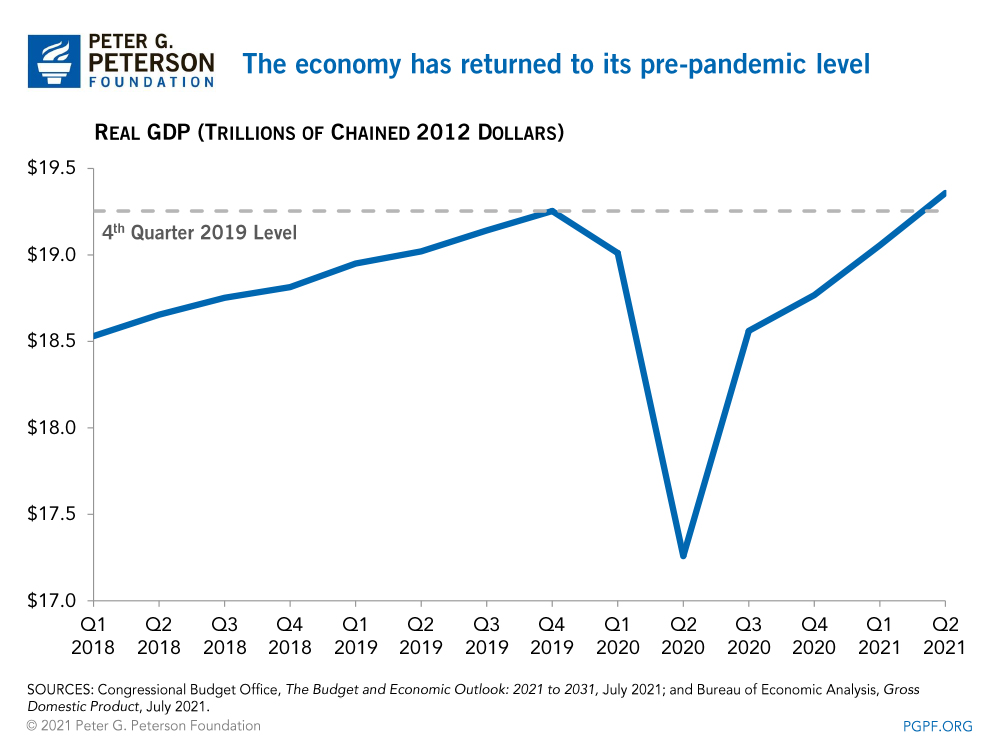

A Year after the Worst Economic Contraction Ever Recorded, Output Returns to Pre-Pandemic Levels

Economic growth remained strong in the second quarter of 2021 according to new data from the Bureau of Economic Analysis (BEA). The continued economic recovery, fueled by consumer spending, brought economic output back to its pre-pandemic level just a year after the worst economic contraction ever recorded.

