The lawmakers we choose this November will face critical fiscal and economic decisions in the next two, four, and six years.

Starting in 2025, the president and Congress will confront a series of urgent deadlines and decision points. The choices our leaders make will determine how much families and businesses pay in taxes, whether or not there are automatic cuts to Social Security and Medicare, the affordability of healthcare under the ACA, and what to do about the debt ceiling. Undoubtedly, 2024 is a Fiscal Election.

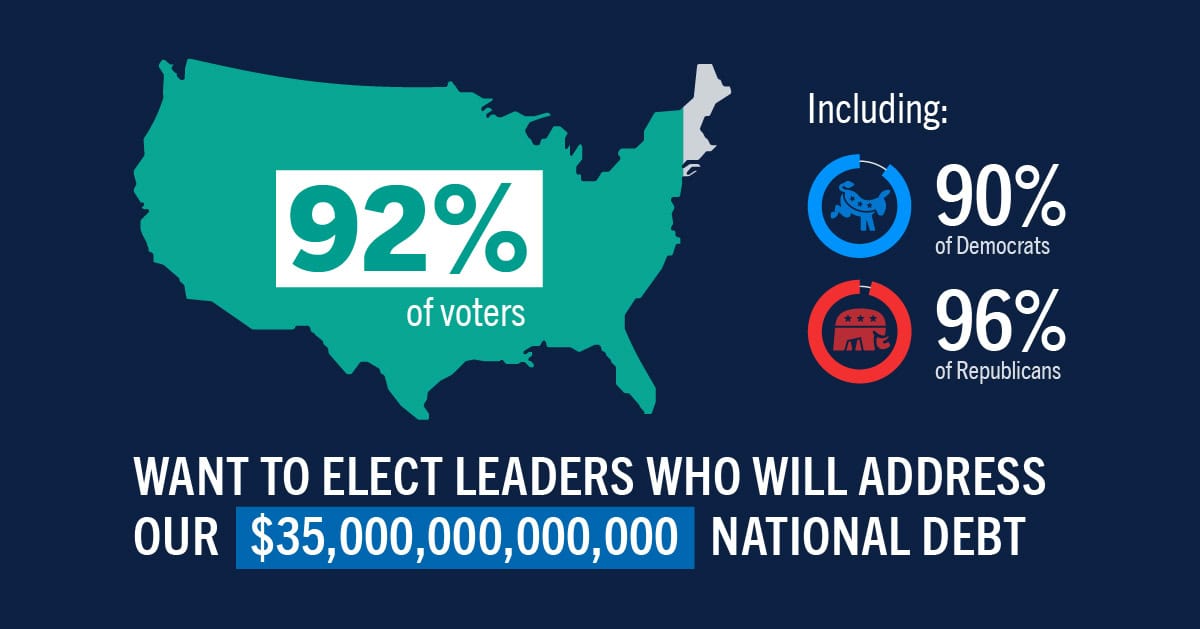

Want to share this image on your site? Copy and paste the embed code below:

<img src="http://www.pgpf.org/sites/default/files/Infographic-The-2024-Fiscal-Election.jpg" width="620" alt="The Fiscal Election">

<a href="https://www.pgpf.org/infographic/the-fiscal-election-whats-at-stake-in-this-election">

</a><p><strong>The Fiscal Election</strong>, courtesy of <a href="https://www.pgpf.org/infographic/the-fiscal-election-whats-at-stake-in-this-election">Peter G. Peterson Foundation</a></p>Feel free to share this infographic on Twitter.

Tweet: The lawmakers we choose this November will face critical fiscal and economic decisions.

Further Reading

What Are Interest Costs on the National Debt?

Interest costs are on track to become the largest category of spending in the federal budget.

Healthcare Costs Are a Major Driver of the National Debt and Here’s the Biggest Reason Why

Improving the U.S. healthcare system will be crucial to providing quality, affordable healthcare and to bettering our nation’s long-term economic and fiscal well-being.

House Reconciliation Bill Would Add Trillions to the National Debt

The bill would increase debt by $3.0 trillion over the next 10 years, driving it from nearly 100 percent of GDP now to 124 percent of GDP by 2034.