National Debt to Double in Size and Other Key Takeaways from the CBO Long-Term Outlook

Today, the nonpartisan Congressional Budget Office (CBO) released its Long-Term Budget Outlook, which offers a look at the nation’s fiscal health through 2052. The report highlights the structural misalignment in the country’s budget and the resulting unsustainable fiscal trajectory.

Here are five key takeaways from CBO’s latest projections.

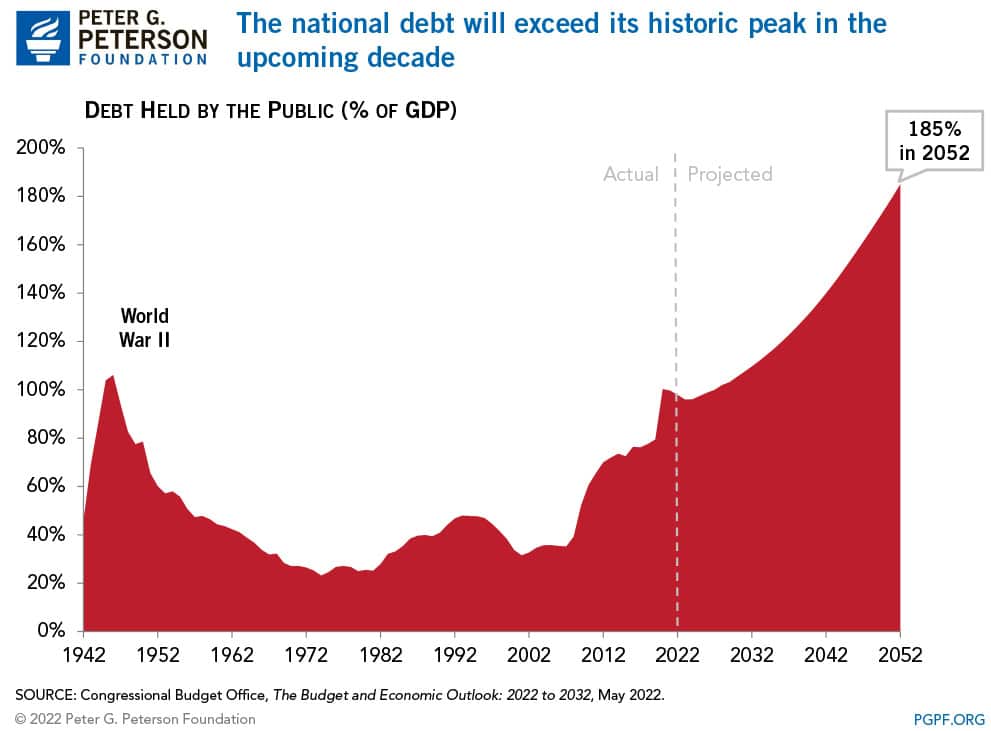

1. Debt will nearly double in size. CBO expects that debt held by the public will climb from 97.9 percent of gross domestic product (GDP) in 2022 to 185.0 percent in 2052.

