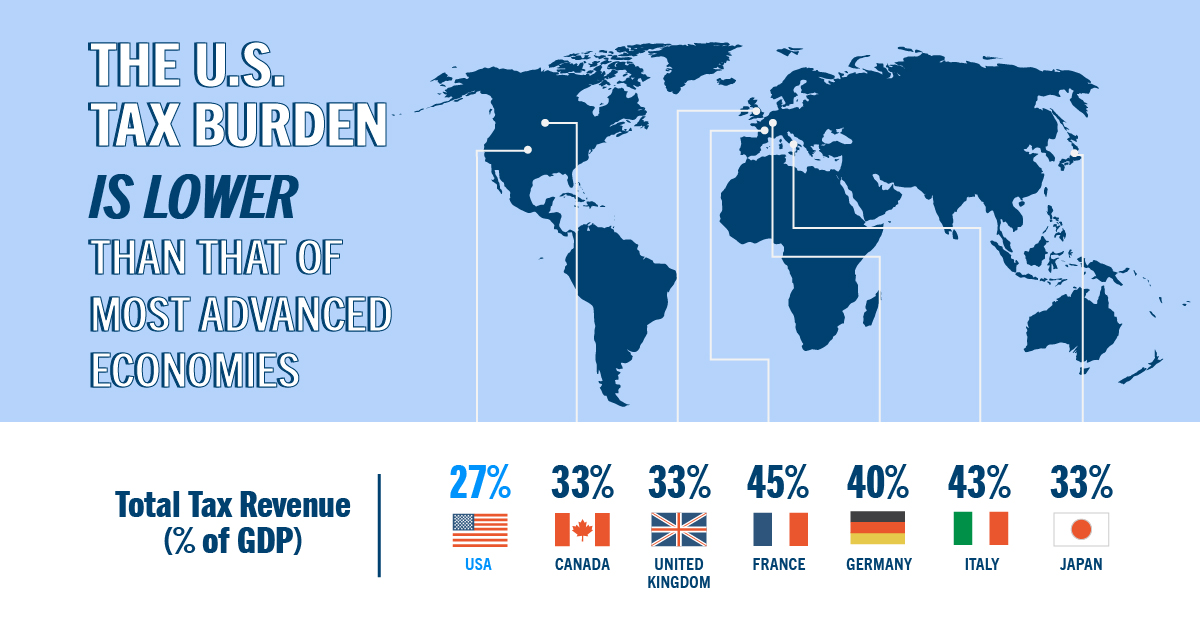

Tweet: Total tax burdens are lower in the U.S. than among other advanced nations. https://ctt.ec/Zo5GA+ via @pgpfoundation

Tweet: What is the #TaxReform opportunity? https://ctt.ec/G6phP+ via @pgpfoundation