National Debt to Double in Size and Other Key Takeaways from the CBO Long-Term Outlook

Today, the nonpartisan Congressional Budget Office (CBO) released its Long-Term Budget Outlook, which offers a look at the nation’s fiscal health through 2052. The report highlights the structural misalignment in the country’s budget and the resulting unsustainable fiscal trajectory.

Here are five key takeaways from CBO’s latest projections.

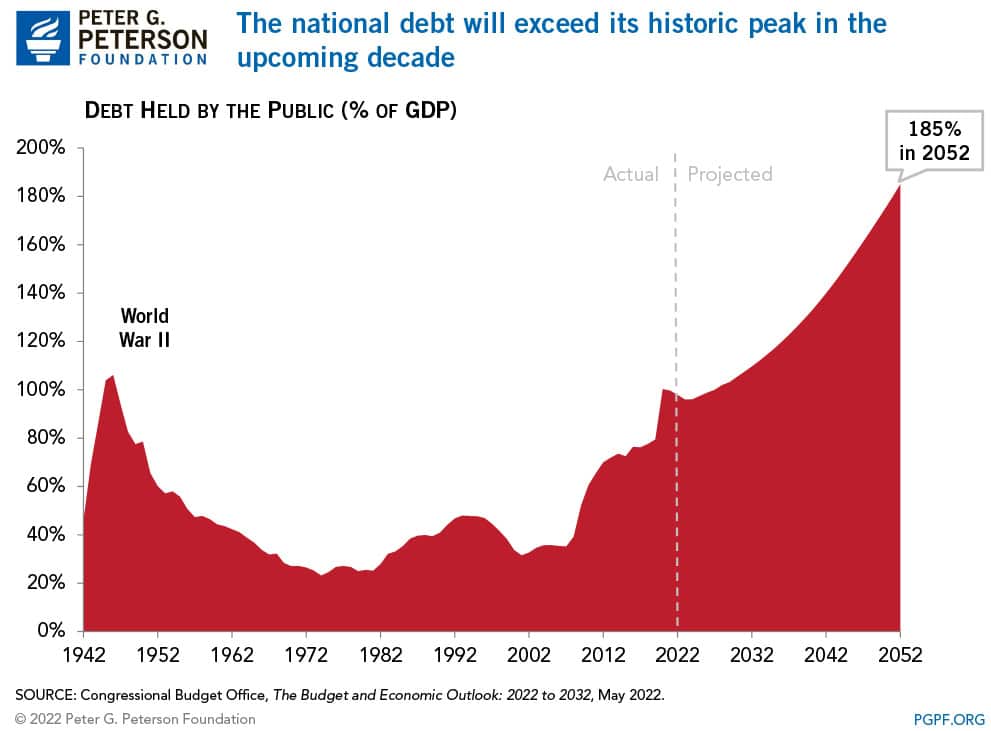

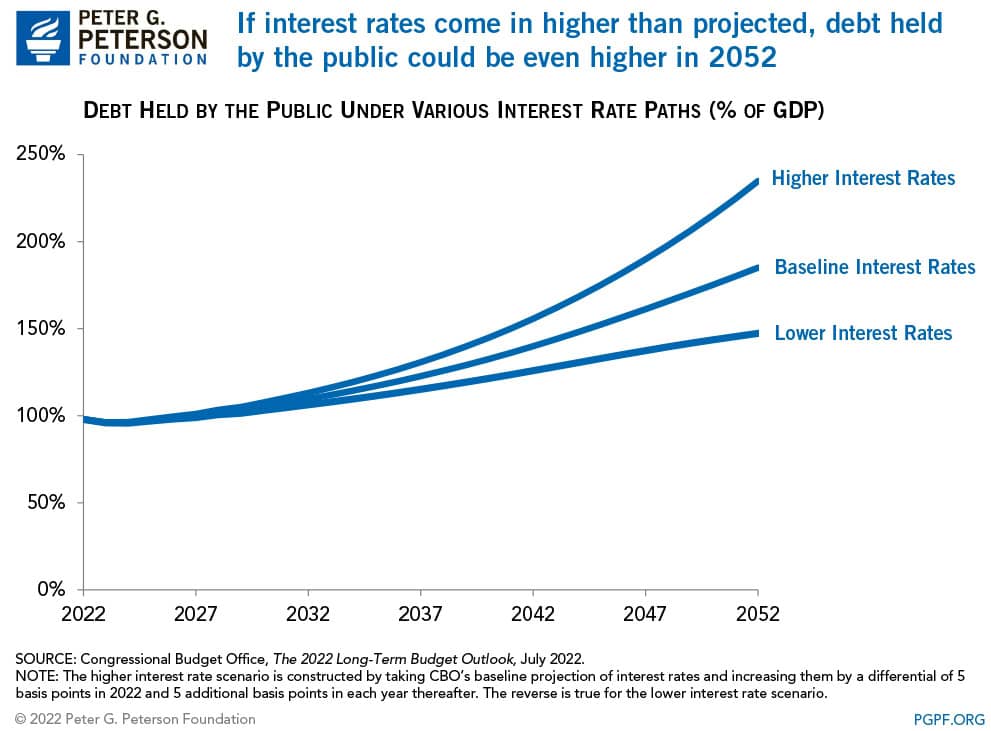

1. Debt will nearly double in size. CBO expects that debt held by the public will climb from 97.9 percent of gross domestic product (GDP) in 2022 to 185.0 percent in 2052.