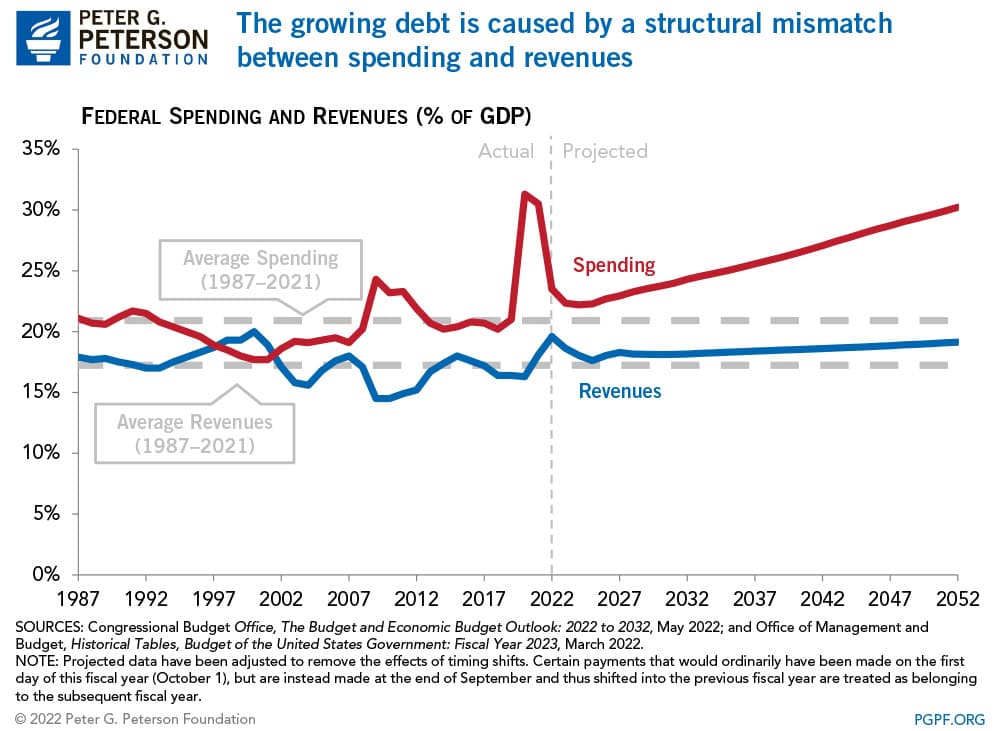

2. There’s an ongoing mismatch between revenues and spending. The COVID-19 pandemic exacerbated the nation’s fiscal trajectory, but the more consequential underlying problem is the structural mismatch between spending and revenues, which will be the primary driver behind growing deficits in the future. CBO projects that outlays will decrease from 23.5 percent of GDP in 2022 to 22.2 percent in 2024 before gradually rising to 30.2 percent of GDP in 2052. CBO also projects that revenues will rise slightly over the next 30 years relative to the size of the economy, but at a slower pace, reaching 19.1 percent of GDP in 2052.

