Peterson Foundation Statement on Tax Legislation

NEW YORK — Michael A. Peterson, President and CEO of the Peter G. Peterson Foundation, commented today following passage of tax legislation:

“This holiday season, American children will be receiving the gift that keeps on taking: more federal debt.

“Lawmakers have squandered a generational opportunity to reform our tax code in a fiscally responsible way. Tax reform done right could have improved our fiscal outlook and economic prospects at the same time. However, this bill will result in significant increases to the national debt, causing harm to our economy.

“Every independent analysis concludes that these tax cuts will not pay for themselves. In fact, they could cost as much as $2.2 trillion, plus interest. With our national debt already at $20 trillion, and slated to grow by $10 trillion more over the next decade, we just can’t afford this tax bill.

“Today’s America will be judged by the state of the nation that it leaves to the next generation. As a result of this legislation, we have much more work to do to create a sustainable fiscal and economic future for our children and grandchildren.”

Further Reading

The United States Collects Less Tax Revenue Than Other G7 Countries

The U.S. collects less tax revenues compared with other G7 countries, and that lower level of revenues is a key driver of the national debt.

Energy Tax Policy Under the OBBBA

As part of the OBBBA, lawmakers rolled back existing energy tax incentives in order to partially offset the bill’s deficit impact.

Top 10 Reasons Why the National Debt Matters

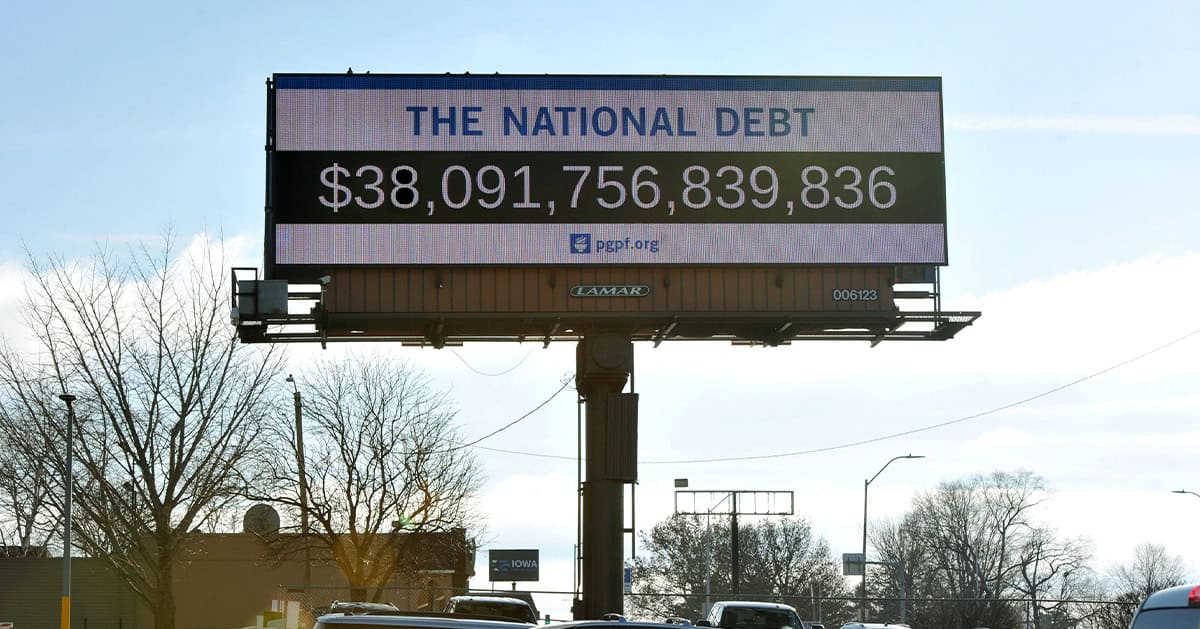

At $38 trillion and rising, the national debt threatens America’s economic future. Here are the top ten reasons why the national debt matters.