CBO: Recent Budget Deal Will Add $1.7 Trillion to the National Debt over the Next 10 Years

The budget projections released by the Congressional Budget Office (CBO) in August reaffirm the perilous path of deficits and debt expected over the next decade. In fact, CBO’s fiscal outlook has deteriorated since its last set of projections was released just three months ago, primarily due to the enactment of the Bipartisan Budget Act of 2019. In its new report, CBO projects that:

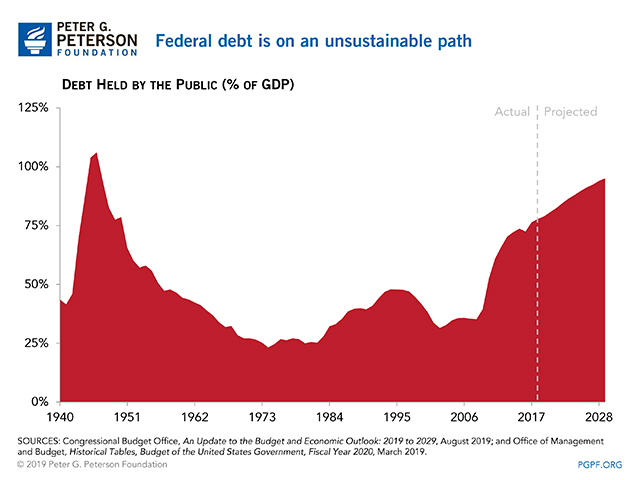

- Relative to the size of the economy, debt is already at its highest level since just after WWII and will continue to rise over the next 10 years.

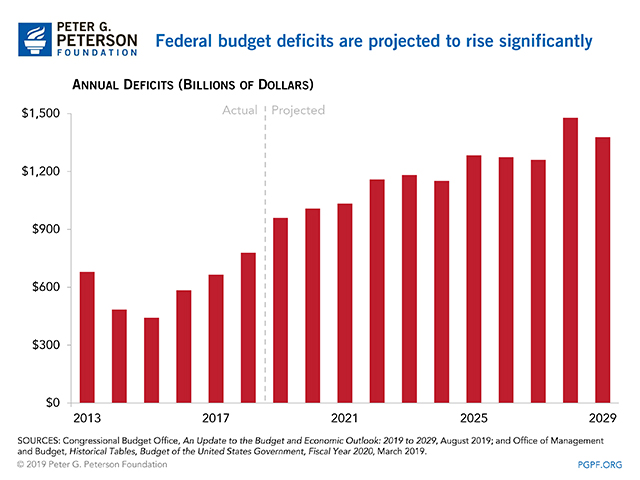

- The budget deficit will reach $960 billion this year — $181 billion higher than it was in 2018 — and deficits will total $12.2 trillion over the next decade.

- The Bipartisan Budget Act of 2019 and the increased future appropriations that will likely follow that legislation will add $1.7 trillion to the national debt over the next 10 years.

Federal Budget Deficits Will Soon Exceed $1 Trillion and Continue to Grow

Under current law, CBO projects that the budget deficit will exceed $1 trillion next year and continue to grow thereafter — averaging 4.7 percent of gross domestic product (GDP) over the next 10 years. That average is significantly higher than the average budget deficit of 2.9 percent of GDP over the past 50 years. It is especially unusual to run deficits of that size during an economic expansion.

The National Debt Is on an Unsustainable Trajectory

CBO projects that the national debt — already at its highest level since immediately after World War II — will climb from 79 percent of GDP today to 95 percent in 2029. Such historically high levels of debt result primarily from structural factors such as rising healthcare costs and the aging of the population, but has been exacerbated by the enactment of fiscally irresponsible legislation such as the Tax Cuts and Jobs Act (TCJA) and the Bipartisan Budget Act of 2019.