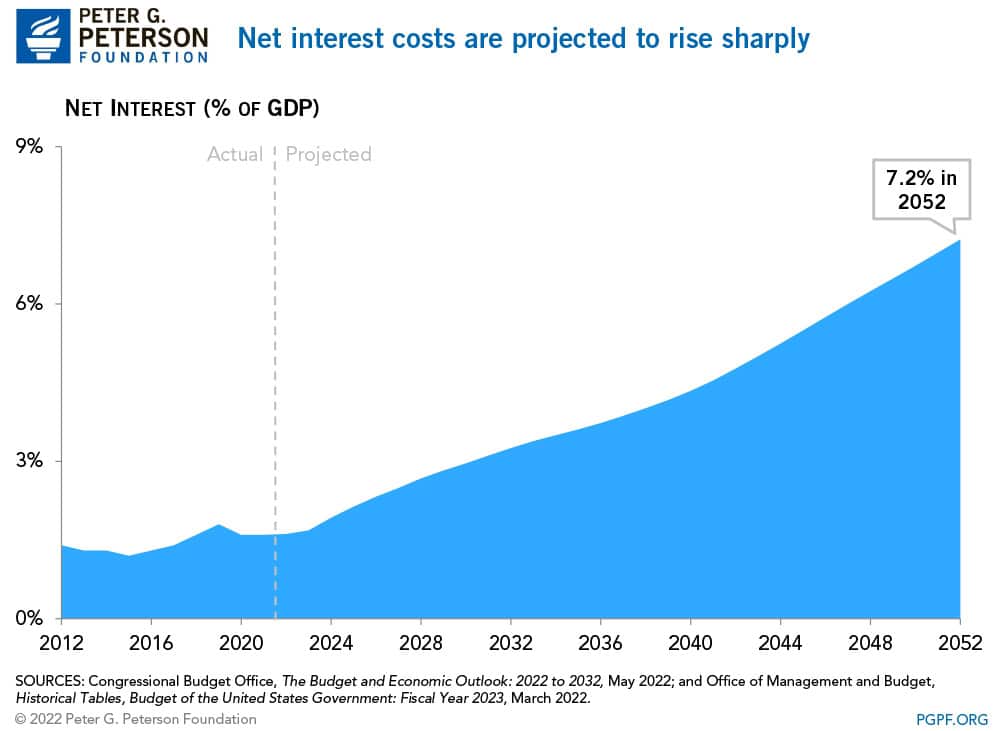

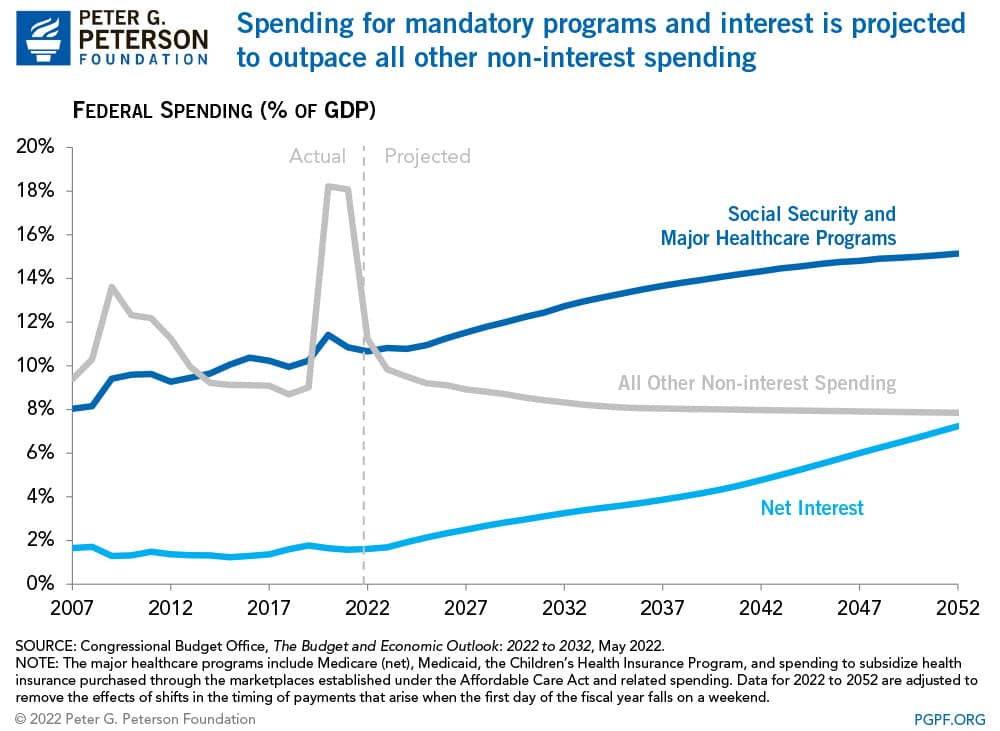

3. Growth in the debt and rising interest rates will push interest costs up substantially over the 30-year horizon. CBO projects that interest costs will grow dramatically from 1.6 percent of GDP in 2022 to 7.2 percent in 2052. In the past 50 years, net interest has averaged 2 percent of GDP; the high for the category was 3.2 percent in 1991.

4. In fact, net interest will become the fastest growing component of the budget. Net interest, along with Social Security and Medicare, will drive up spending in the long term.

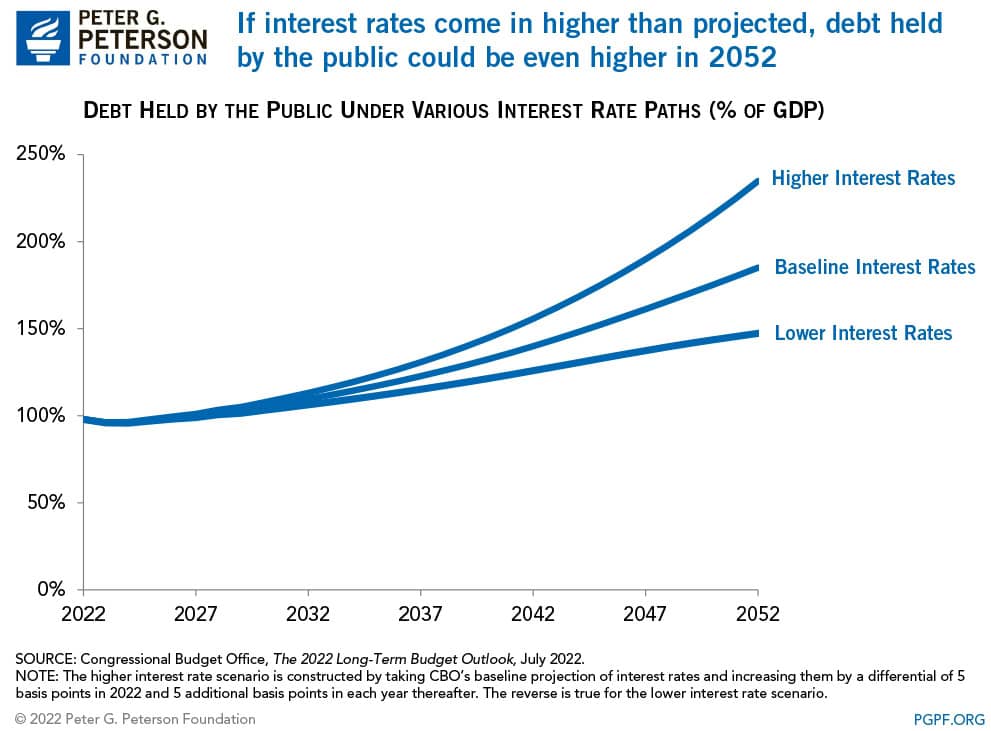

5. Debt could be even higher if interest rates exceed projections. Debt would reach 185 percent of GDP by 2052 under CBO’s baseline projections of interest rates. If interest rates climb higher than CBO projects, however, the debt picture would look even worse. For example, if rates creep up by an additional 5 basis points (a basis point is 1/100th of 1 percent) each year that cumulates above the baseline projection, the debt-to-GDP ratio would rise to 235 percent.

The country faces near-term economic concerns about inflation, rising interest rates, and a potential recession. Nevertheless, we also need to maintain focus on the daunting long-term budget trajectory that is outlined in the latest CBO report.

Image credit: Chip Somodevilla/Getty Images

Further Reading

House Reconciliation Bill Would Add Trillions to the National Debt

The bill would increase debt by $3.0 trillion over the next 10 years, driving it from nearly 100 percent of GDP now to 124 percent of GDP by 2034.

House Reconciliation Bill Would Increase the National Debt by More Than Any Other Recent Legislation

The House recently passed the largest reconciliation bill ever. CBO estimates it would add $2.4 trillion (excluding interest) to the national debt over 10 years.

United States Is Borrowing at a Higher Rate than the Global Average, Warns IMF

New IMF reports serve as a warning to all countries that global fiscal and economic conditions are veering into dangerous territory.