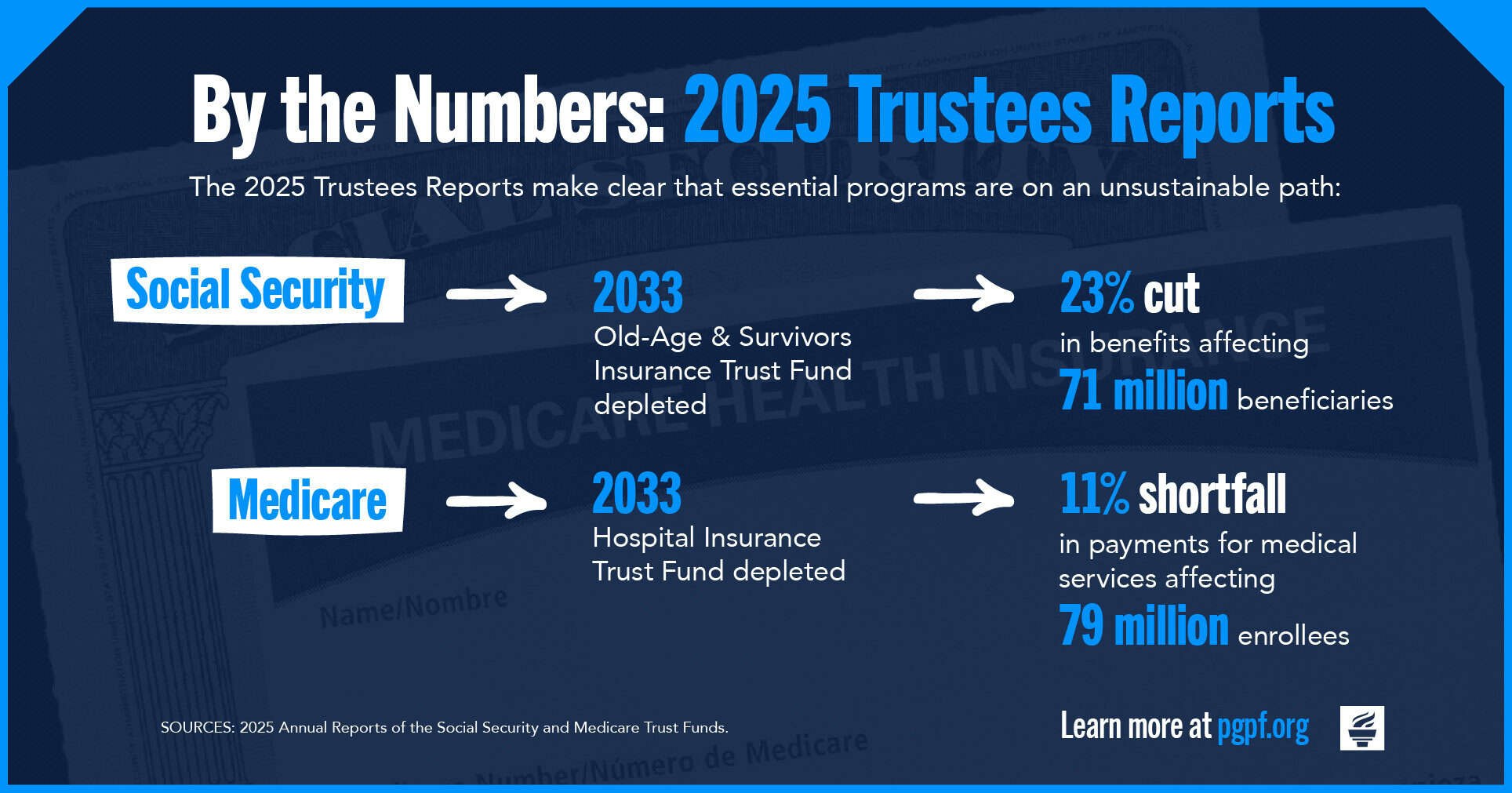

Today, the Social Security and Medicare Trustees released their annual reports on the programs’ financing, showing that the future of these vital programs remains at risk. The Social Security Trustees note that the Old-Age and Survivors Insurance (OASI) Trust Fund is expected to become depleted in 2033, the same year noted in the last two reports and as the Congressional Budget Office projected earlier this year. Upon depletion of the OASI Trust Fund in just 8 years, millions of older Americans would face an automatic cut of 23 percent to their Social Security retirement benefits. The Medicare Trustees project that the Hospital Insurance (HI) Trust Fund, which finances Medicare Part A, would also become depleted in 2033, a deterioration from the projected depletion year of 2036 in last year’s report. Upon depletion of the HI Trust Fund, payments to medical providers would be reduced by 11 percent. The reports make clear that the trust funds of these vital programs remain on an unsustainable path. The good news is that it is entirely within policymakers’ control to shore up Social Security and Medicare and preserve them for the future. Doing so will not only protect millions of beneficiaries — and especially the country’s most vulnerable citizens — but will provide stability and strength to the fiscal and economic outlook.

Image credit: Photo by Michael Vi/Getty Images

Further Reading

Budget Basics: How Does Social Security Work?

Social Security is the largest single program in the federal budget and typically makes up one-fifth of total federal spending.

Budget Basics: Unemployment Insurance Explained

The Unemployment Insurance program is a key counter-cyclical tool to help stabilize the economy and speed recovery during downturns or crises.

Can We Raise the Retirement Age and Protect Vulnerable Workers?

Some policy options aim to protect economically vulnerable workers or those who are unable to delay retirement because they work in physically demanding occupations.