Statement by Michael A. Peterson, Vice Chairman of the Peter G. Peterson Foundation, on the CBO Analysis of the President’s Proposed Budget and Bipartisan Senate Majority Letter to the President

“Today’s Congressional Budget Office (CBO) analysis is further indication that we must address our long-term fiscal challenges, and the bipartisan Senate letter to the President demonstrates that we can. The letter to President Obama signed by a bipartisan majority of Senators today is an encouraging step toward the grand bargain we need to tackle our mounting fiscal challenges.”

“The CBO report released today indicates higher levels of debt over the next ten years. Most importantly, both the President’s budget and the CBO project that federal debt will increase significantly over the longer term. There is no doubt that both parties must look beyond the next ten years and address our long-term debt and deficits.

“The efforts underway in the Senate demonstrate that both parties can work together to build sustainable fiscal policies for our nation. The progress of Senators Chambliss (R-Ga.), Coburn (R-Okla.), Conrad (D-N.D.), Crapo (R-Idaho), Durbin (D-Ill.), and Warner (D-Va.) provides a working example of leadership. The bipartisan Senate majority letter to President Obama is a promising indication that real momentum is building toward a comprehensive fiscal plan. We hope the President and Congressional leaders will seize this moment of opportunity to make tangible progress on securing America’s fiscal future.”

About the Peter G. Peterson Foundation

The Peter G. Peterson Foundation is a nonprofit, nonpartisan organization established by Pete Peterson – businessman, philanthropist, and former U.S. Secretary of Commerce. The Foundation is dedicated to increasing public awareness of the nature and urgency of key long-term fiscal challenges threatening America’s future and to accelerating action on them. To address these challenges successfully, we work to bring Americans together to find and implement sensible, long-term solutions that transcend age, party lines and ideological divides in order to achieve real results. To learn more, please visit www.PGPF.org.

Further Reading

The United States Collects Less Tax Revenue Than Other G7 Countries

The U.S. collects less tax revenues compared with other G7 countries, and that lower level of revenues is a key driver of the national debt.

Energy Tax Policy Under the OBBBA

As part of the OBBBA, lawmakers rolled back existing energy tax incentives in order to partially offset the bill’s deficit impact.

Top 10 Reasons Why the National Debt Matters

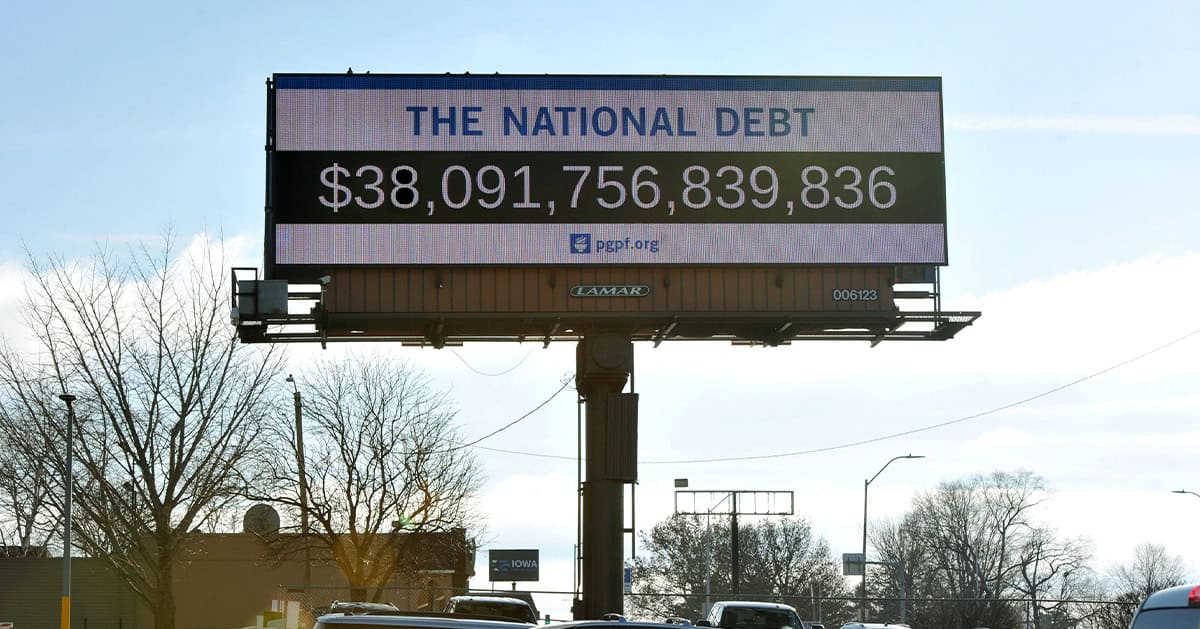

At $38 trillion and rising, the national debt threatens America’s economic future. Here are the top ten reasons why the national debt matters.