You are here

Medicare is an essential health insurance program serving millions of Americans and is a major part of the federal budget. The program was signed into law by President Lyndon B. Johnson in 1965 to provide health insurance to people age 65 and older. Since then, the program has been expanded to serve the blind and disabled.

The number of people enrolled in Medicare has tripled since 1972, climbing from 21 million to nearly 65 million in 2022, and it is projected to reach about 88 million in 30 years. A major driver of Medicare enrollment is the increase in the number of older Americans. There are currently 60 million people age 65 and older, and that number is projected to increase by 43 percent over the next three decades. In addition to that population, Medicare also covers certain younger people with disabilities or specific illnesses.

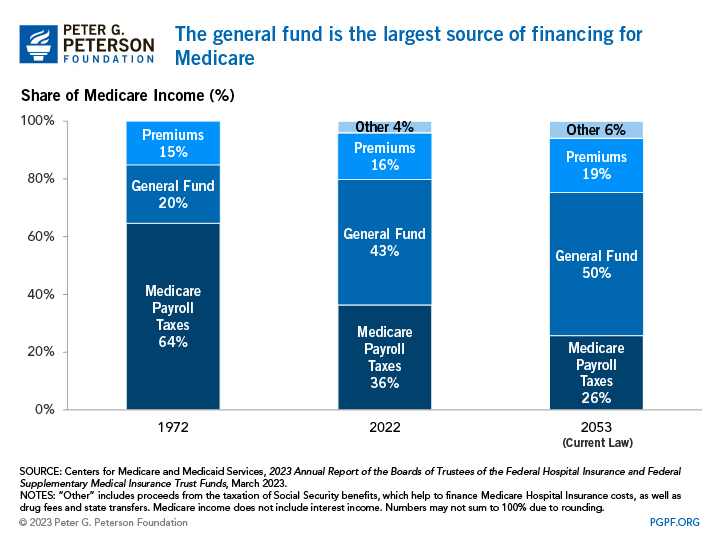

One of the biggest misconceptions about Medicare is that it is self-financed by current beneficiaries through premiums and by future beneficiaries through payroll taxes. In fact, payroll taxes and premiums together only cover about half of the program’s cost.

Key Facts

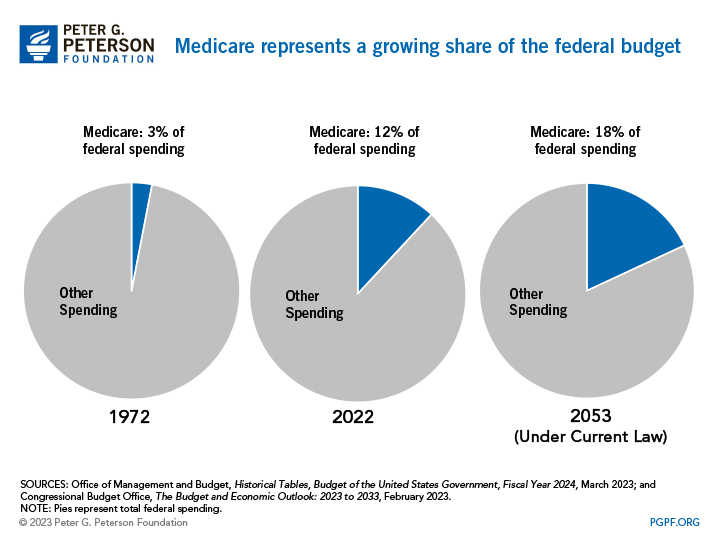

- Medicare is the second largest program in the federal budget: 2022 Medicare expenditures, net of offsetting receipts, totaled $747 billion — representing 12 percent of total federal spending.

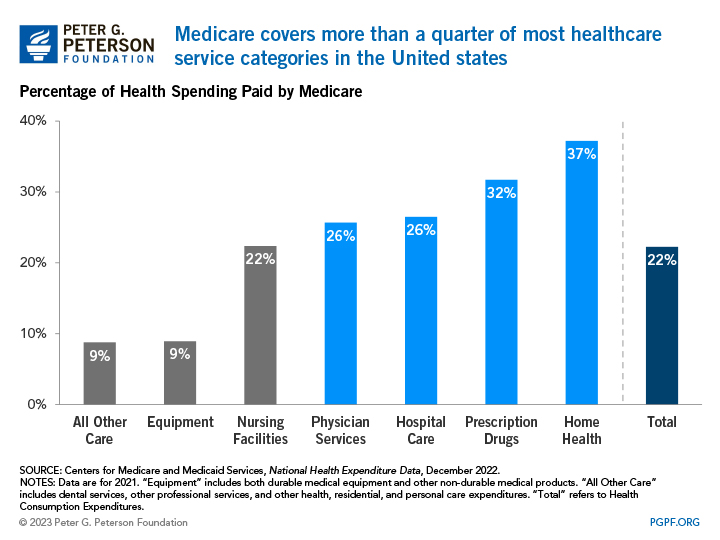

- Medicare has a large impact on the overall healthcare market: it finances over one-fifth of all health spending and nearly 40 percent of all home health spending.

