Peterson Foundation Statement on End to Government Shutdown

NEW YORK — Michael A. Peterson, President and CEO of the Peter G. Peterson Foundation, commented today after lawmakers agreed to pass a new continuing resolution to end the current government shutdown, providing funding through February 8. Peterson said:

“While it’s good news that lawmakers have come to an agreement to reopen the government, it’s unfortunate that we are operating, yet again, under temporary funding.

“Piecemeal budgeting is a form of fiscal irresponsibility because it injects uncertainty and unpredictability into our economy. Budgeting is a basic function of government, and lawmakers all too often rely on short-term fixes. In fact, this continuing resolution is the 113th temporary funding measure since 1998, meaning Congress has failed to budget on time for two decades. Governing week-to-week is no way to run the country’s finances.

“In addition, it’s essential that lawmakers begin to improve our fiscal bottom line. Unfortunately, even this short-term measure through February 8 includes both new spending and new tax cuts that will add $31 billion to deficits. It’s critical that our final appropriations for the year do not make our fiscal condition any worse than it already is. If lawmakers want to raise discretionary spending caps, they should pay for their priorities.

“Our nation remains on a dangerous and unsustainable fiscal path that threatens our economy and future generations. Our budget process should begin a path toward sustainability of our nation’s finances.”

Further Reading

The United States Collects Less Tax Revenue Than Other G7 Countries

The U.S. collects less tax revenues compared with other G7 countries, and that lower level of revenues is a key driver of the national debt.

Energy Tax Policy Under the OBBBA

As part of the OBBBA, lawmakers rolled back existing energy tax incentives in order to partially offset the bill’s deficit impact.

Top 10 Reasons Why the National Debt Matters

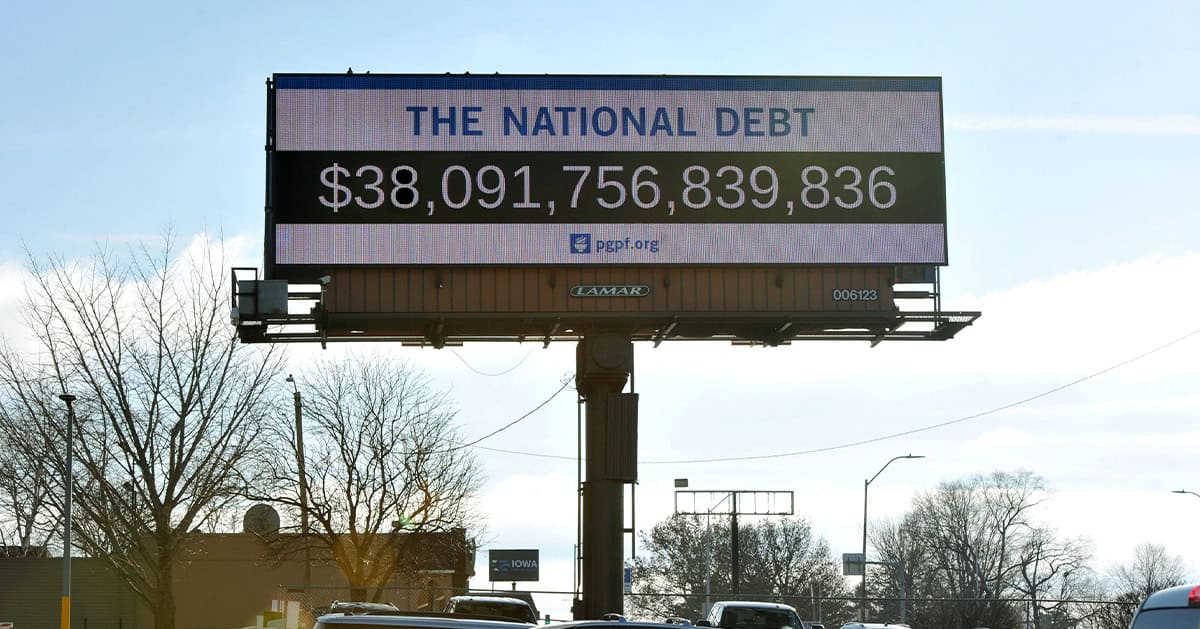

At $38 trillion and rising, the national debt threatens America’s economic future. Here are the top ten reasons why the national debt matters.