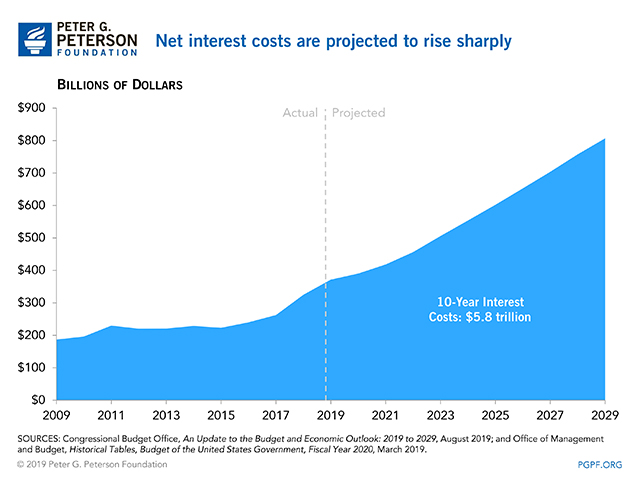

Interest Costs Continue to Rise

As the federal debt continues to grow, so too will the interest costs of servicing that debt. Although interest rates have fallen recently and CBO has reduced their forecast of future rates, the cost of borrowing is still expected to grow from today’s levels. As a result of the accumulating debt and higher rates, federal interest payments are expected to more than double in the next 10 years — climbing from $372 billion this year to $807 billion in 2029. With interest costs occupying a growing share of our budget each year, it will become increasingly difficult to invest in other areas such as education, research and development, and infrastructure.

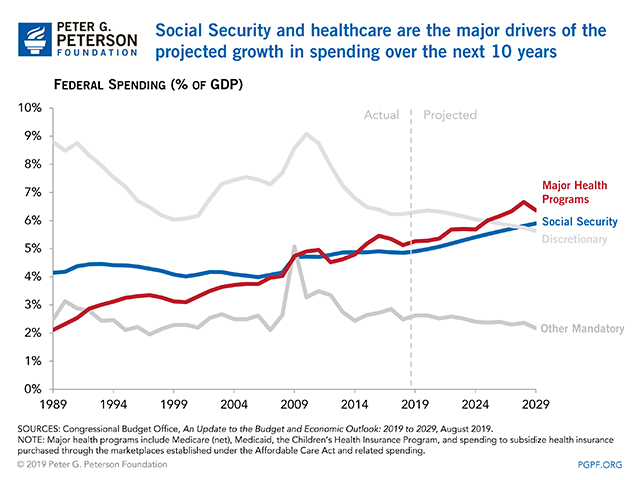

Mandatory Programs Are the Primary Driver of the Growth of Spending

Certain mandatory programs — programs governed by provisions of permanent law — are the key drivers of growth in spending:

- Major Health Programs: According to CBO, spending on healthcare programs such as Medicare, Medicaid, and the Children’s Health Insurance Program will rise from 5.3 percent of GDP in 2019 to 6.4 percent in 2029. Most of that increase is attributed to Medicare — which is growing as a result of an aging population and rising healthcare costs.

- Social Security: The aging of the population will also lead to substantial growth in spending on Social Security — the largest federal program — which is projected to climb from 4.9 percent of GDP in 2019 to 5.9 percent in 2029.