- In 2022, Medicare provided benefits to 20 percent of the population.

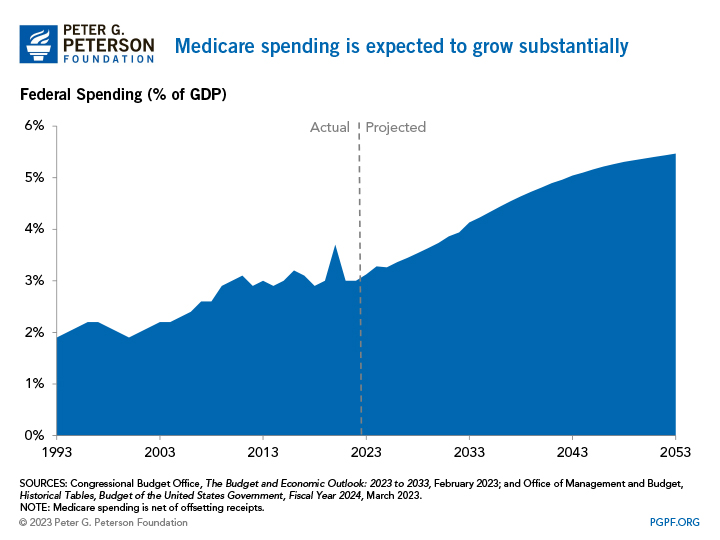

- Medicare spending is a major driver of long-term federal spending and is projected to rise from 3.0 percent of GDP in fiscal year 2022 to 5.5 percent in fiscal year 2053 due to the retirement of the baby-boom generation and the rapid growth of per capita healthcare costs.

What Are the Components of Medicare?

Medicare is a federal program that provides health insurance to people who are age 65 and older, blind, or disabled. Medicare consists of four "parts":

- Part A pays for hospital care;

- Part B provides medical insurance for doctor’s fees and other medical services;

- Part C is Medicare Advantage, which allows beneficiaries to enroll in private health plans to receive Part A and Part B Medicare benefits;

- Part D covers prescription drugs.

Almost all seniors are automatically enrolled in Part A at no additional cost once they turn 65. Parts B, C, and D are voluntary and require enrollees to pay premiums to receive coverage.

Where Does Medicare Funding Come From?

Medicare is financed by two trust funds: the Hospital Insurance (HI) trust fund and the Supplementary Medical Insurance (SMI) trust fund. The HI trust fund finances Medicare Part A and collects its income primarily through a payroll tax on U.S. workers and employers. The SMI trust fund, which supports both Part B and Part D, receives most of its income from the federal government’s general fund because premiums only cover about one-quarter of the fund’s total expenditures. Part C, on the other hand, is paid for through both the HI and SMI trust funds and collects its income from a combination of the general fund, payroll taxes, premiums paid by beneficiaries, and out-of-pocket charges.

As a whole, only 56 percent of Medicare’s costs were financed through payroll taxes, premiums, and other receipts in 2022. Payments from the federal government’s general fund made up the difference.

The composition of Medicare financing has changed significantly over the past 40 years, with an evolving mix of premiums, payroll taxes, and general fund support. In 1972, payroll taxes financed 64 percent of Medicare spending. In 2022, however, payroll taxes covered only 36 percent of the program’s costs. In 1986 the payroll tax rate for Medicare increased the contribution rates for both employers and employees from 0.6 percent to 1.45 percent of wages. Later, in 1994, the cap on earnings, which limited the amount of income subject to the Medicare payroll tax, was eliminated (the cap on earnings for the payroll tax that funds Social Security, however, was not eliminated). Most recently, the Affordable Care Act increased payroll tax rates for high earners by an additional 0.9 percentage points beginning in 2013. Unfortunately, the sum of those changes will not be sufficient to offset future cost growth.

Premiums play only a modest role in funding the Medicare program. They financed 16 percent of Medicare’s overall costs in 2022, about the same share as in 1972.

The federal government’s general fund has been playing a larger role in Medicare financing. In 2022, 43 percent of Medicare’s income came from the general fund, up from 20 percent in 1972. Looking forward, such revenues are projected to continue funding a major share of the Medicare program. By 2053, the Trustees project that general revenues will cover half of the program’s costs.

How Much Does Medicare Cost and What Does It Cover?

Medicare accounts for a significant portion of federal spending. In fiscal year 2022, the Medicare program cost $747 billion — about 12 percent of total federal government spending. Medicare was the second largest program in the federal budget last year, after Social Security.

Medicare faces significant financial pressures as federal healthcare costs are expected to grow considerably relative to the size of the economy over the next few decades. In fact, Medicare spending is projected to rise from 3.0 percent of GDP in 2022 to about 5.5 percent of GDP by 2053. That increase in spending is largely due to the retirement of the baby boomers (those born between 1944 and 1964), longer life expectancies, and healthcare costs that are growing faster than the economy.

