If your tax rate is 20%, does that mean you will pay 20 cents in taxes for every dollar you earn? It’s not quite that simple, so let’s look at the difference between statutory and effective tax rates.

The statutory tax rate is the rate imposed by law on taxable income that falls within a given tax bracket. The effective tax rate is the percentage of income actually paid by an individual or a company after taking into account tax breaks (including loopholes, deductions, exemptions, credits and preferential rates).

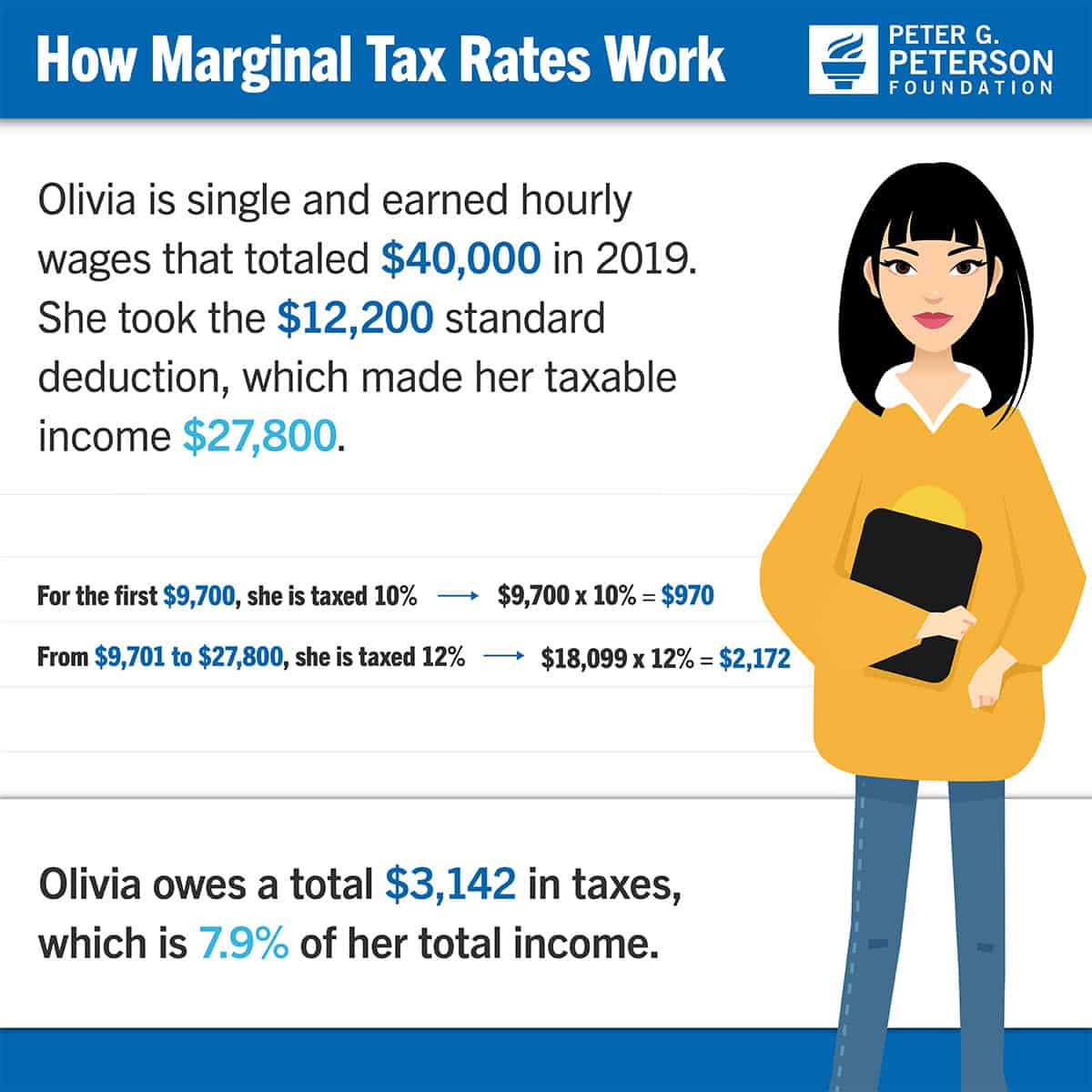

For example, an individual making $40,000 in 2019 would find him or herself in a bracket with a maximum statutory tax rate of 22 percent. However, the average effective tax rate for someone with that income is 7.9 percent after taking into account marginal tax rates, the standard deduction and other provisions for which they may be eligible.

The same concept applies to corporate taxes. The federal statutory corporate tax rate is currently set at 21.0 percent — reduced from 35.0 percent by the 2017 Tax Cuts and Jobs Act (TCJA). However, the U.S. tax code has many preferences that affect the rate actually paid by corporations; taking those preferences into account, the average effective tax rate for corporations was 19.7 percent in 2021.

Photo by Zach Gibson/Stringer/Getty Images

Further Reading

The United States Collects Less Tax Revenue Than Other G7 Countries

The U.S. collects less tax revenues compared with other G7 countries, and that lower level of revenues is a key driver of the national debt.

Energy Tax Policy Under the OBBBA

As part of the OBBBA, lawmakers rolled back existing energy tax incentives in order to partially offset the bill’s deficit impact.

What Are Refundable Tax Credits?

The cost of refundable tax credits has grown over the past several years, with the number and budgetary impact of the credits increasing.