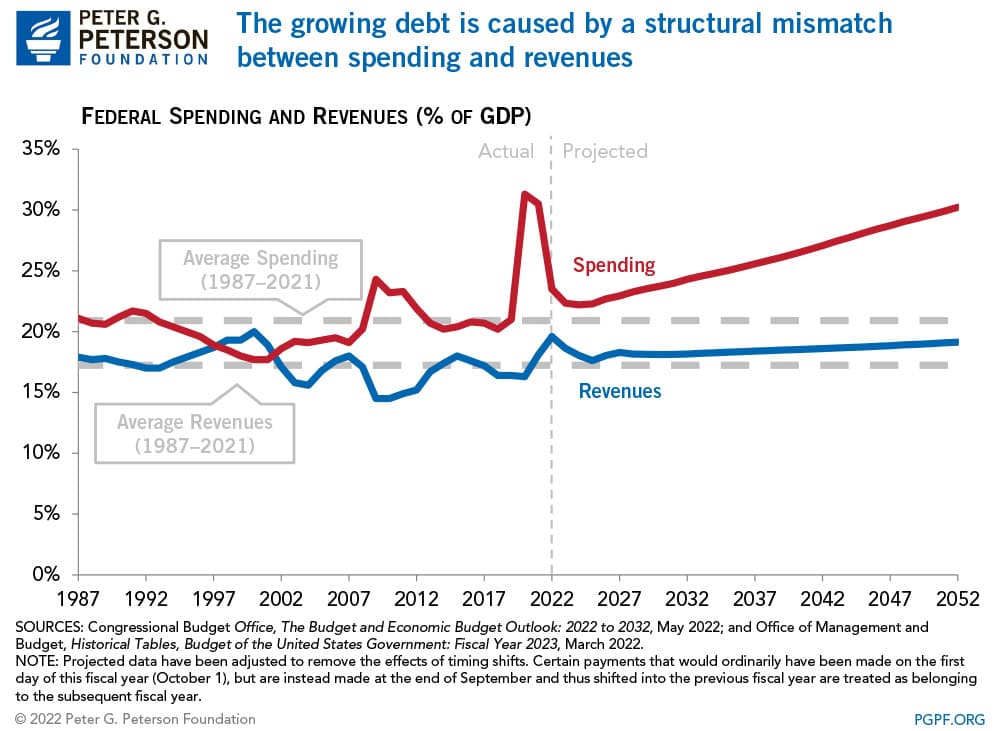

2. There’s an ongoing mismatch between revenues and spending. The COVID-19 pandemic exacerbated the nation’s fiscal trajectory, but the more consequential underlying problem is the structural mismatch between spending and revenues, which will be the primary driver behind growing deficits in the future. CBO projects that outlays will decrease from 23.5 percent of GDP in 2022 to 22.2 percent in 2024 before gradually rising to 30.2 percent of GDP in 2052. CBO also projects that revenues will rise slightly over the next 30 years relative to the size of the economy, but at a slower pace, reaching 19.1 percent of GDP in 2052.

