Fiscal year 2019 started on October 1 and may mark an unfortunate milestone: a permanent return to trillion-dollar deficits for the federal government.

The nonpartisan Congressional Budget Office (CBO) projects that the deficit this fiscal year (October 1, 2018 – September 30, 2019) will total $973 billion if current policies remain the same; the Trump Administration anticipates a deficit of $1.085 trillion under their budget proposal. Other than during the recent recession caused by the financial crisis and its aftermath, the U.S. government has never witnessed deficits that exceeded $1 trillion.

Moreover, due to recent tax and spending legislation as well as a foreseeable wave of demographic changes, deficits are projected to continue rising in the years ahead.

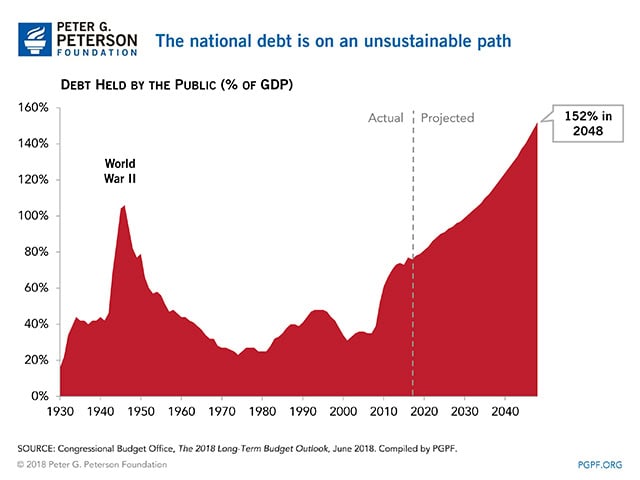

More troubling than crossing the trillion-dollar milestone is the fact that debt is increasing relative to the size of the economy. Debt in 2019 is expected to creep closer to 80 percent of GDP — about twice the level that existed before the financial crisis. Under CBO’s long-term budget projections, debt would nearly double again in 30 years, rising to 152 percent of GDP by 2048. Those are clearly unsustainable and dangerous levels.

Looking ahead to the first few months of this fiscal year, here are key fiscal and economic dates to consider:

- October 26 — Release of the estimate for gross domestic product for July-September 2018.

- November 6 — Election Day.

- November 30 — The deadline for the Joint Select Committee on Budget and Appropriations Process Reform to release a set of recommendations. See our principles for reform here.

- December 7 — Recent legislation preventing a government shutdown included full-year funding for five of twelve appropriations bills, which include the departments of Defense, Labor, Education, and Health and Human Services. The remaining seven bills fall under a short-term continuing resolution that expires on 12/7. If lawmakers can’t come to agreement on the remaining seven appropriations bills by then, they will risk a partial government shutdown.

Image credit: Leo Ang/Getty Images

Further Reading

What’s the Difference Between the Trade Deficit and Budget Deficit?

The terms “budget deficit” and “trade deficit” can be conflated, but they are distinct measurements of important fiscal and economic concepts.

The Federal Government Has Borrowed Trillions. Who Owns All that Debt?

Most federal debt is owed to domestic holders, but foreign ownership is much higher now than it was about 50 years ago.

The Fed Reduced the Short-Term Rate Again, but Interest Costs Remain High

High interest rates on U.S. Treasury securities increase the federal government’s borrowing costs.