You are here

Fiscal Confidence Index

Introduction

In 2012, the Peterson Foundation launched the Fiscal Confidence Index to help policymakers, members of the media, and the American public gauge public opinion on the nation’s fiscal and economic challenges.

The Fiscal Confidence Index is an important indicator of the American public’s views about our fiscal and economic condition and the progress elected leaders are making in addressing it. Since its inception, the Fiscal Confidence Index has consistently shown that Americans hold deep concerns about the level of our long-term debt, and they urge policymakers to make addressing our fiscal and economic future a top priority.

The Fiscal Confidence Index, released monthly, is modeled after the Consumer Confidence Index and measures public opinion about the national debt and the economy by asking questions in three key areas:

- CONCERN: Level of concern and views about the direction of the national debt.

- PRIORITY: How high a priority addressing the debt should be for elected leaders.

- EXPECTATIONS: Expectations about whether the debt situation will get better or worse in the next few years.

The individual scores in these three areas are averaged to produce the Fiscal Confidence Index value.

Check back monthly for updates.

Detailed Results

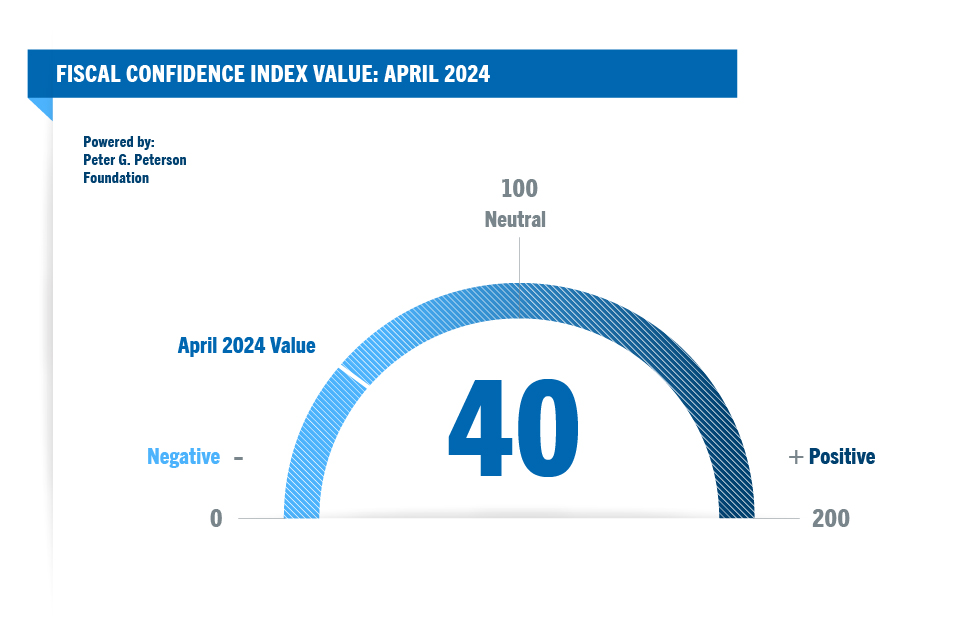

Topline survey results from the Fiscal Confidence Index for April 2024. The FCI value for April is 40.

The Peter G. Peterson Foundation commissioned this poll by the Global Strategy Group and North Star Opinion Research to survey public opinion on the national debt. The online poll included 1,001 registered voters nationwide, surveyed between April 16, 2024 and April 18, 2024. The poll has a margin of error of +/− 3.1%. The poll examined voters’ opinions on the national debt, political leadership, and America’s fiscal and economic health.

The Fiscal Confidence Index value is derived from six questions in three categories: Concern, Priority, and Expectations. The April 2024 scores are: Concern (32), Priority (22), Expectations (64). For the complete methodology used to determine the Fiscal Confidence Index value, click here. For full results, including demographic information, download the PDF below:

Concern (32)

Thinking about our national debt over the last few years, would you say your level of concern has increased or decreased?

