RESOURCES

Research, analyses, and news from the Peter G. Peterson Foundation

Featured Articles

Press Releases

Explore news and announcements from the Peter G. Peterson Foundation.

Chart Packs

Our charts frame the fiscal outlook of the U.S. government within a broad economic, political, and demographic context.

Polling

Our polling tracks the public’s views about our fiscal and economic condition and the progress elected leaders are making in addressing it.

Latest Articles

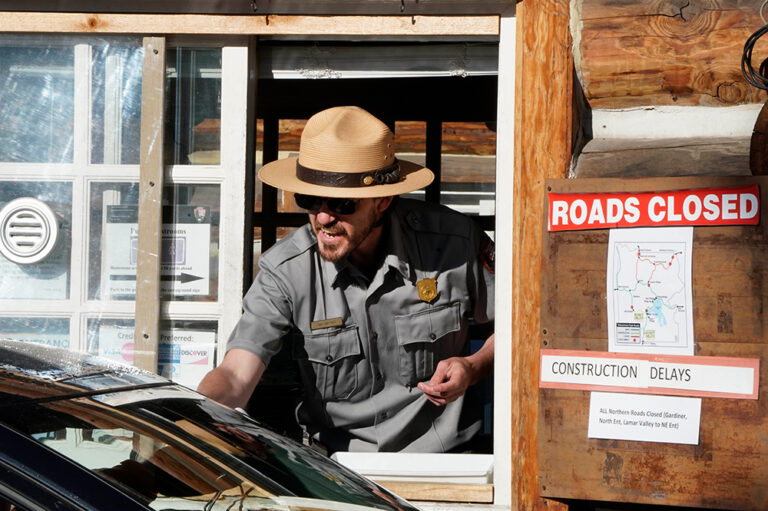

How Much Do We Spend on the Federal Workforce?

Here, we examine the federal government’s expenditure on its workforce, the evolution of its size over time, and the opportunities for budget savings.

What Are Interest Costs on the National Debt?

Interest costs are on track to become the largest category of spending in the federal budget.

The One Big Beautiful Bill Act Is the Most Expensive Reconciliation Package in Recent History

The legislative package will be the most expensive reconciliation bill in a quarter of a century and will add trillions of dollars to the U.S. debt.

Explore All Resources

SEARCH

SORT

Type

Issues

Jul 18, 2025

How Much Do We Spend on the Federal Workforce?

Here, we examine the federal government’s expenditure on its workforce, the evolution of its size over time, and the opportunities for budget savings.

Jul 14, 2025

What Are Interest Costs on the National Debt?

Interest costs are on track to become the largest category of spending in the federal budget.

Jul 7, 2025

Chart Pack: Fiscal Outlook

The national debt is already at its highest level since just after World War II, and annual deficits are on an upward trajectory.

Jul 3, 2025

The One Big Beautiful Bill Act Is the Most Expensive Reconciliation Package in Recent History

The legislative package will be the most expensive reconciliation bill in a quarter of a century and will add trillions of dollars to the U.S. debt.

Jul 2, 2025

Healthcare Costs Are a Major Driver of the National Debt and Here’s the Biggest Reason Why

Improving the U.S. healthcare system will be crucial to providing quality, affordable healthcare and to bettering our nation’s long-term economic and fiscal well-being.

Jul 1, 2025

Despite Decades of Warnings, Depletion of Social Security’s Trust Fund Is Getting Closer

The depletion dates for Social Security and Medicare’s Trust Funds are rapidly approaching.

Jun 30, 2025

Lifting the Debt Ceiling Has Been Paired with Budget Reform in the Past

Earlier this year, the United States once again hit its debt ceiling, which is currently capped at $36.1 trillion.