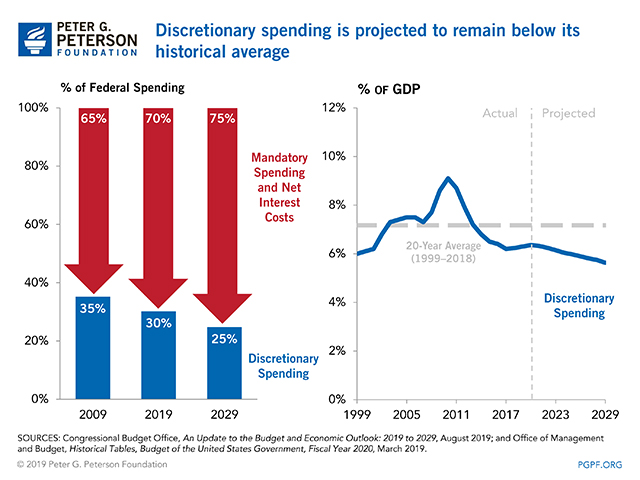

Discretionary spending — spending determined by Congress through the appropriation process — will not grow as fast as those mandatory programs over the next decade. CBO’s new baseline incorporates the addition of $1.7 trillion in discretionary spending above the total for the decade that was estimated in May; however, discretionary outlays are still projected to decline relative to the size of the economy — dropping from 6.3 percent of GDP in 2019 to 5.6 percent in 2029.

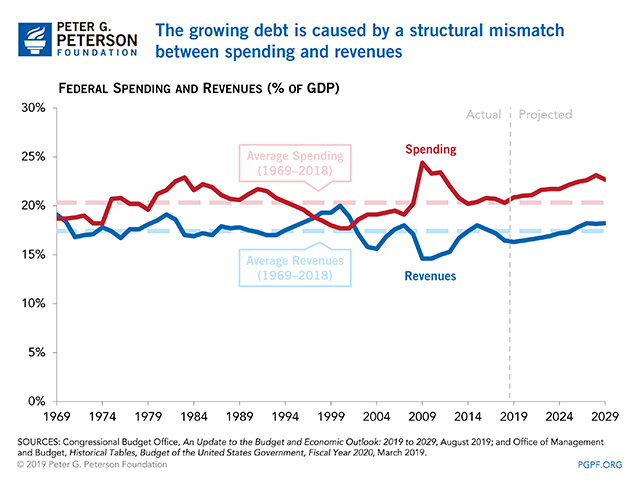

Revenues Will Be Insufficient to Cover Spending

Debt continues to grow as a result of the structural gap between spending and revenues. Over the next decade, federal revenues are projected to grow at an average annual rate of 5 percent under current law — roughly in line with the projected growth rate for federal spending — thereby continuing the mismatch between spending and revenues. However, those revenue projections may be too optimistic, as they assume that the individual income tax provisions of the TCJA will expire at the end of December 2025, as scheduled under current law. If those elements of the tax law were to be extended, revenues would be lower in the future — widening the disparity with spending.

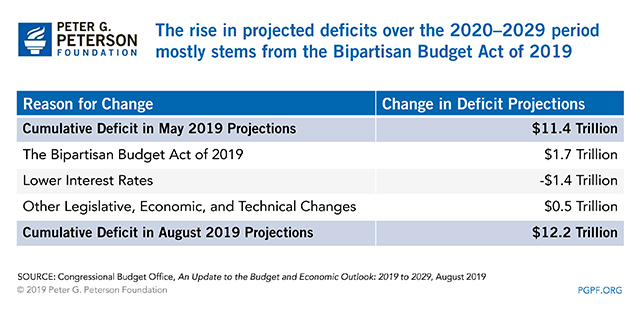

The Bipartisan Budget Act of 2019 Has Worsened the Fiscal Outlook since CBO’s Last Projection

The current CBO baseline reports that the cumulative deficit for the 2020 to 2029 period will be $12.2 trillion — $0.8 trillion more than the $11.4 trillion they reported in their May 2019 projections. The primary factors contributing to CBO’s new deficit forecast are:

- The Bipartisan Budget Act of 2019: Earlier this month, Congress and the President enacted legislation to raise discretionary spending caps for fiscal years 2020 and 2021. That increase in the caps will result in an additional $320 billion in debt over the next two years. The spending caps will expire in 2021, however, and CBO projects that discretionary spending will rise with inflation thereafter — resulting in an additional $1.2 trillion in outlays over the 2022 to 2029 period. Including net interest and a small amount of offsets, the Bipartisan Budget Act of 2019 will add $1.7 trillion to the debt over the next decade.

