The number one financial worry for Americans, according to a recent Gallup poll, is having enough money for retirement — and for good reason. “Too many Americans are still not preparing adequately,” according to Securing Our Financial Future, a new report from the bipartisan Commission on Retirement Security and Personal Savings.

Convened in 2014 by the Bipartisan Policy Center, the commission members have spent the past two years examining the retirement system in the United States, and they identified six key challenges in their recently released final report:

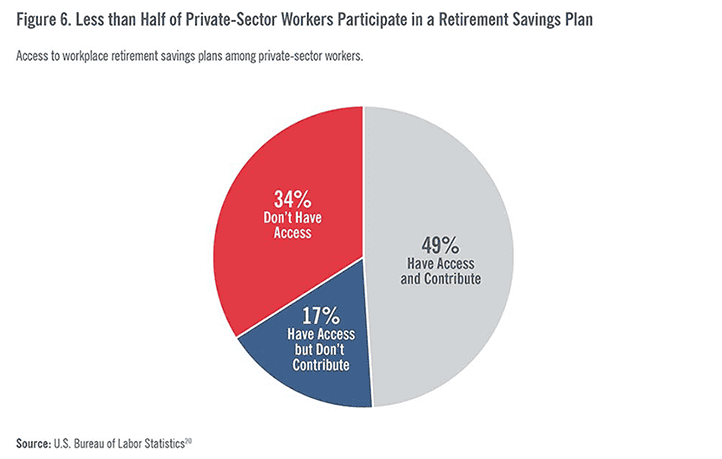

1. Too many Americans lack access to workplace retirement savings plans. "Tens of millions of American workers lack access to retirement plans," according to the report (see chart below). “Even among workers who have access to a plan, many choose not to participate."

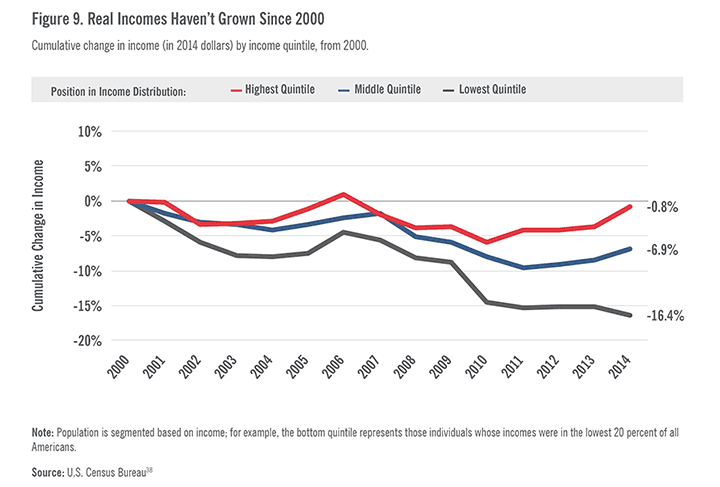

2. Many Americans lack the income or resources to save for short-term needs — so they raid their retirement accounts. "Unfortunately, many Americans are unable to save because they have low earnings, coupled with immediate demands that consume all of their income," according to the report (see chart below). "But the problem is broader than that. Nearly half of individuals say that they could not come up with $2,000 in 30 days without selling possessions or taking out payday loans."

3. Americans are increasingly at risk of outliving their savings. Overall life expectancy among Americans who live to 65 has risen from 79 in 1940 to 85 in 2014. Over the next 25 years, the number of people age 85 and older will more than double. "Today, working Americans who want to retire at the same age as was typical of previous generations must save more to cover additional years of consumption in retirement," the report warns.

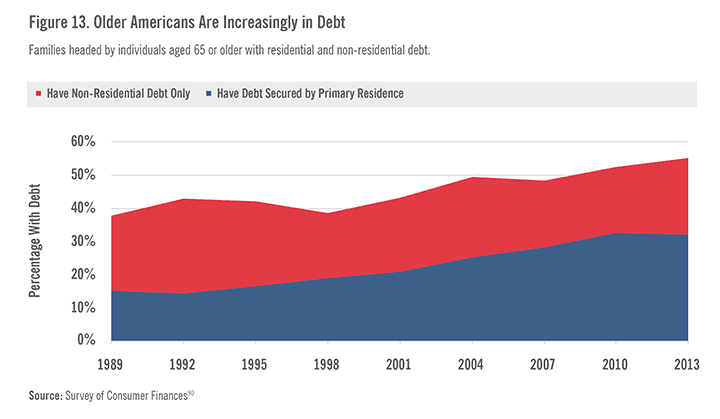

4. Home equity is underutilized in retirement. Homeowners can use home equity to help their retirement consumption, but too many tap into their equity before retirement. Recent growth in old-age debt, particularly housing-related debt (see chart below), "poses a unique threat to retirement security," according to the report. "Holding mortgage debt in retirement limits retirees’ ability to tap home equity and is just one of many considerations that Americans need to understand as they make decisions about their own savings and retirement."

5. Many Americans lack the basic knowledge to manage their personal finances and prepare for retirement. The report cites numerous studies indicating that the majority of Americans “display low levels of financial understanding.”

6. Social Security is at a crossroads. Absent reform, Social Security's trustees project that the trust fund will be exhausted in 2034 and when that happens, 89 million beneficiaries could face across-the-board benefit cuts of 21 percent. This could seriously undermine the retirement security of low-income beneficiaries. As the report notes, “Social Security provides over 70 percent of disposable income for older Americans in the bottom 40 percent of the lifetime-earnings distribution.”

To address these serious challenges, the report presents a comprehensive package of bipartisan proposals. "People need the assistance of a well-designed system as they accumulate, invest, and spend down their retirement savings," the Commission writes. "Public policy has a critical role to play in facilitating savings and a secure retirement."

For more detail on those policy recommendations, read the full report.

Image credit: Getty Images

Further Reading

Lawmakers are Running Out of Time to Fix Social Security

Without reform, Social Security could be depleted as early as 2032, with automatic cuts for beneficiaries.

Budget Basics: How Does Social Security Work?

Social Security is the largest single program in the federal budget and typically makes up one-fifth of total federal spending.

Budget Basics: Unemployment Insurance Explained

The Unemployment Insurance program is a key counter-cyclical tool to help stabilize the economy and speed recovery during downturns or crises.