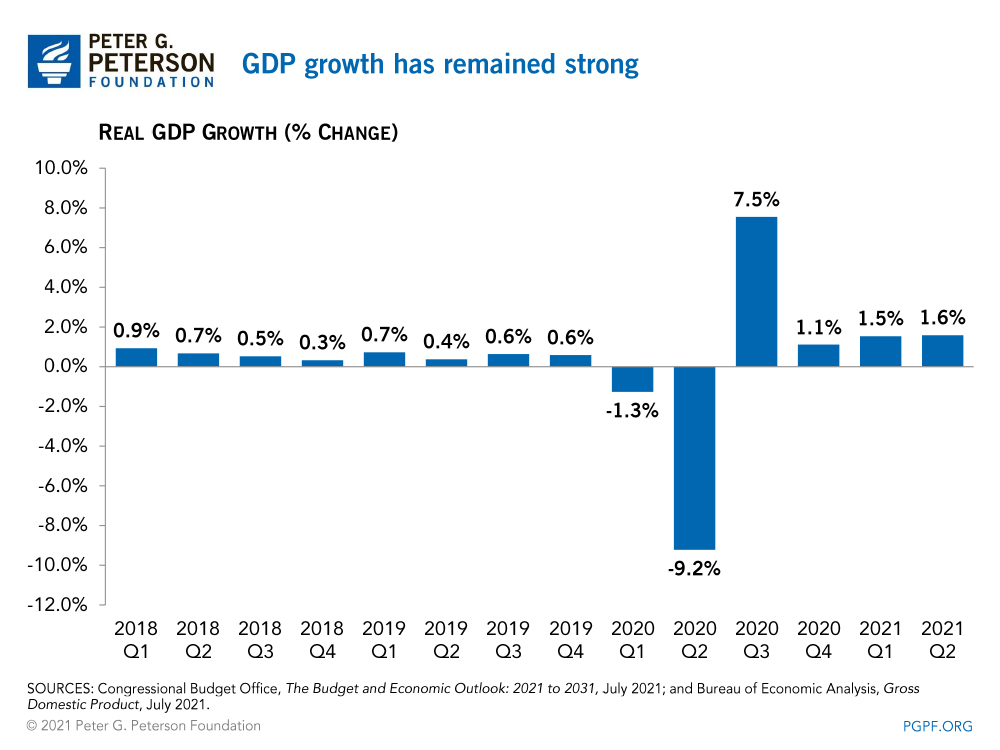

Real (inflation-adjusted) gross domestic product (GDP) grew by an annual rate of 6.5 percent in the second quarter of 2021, according to the BEA. Looking at the quarter in isolation (without annualizing the growth), the economy grew by 1.6 percent, which was approximately the same as the growth rate in the first quarter of the year.

The increase in real GDP was driven by a large jump in personal consumption (11.8 percent on an annualized basis compared with the previous quarter) for both goods and services and non-residential fixed investment (8 percent). Those areas of growth were offset by decreases in retail trade inventories, residential fixed investment, and federal spending.

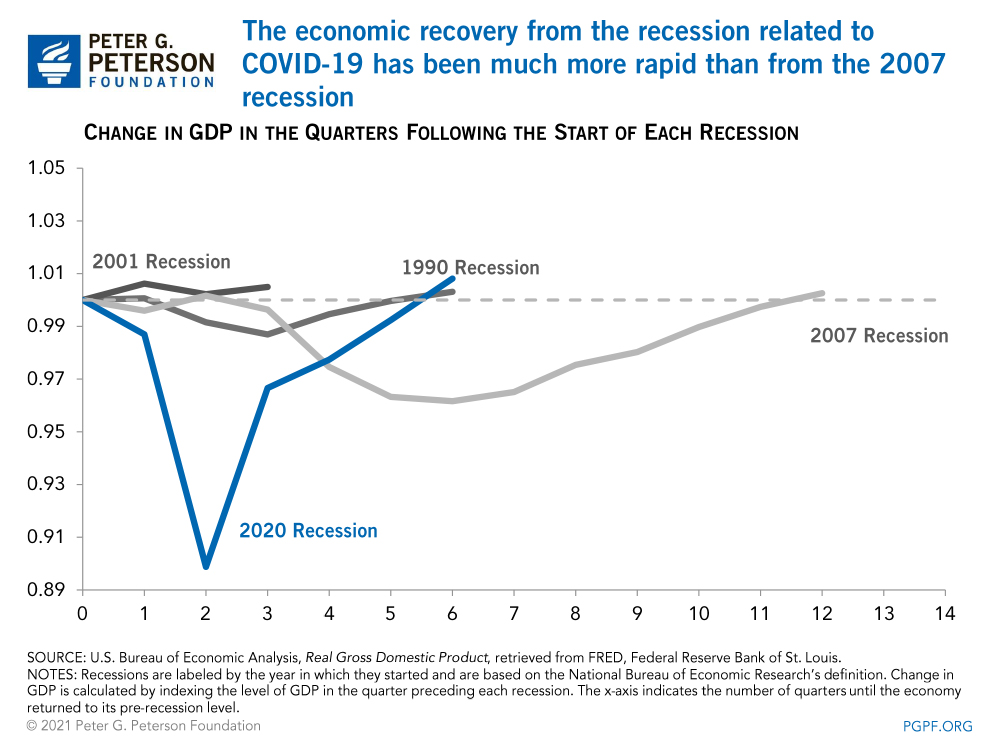

The recovery in the last year is cause for optimism, as the rebound in economic output has been much quicker than in the last recession. The labor market is also recovering, though there are ongoing concerns that the recovery is not equally distributed, particularly for Black, Hispanic, and Asian workers.

That strong rebound is largely thanks to unprecedented levels of government spending. As we continue to emerge from the pandemic, and as policymakers turn their eyes towards longer-term issues, they should keep in mind that strengthening our fiscal outlook is a necessary element of positioning America for its next chapter.

Image credit: Photo by David Dee Delgado / Stringer / Getty Images

Further Reading

What’s the Difference Between the Trade Deficit and Budget Deficit?

The terms “budget deficit” and “trade deficit” can be conflated, but they are distinct measurements of important fiscal and economic concepts.

The Fed Reduced the Short-Term Rate Again, but Interest Costs Remain High

High interest rates on U.S. Treasury securities increase the federal government’s borrowing costs.

What Types of Securities Does the Treasury Issue?

Learn about the different types of Treasury securities issued to the public as well as trends in interest rates and maturity terms.