Is that a lot or just a little?

| Increased a lot | 50% |

| Increased a little | 30% |

| Decreased a little | 5% |

| Decreased a lot | 3% |

| (No change) | 8% |

| (Don't Know/Refused) | 4% |

| INCREASED (NET) | 80% |

| DECREASED (NET) | 8% |

When it comes to addressing our national debt, would you say things in the United States are heading in the right direction or do you think things are off on the wrong track?

Do you feel that way strongly or just somewhat?

| Right direction - Strongly | 9% |

| Right direction - Somewhat | 19% |

| Wrong track - Somewhat | 26% |

| Wrong track - Strongly | 42% |

| (Neither/Mixed) | 1% |

| (Don't Know/Refused) | 3% |

| RIGHT DIRECTION (NET) | 28% |

| WRONG TRACK (NET) | 68% |

Priority (22)

Some people say that addressing the national debt should be among the President and Congress' top 3 priorities. Do you agree or disagree?

Do you feel that way strongly or just somewhat?

| Strongly agree | 53% |

| Somewhat agree | 24% |

| Somewhat disagree | 15% |

| Strongly disagree | 3% |

| (Don't Know/Refused) | 5% |

| AGREE (NET) | 77% |

| DISAGREE (NET) | 18% |

And when it comes to our national debt, do you think it is an issue that the President and Congress should spend more time addressing or less time addressing?

Would you say a lot (more or less) time or just a little?

| A lot more time | 52% |

| A little more time | 31% |

| A little less time | 5% |

| A lot less time | 4% |

| (The same amount of time) | 3% |

| (Don't Know/Refused) | 4% |

| MORE TIME (NET) | 84% |

| LESS TIME (NET) | 9% |

Expectations (64)

And thinking about our national debt over the next few years, do you expect the problem to get better or worse?

Is that much (better or worse) or just somewhat (better or worse)?

| Much better | 8% |

| Somewhat better | 20% |

| Somewhat worse | 30% |

| Much worse | 35% |

| (No change) | 2% |

| (Don't know/Refused) | 5% |

| BETTER (NET) | 28% |

| WORSE (NET) | 65% |

And when it comes to our national debt, are you optimistic or pessimistic that the United States will be able to make progress on our national debt over the next few years?

Would you say you are very (optimistic or pessimistic) or just somewhat?

| Very optimistic | 8% |

| Somewhat optimistic | 31% |

| Somewhat pessimistic | 34% |

| Very pessimistic | 22% |

| (Neither/Mixed) | 2% |

| (Don't Know/Refused) | 3% |

| OPTIMISTIC (NET) | 39% |

| PESSIMISTIC (NET) | 55% |

For Press

NEW YORK — With election day just six months away, new polling shows overwhelming bipartisan support for candidates who are committed to solving the key fiscal challenges coming to a head starting next year. The survey finds Democratic and Republican voters are looking for leaders who will address critical issues related to the national debt, including the debt ceiling, expirations in the Tax Cuts and Jobs Act, and the rapidly depleting Social Security and Medicare trust funds. Further, April’s U.S. Fiscal Confidence Index, modeled after the Consumer Confidence Index, remained low at 40 (100 is neutral), indicating Americans’ deep concerns about the $34 trillion national debt and unprecedented interest costs on tap.

Read the Full FCI Press Release for April 2024

For media inquiries please call (212) 542-9200 or jrosen@pgpf.org.

Methodology

The Fiscal Confidence Index will be released monthly by the Peter G. Peterson Foundation.

The Fiscal Confidence Index value is based on six questions in three categories.

As is done with the Consumer Confidence Index, the first step in calculating the Fiscal Confidence Index is determining the "Relative Value" for each question. This calculation is made by taking the positive response for each question and dividing it by the sum of the positive and negative responses. Each question was asked on a four-point scale, and answers were weighted according to intensity, with the strongest responses counting twice as much as the middle responses ("much" better or worse answers count twice as heavily as "somewhat" better or worse answers).

The scores for the Concern, Priority, and Expectations categories are determined by averaging the scores derived from the two questions in each category.

The Fiscal Confidence Index value is converted from the Relative Value to place it on a scale on which 100 indicates equal positive and negative sentiment, while values below 100 indicate negative sentiment and values above 100 indicate positive sentiment.