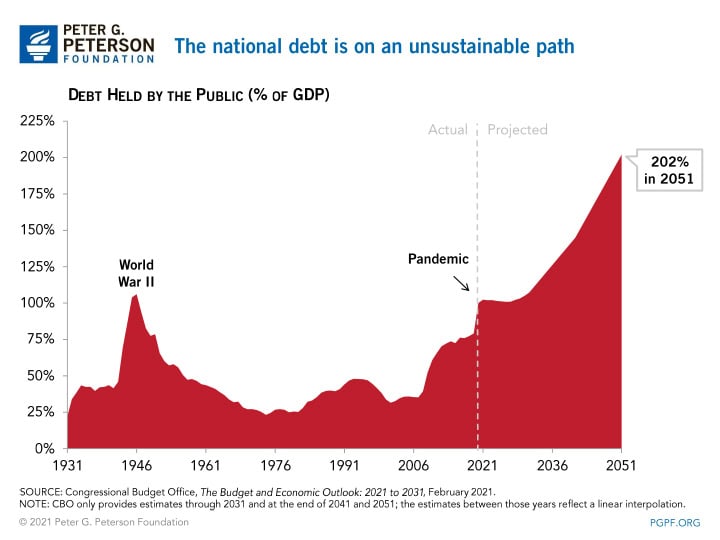

The Congressional Budget Office (CBO) recently released projections showing that the national debt will nearly double in size in the coming decades. If current laws remain the same, debt held by the public would rise from 102 percent of gross domestic product (GDP) at the end of 2021 to 202 percent at the end of 2051. The debt growing to double the size of GDP is, in many respects, a symbolic milestone — but it is a clear indicator of the monumentally unsustainable path of our fiscal trajectory.

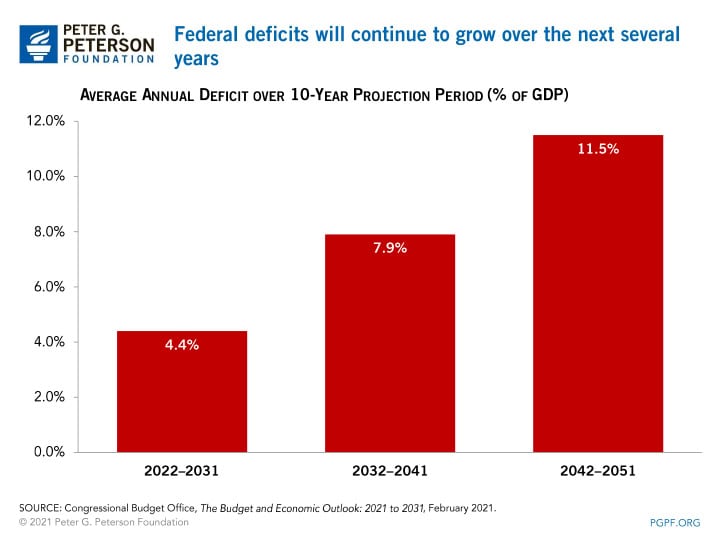

The agency’s baseline projections earlier this month indicated that while the COVID-19 pandemic has exacerbated the nation’s fiscal trajectory, the structural mismatch between spending and revenues will be the primary driver behind the nation’s growing debt long after the pandemic is behind us. Over the 10-year period from 2022–2031, the federal deficit is expected to average 4.4 percent of GDP. That budgetary shortfall would leap to an annual average of 11.5 percent of GDP over the 2042 to 2051 period. As was the case before the pandemic, predictable factors such as rising healthcare costs and an aging population — along with insufficient revenues to meet our commitments — would fuel such growth in the nation’s debt and deficits. The interest costs paid on that mounting debt would also grow rapidly; CBO projects that interest costs would average 7.0 percent of GDP between 2042 and 2051 — 3.5 times larger than the average of 2.0 percent over the past 50 years.

A sustainable fiscal trajectory is essential for a strong economy. While the economic damage from the COVID-19 pandemic and the necessary legislative response have led to an unprecedented rise in federal borrowing, the underlying gap between spending and revenues threatens the nation’s fiscal future in the decades ahead. Once the pandemic has subsided and the nation’s economy has fully recovered, policymakers should return to addressing America’s fiscal challenges.

Image credit: Photo by Brandon Bell/Getty Images

Further Reading

House Reconciliation Bill Would Add Trillions to the National Debt

The bill would increase debt by $3.0 trillion over the next 10 years, driving it from nearly 100 percent of GDP now to 124 percent of GDP by 2034.

House Reconciliation Bill Would Increase the National Debt by More Than Any Other Recent Legislation

The House recently passed the largest reconciliation bill ever. CBO estimates it would add $2.4 trillion (excluding interest) to the national debt over 10 years.

United States Is Borrowing at a Higher Rate than the Global Average, Warns IMF

New IMF reports serve as a warning to all countries that global fiscal and economic conditions are veering into dangerous territory.