A new report released this week from the nonpartisan Yale Budget Lab outlines the impact of high debt on inflation. The paper argues that America’s unsustainable fiscal outlook can have “significant consequences for price stability, interest rates, and overall economic performance.”

In an article about the report in the New York Times, Ernie Tedeschi, director of economics at the Yale Budget Lab, said “When you deficit finance policies, that is going to put upward cost pressure on American households.”

Here are the top five takeaways from the Yale Budget Lab report:

- Higher debt puts upward pressure on inflation in both the short- and long-term.

- Credible monetary policy can help fight inflationary pressure, but comes at the cost of higher interest rates for businesses and consumers.

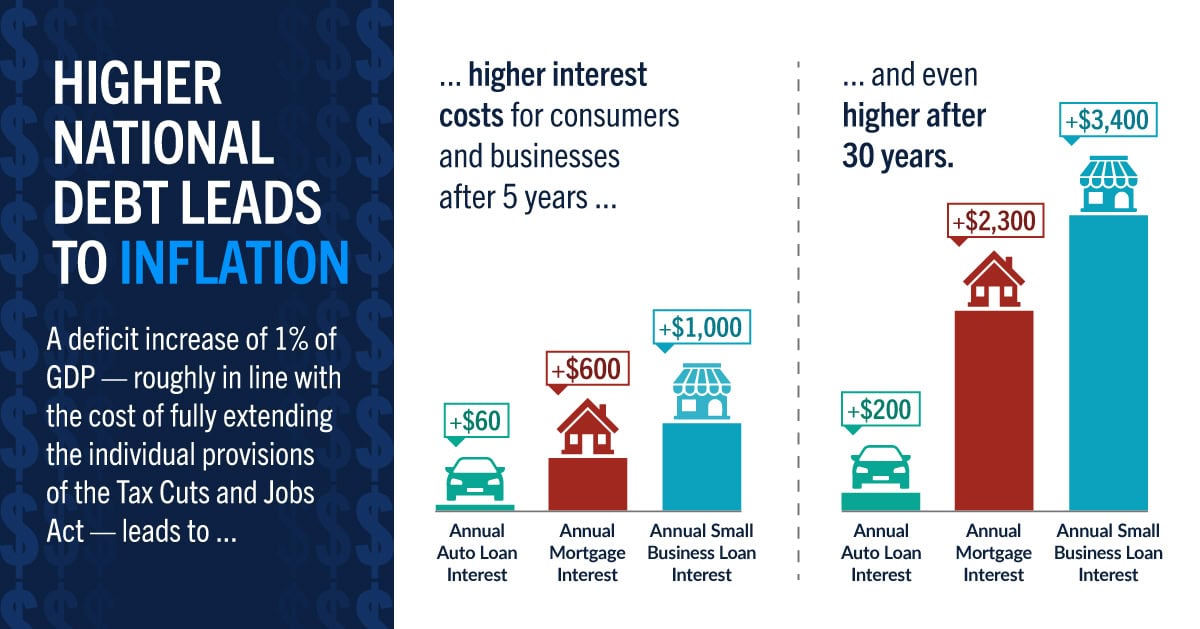

- A permanent deficit increase of 1% of GDP — roughly in line with the cost of fully extending the individual provisions of the Tax Cuts and Jobs Act — would:

-

- decrease household purchasing power by $300–1,250 over five years

- increase mortgage interest payments by $600–1,240 per year

- Debt rising unchecked risks substantial negative effects on capital accumulation, output, and living standards.

- As the U.S. debt-to-GDP ratio approaches historic highs, these findings emphasize the importance of prudent fiscal management and the need for policymakers to carefully consider the long-term consequences of persistent deficit spending.

Further Reading

What Are Interest Costs on the National Debt?

Interest costs are on track to become the largest category of spending in the federal budget.

Moody’s Downgrade of U.S. Credit Rating Highlights Risks of Rising National Debt

For the first time ever, all three major credit ratings agencies have downgraded U.S. credit below their top rating.

New Report: Rising National Debt Will Cause Significant Damage to the U.S. Economy

On all key financial metrics, from GDP and investment to jobs to wages, the growing national debt harms future economic prospects for American citizens.