As a new president and Congress get to work on their policy priorities for 2017, there is one issue that affects all others: the nation’s unsustainable long-term fiscal outlook. Yesterday, the nonpartisan Congressional Budget Office (CBO) released its latest budget projections, outlining the fact that we’re still on a dangerous path that threatens our economic future. CBO’s new report serves as a reminder that the lawmakers need to take into account our nation’s long-term fiscal challenges as they consider policy changes.

Here are the top three takeaways from our analysis of the report:

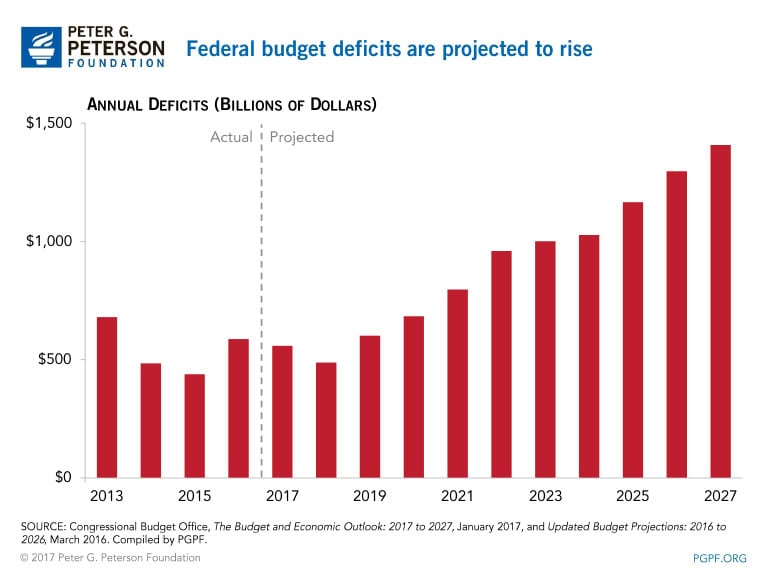

1. Deficits will reach $1 trillion by 2023 and total $9.4 trillion over the next ten years. These deficits stem from a structural mismatch between spending and revenues: Over the next ten years, CBO projects that revenues will grow by $1.7 trillion, while spending will grow by $2.6 trillion.

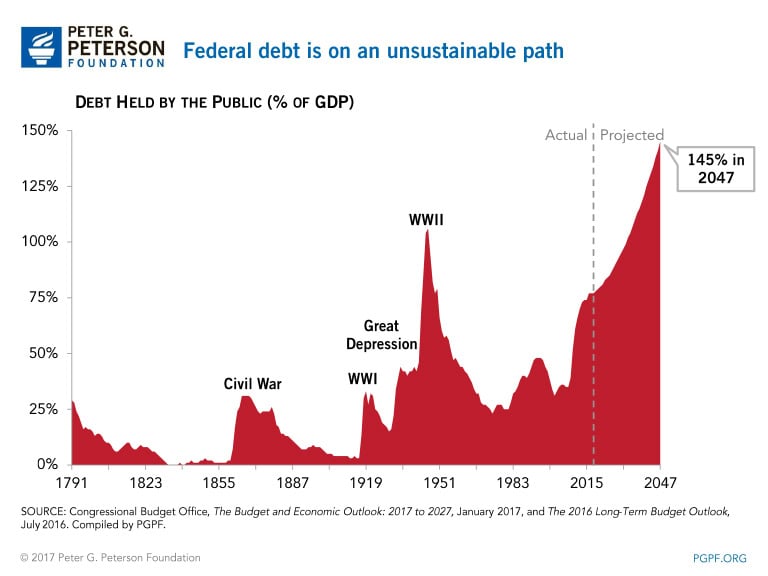

2. The national debt will climb significantly over the next ten years, reaching 89 percent of gross domestic product (GDP) in 2027 — more than double the 50-year historical average of approximately 40 percent.

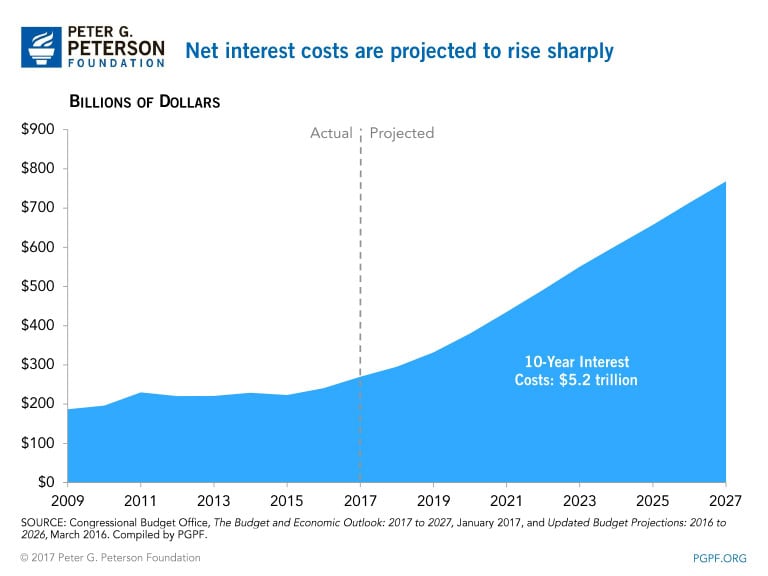

3. Interest costs on the debt will rise sharply. Over the next ten years, net interest will total $5.2 trillion. As debt continues to accumulate and interest rates increase, net interest costs are projected to more than double over the decade.

“The long-term imbalance between revenues and spending must be taken into account as lawmakers look to address major policy areas, including healthcare and tax reform,” Michael A. Peterson, President and CEO of the Peter G. Peterson Foundation, said in a statement on the CBO report. “These reforms should improve our fiscal outlook in the decades ahead, by stabilizing our debt as a share of the economy.”

Read our full analysis of the CBO report or learn more about the country’s fiscal and economic challenges.

Photo by Chip Somodevilla/Getty Images

Further Reading

Top 10 Reasons Why the National Debt Matters

At $38 trillion and rising, the national debt threatens America’s economic future. Here are the top ten reasons why the national debt matters.

What Is the National Debt Costing Us?

Programs that millions of Americans depend on and care about may be feeling a squeeze from interest costs on our high and rising national debt.

Interest Costs on the National Debt Are Reaching All-Time Highs

The most recent CBO projections confirm once again that America’s fiscal outlook is on an unsustainable path — increasingly driven by higher interest costs.