- Lower Interest Rates: CBO anticipates lower interest rates than it had previously forecasted. The level of interest payments remains high and growing — reaching nearly $6 trillion over the next decade; however, the reduction in anticipated future interest rates decreased net interest costs by $1.4 trillion between 2020 and 2029 relative to CBO’s May projections.

- Other Changes: Additional revisions to CBO’s projections, such as those resulting from supplemental appropriations for disaster relief and border security, increased the projected cumulative deficit by $0.5 trillion.

The Baseline Projection May Be Too Optimistic

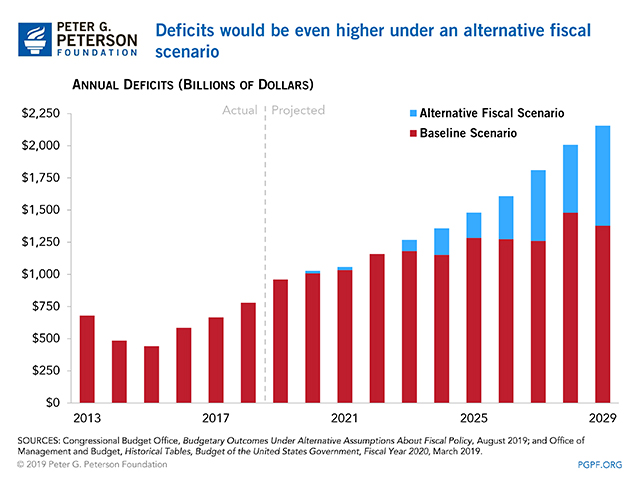

CBO’s baseline projections are built on the assumption that current law will remain unchanged and that Congress will allow certain provisions to expire as scheduled. If, however, policies that are currently in place are maintained, deficits and debt would be much larger than shown in CBO’s baseline.

CBO has also presented an alternative fiscal scenario that incorporates those potential legislative changes. For example, many provisions in the TCJA that relate to individual income taxes are set to expire at the end of December 2025. The alternative fiscal scenario, however, incorporates the assumption that those provisions are extended. In addition, the alternative fiscal scenario keeps appropriations at their current share of GDP (6.3 percent) rather than following the baseline assumption that they drop to 5.6 percent in 10 years.

Under those assumptions, CBO projects that budget deficits would total $14.9 trillion over the next decade — $2.7 trillion higher than calculated under the baseline projection. As a result of higher deficits, debt held by the public would reach 104 percent of GDP by 2029 — higher than the baseline projection of 95 percent of GDP.

It’s Not Too Late for Policymakers to Act

The United States will face a range of complex and critical issues in the coming years and reducing our national debt now will provide us with the fiscal flexibility to properly deal with those challenges.

No American wants a future in which our economy is buried with debt, lacking investment, and struggling to grow. We can improve America’s long-term fiscal outlook by making sensible decisions now. Charting our country on a sustainable fiscal path will further our ability to overcome those challenges and create the conditions that will encourage economic growth and build a prosperous future. As CBO notes:

“The nation’s fiscal outlook is challenging. Federal debt, which is already high by historical standards, is on an unsustainable course… To put it on a sustainable path, lawmakers will have to make significant changes to tax and spending policies — increasing revenues more than they would under current law, reducing spending below projected amounts, or adopting some combination of those approaches.”

Photo by Chip Somodevilla/Getty Images

Further Reading

What Is the National Debt Costing Us?

Programs that millions of Americans depend on and care about may be feeling a squeeze from interest costs on our high and rising national debt.

Interest Costs on the National Debt Are Reaching All-Time Highs

The most recent CBO projections confirm once again that America’s fiscal outlook is on an unsustainable path — increasingly driven by higher interest costs.

New Report: National Debt Outlook Gets Worse as Interest Costs Exceed $1 Trillion Annually

A new CBO report shows that the national debt outlook worsened from last year’s projections.