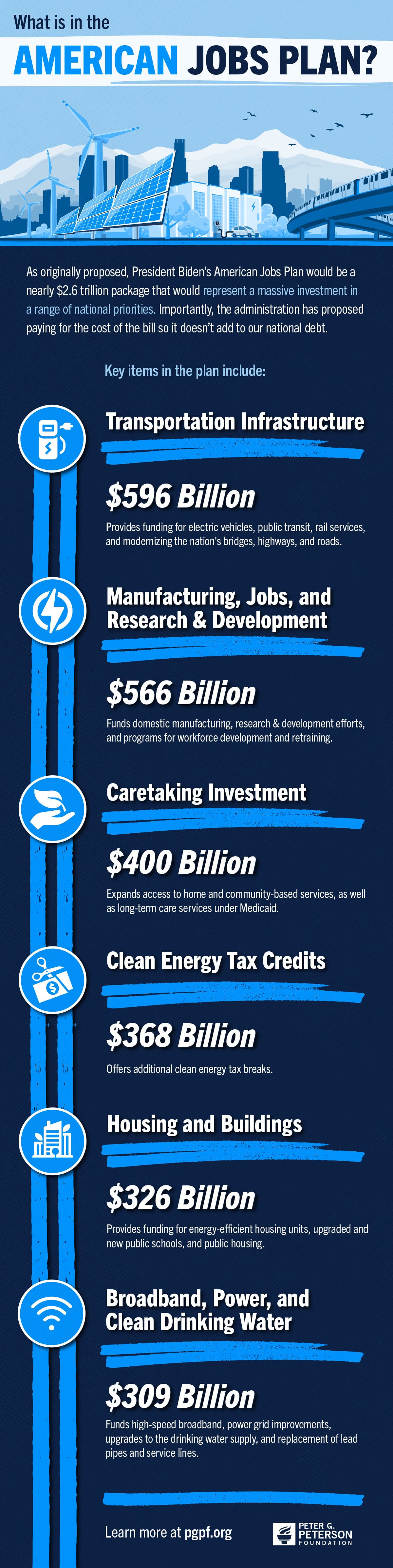

In May, the Administration released details for the proposed American Jobs Plan. It would be a massive investment in a range of national priorities including transportation, climate change, caregiving, and housing.

The Biden administration has proposed offsetting the spending in the $2.6 trillion package through changes to the corporate tax code, including an increase in the corporate tax rate.

The proposed spending in the American Jobs Plan covers a 10-year window and is broken down in the following ways.

Feel free to share this infographic on Twitter.

Further Reading

The One Big Beautiful Bill Act Is the Most Expensive Reconciliation Package in Recent History

This week, lawmakers in Congress approved reconciliation legislation that will add trillions of dollars to America’s already unsustainable fiscal trajectory

Lifting the Debt Ceiling Has Been Paired with Budget Reform in the Past

Earlier this year, the United States once again hit its debt ceiling, which is currently capped at $31.4 trillion.

Even with Economic Growth Factored in, OBBBA Would Increase Deficits

The small, positive fiscal impact from slightly higher economic growth is projected to be more than offset by increased federal interest costs.