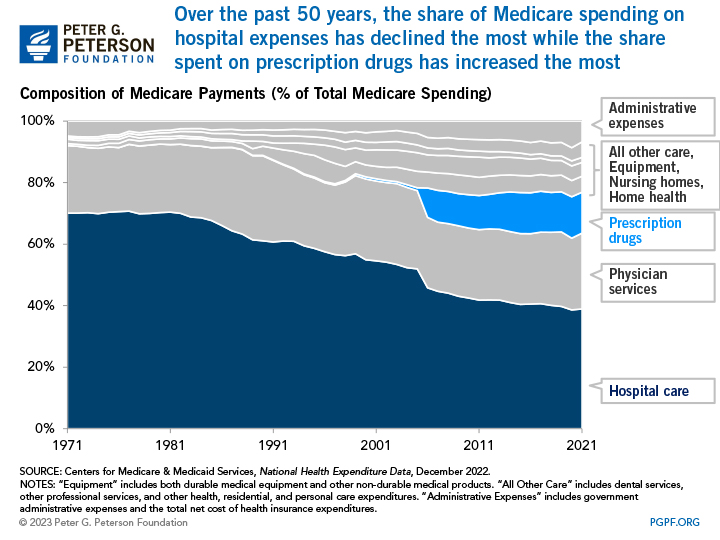

Medicare finances an array of health services. Hospital expenses are the largest single component of Medicare’s spending, accounting for nearly 40 percent of the program’s spending. That is not surprising, as hospitalizations are associated with high-cost health episodes.

However, the share of spending devoted to hospital care has declined since the program's inception. While spending for physician services has hovered between 20 and 25 percent for most of the program's history, the share devoted to other benefits has grown. Most notably, the introduction of the prescription drug benefit in 2006 significantly shifted the composition of Medicare spending.

How Do Medicare Trust Funds Work?

Medicare’s two trust funds keep track of inflows and outflows related to each fund. Income from payroll taxes and other sources are credited to the trust funds, while disbursements for benefits and administration are debited from the funds’ balance. When the trust funds receive more revenues than are needed to cover expenses, the funds accumulate a surplus that is held in non-marketable U.S. Treasury securities, which are then used to finance other governmental activities and reduce the amount of public borrowing needed. On the other hand, if the funds run a negative balance, those securities are redeemed to cover the program’s costs.

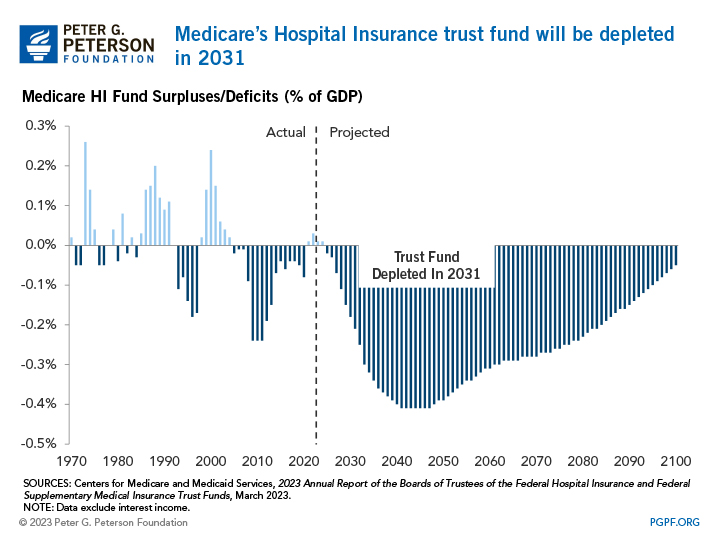

The HI Trust Fund has been running deficits over the past few years, and the Medicare Trustees project that the fund will be depleted in 2031. At that point, program expenses cannot exceed incoming revenues — which means that Medicare will have to cut spending by 11 percent that year.

The SMI Trust Fund cannot be depleted because premiums and transfers from the general fund for Part B and Part D are automatically adjusted to cover expected costs. However, the Trustees also have expressed concerns about the rapid growth in costs covered by SMI.

Medicare Plays an Important Role in Financing American Healthcare

Medicare is a major player in our nation's health system and is the bedrock of care for millions of Americans. The program pays for over one-fifth of all healthcare spending in the United States, including 32 percent of prescription drug costs and 37 percent of home health spending (which includes in-home care by skilled nurses to support recovery and self-sufficiency in the wake of illness or injury).

The Future of Medicare

To preserve Medicare and to put the nation on a sustainable fiscal path in the long term, more reforms are required and policymakers will need to address the program’s rapidly growing costs — one of the primary drivers of our rising federal debt. Balancing cost concerns with considerations about the health and welfare of our nation’s older citizens will be important for successful long-term solutions.