A new report from the nonpartisan Congressional Budget Office (CBO) warns that the “high and rising debt would have serious negative consequences for the budget and the nation,” including reduced incomes for families, an increased likelihood of financial crisis, and decreased flexibility for lawmakers when responding to unexpected challenges.

Here are five key takeaways — drawn from our analysis of the report — to help you better understand the scope, drivers, and consequences of our fiscal challenge:

1. The federal deficit will grow significantly over the next ten years. The deficit will exceed $1 trillion annually by 2022, and will remain above $1 trillion permanently unless policies are changed.

2. Federal debt will reach historically high levels. The national debt will climb significantly over the next ten years, reaching 91 percent GDP in 2027 — more than double the 50-year historical average.

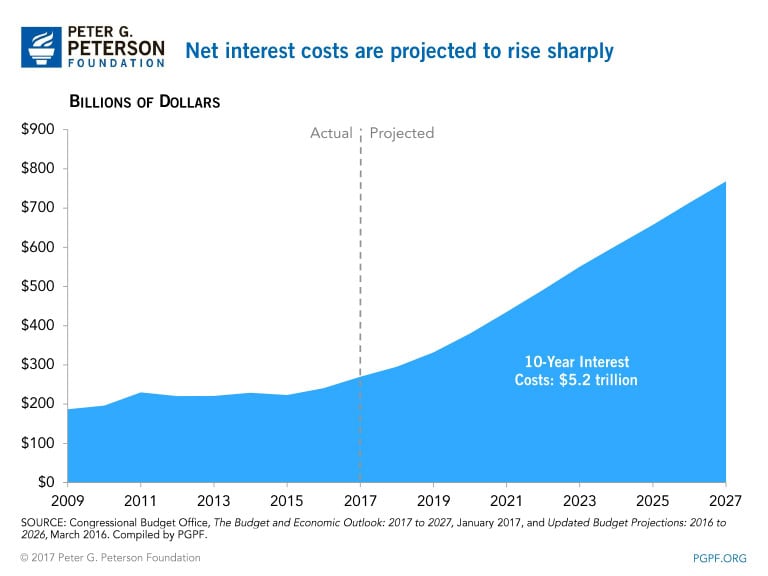

3. Interest costs are the fastest growing major item in the budget. As debt continues to accumulate and compound, and interest rates increase, net interest costs are projected to more than double over the decade.

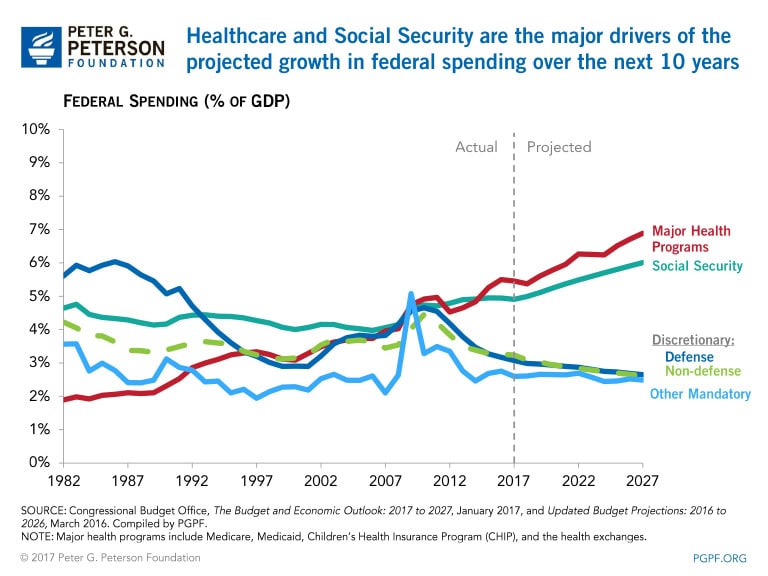

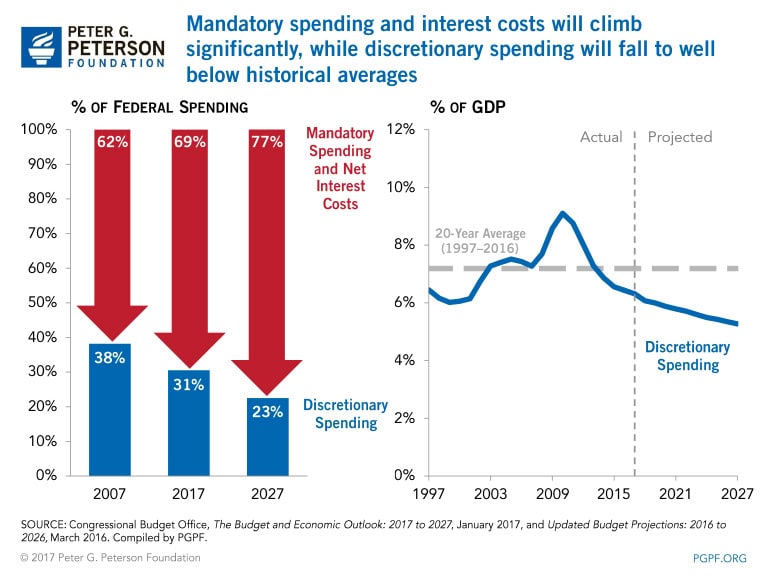

4. Mandatory spending is projected to climb in the coming years. Due primarily to demographics and our nation’s inefficient healthcare system, mandatory spending (excluding net interest) is projected to increase from $2.5 trillion in 2017 to $4.3 trillion in 2027.

5. Discretionary spending is projected to decline. As spending on mandatory programs and interest costs continues to rise, federal spending on discretionary programs will decline from 6.3 percent of GDP in 2017 to 5.4 percent in 2027.

Further Reading

What’s the Difference Between the Trade Deficit and Budget Deficit?

The terms “budget deficit” and “trade deficit” can be conflated, but they are distinct measurements of important fiscal and economic concepts.

The Federal Government Has Borrowed Trillions. Who Owns All that Debt?

Most federal debt is owed to domestic holders, but foreign ownership is much higher now than it was about 50 years ago.

The Fed Reduced the Short-Term Rate Again, but Interest Costs Remain High

High interest rates on U.S. Treasury securities increase the federal government’s borrowing costs.