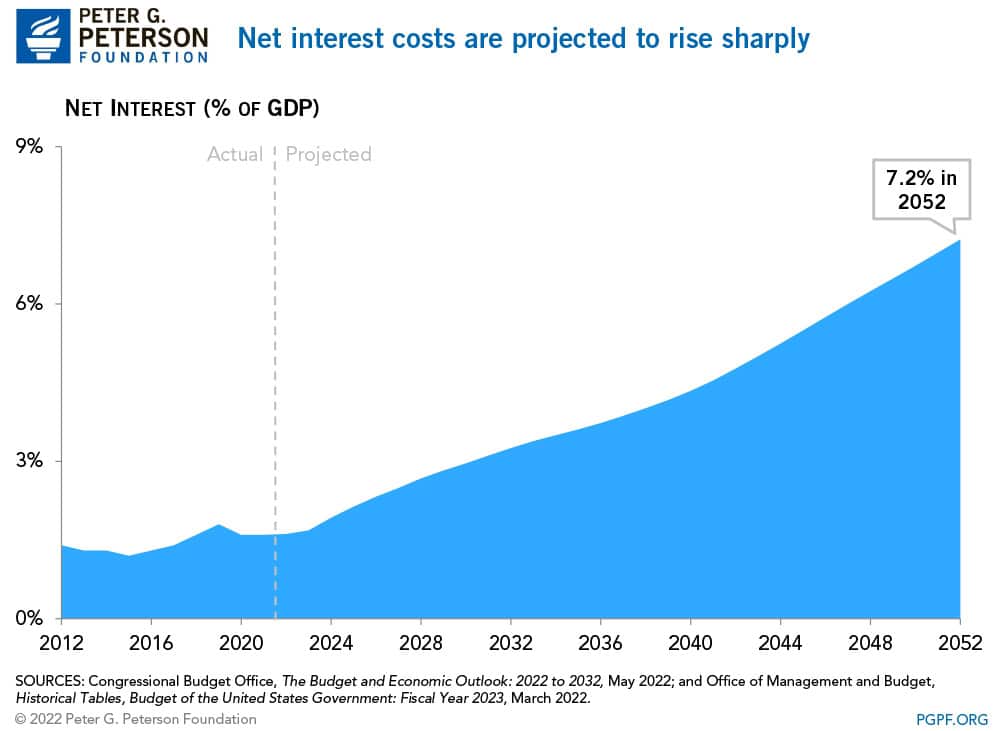

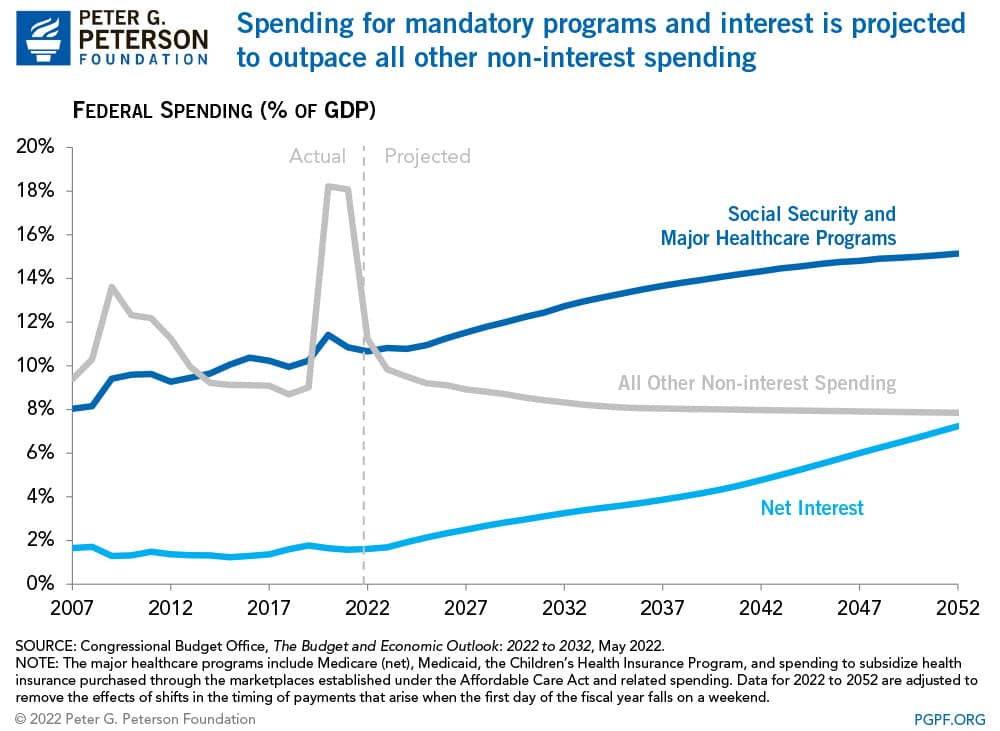

3. Growth in the debt and rising interest rates will push interest costs up substantially over the 30-year horizon. CBO projects that interest costs will grow dramatically from 1.6 percent of GDP in 2022 to 7.2 percent in 2052. In the past 50 years, net interest has averaged 2 percent of GDP; the high for the category was 3.2 percent in 1991.

4. In fact, net interest will become the fastest growing component of the budget. Net interest, along with Social Security and Medicare, will drive up spending in the long term.

5. Debt could be even higher if interest rates exceed projections. Debt would reach 185 percent of GDP by 2052 under CBO’s baseline projections of interest rates. If interest rates climb higher than CBO projects, however, the debt picture would look even worse. For example, if rates creep up by an additional 5 basis points (a basis point is 1/100th of 1 percent) each year that cumulates above the baseline projection, the debt-to-GDP ratio would rise to 235 percent.

The country faces near-term economic concerns about inflation, rising interest rates, and a potential recession. Nevertheless, we also need to maintain focus on the daunting long-term budget trajectory that is outlined in the latest CBO report.

Image credit: Chip Somodevilla/Getty Images

Further Reading

The Fed Held Its Target Range After Reducing the Short-Term Rate Three Meetings in a Row

High interest rates on U.S. Treasury securities increase the federal government’s borrowing costs.

How Does the United States’ Fiscal Position Compare to Other Countries’?

The United States is in a poor fiscal condition compared to the rest of the world, according to the OECD.

Top 10 Reasons Why the National Debt Matters

At $38 trillion and rising, the national debt threatens America’s economic future. Here are the top ten reasons why the national debt matters.