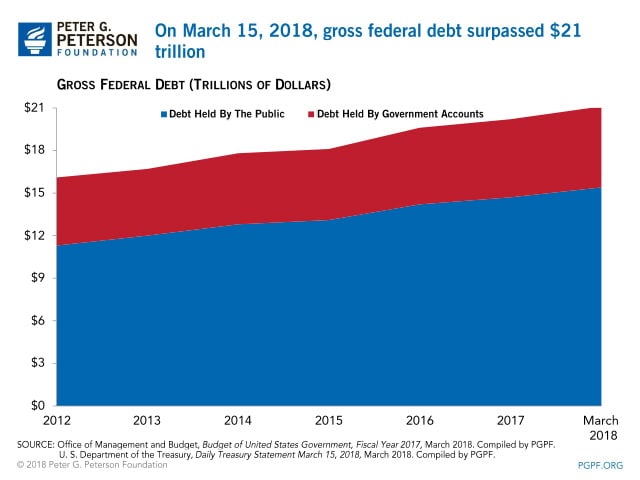

On March 15, 2018, the federal government passed an unfortunate milestone: $21 trillion dollars in gross federal debt.

Gross federal debt has grown by $5 trillion in just the last five years—from $16 trillion at the end of fiscal year 2012 to $21 trillion today. More than 80 percent of that growth has come from debt held by the public. It took just six months to add on the most recent trillion dollars.

The growth of our debt stems from a fundamental imbalance between spending and revenues. Growth in spending — driven by an aging population, rising healthcare costs, and mounting interest payments — is outstripping collections of taxes to pay for it. As a result, the national debt is on an unsustainable long-term trajectory that will undermine economic opportunities for individuals and families in the future.

As Foundation CEO Michael Peterson noted, this trend is especially troubling because our fiscal outlook has only begun to reflect the effects of fiscally irresponsible tax and spending legislation that has been enacted in recent months. During a time of low unemployment and economic expansion, now is the time to get the national debt under control — but lawmakers have been moving in the wrong direction.

Image credit: Photo by Alex Neill/Getty Images

Further Reading

What’s the Difference Between the Trade Deficit and Budget Deficit?

The terms “budget deficit” and “trade deficit” can be conflated, but they are distinct measurements of important fiscal and economic concepts.

The Federal Government Has Borrowed Trillions. Who Owns All that Debt?

Most federal debt is owed to domestic holders, but foreign ownership is much higher now than it was about 50 years ago.

The Fed Reduced the Short-Term Rate Again, but Interest Costs Remain High

High interest rates on U.S. Treasury securities increase the federal government’s borrowing costs.