Yesterday the nonpartisan Congressional Budget Office released the 2017 Long-Term Budget Outlook, highlighting the significant fiscal challenges facing our nation.

Here are four key takeaways from our analysis of the CBO report:

1. Federal debt is already at its highest level since 1950 and is projected to climb to 150 percent of GDP under current law by 2047 — by far an all-time high.

2. Rising debt is a result of a structural imbalance between revenues and spending. Under current law, spending growth, which is fueled primarily by the aging of the population and growing healthcare costs, significantly outpaces the projected growth in revenues.

3. As the debt grows and interest rates rise, interest costs are projected to increase rapidly. By 2028, interest will become the third largest category of the budget, behind only Social Security and Medicare.

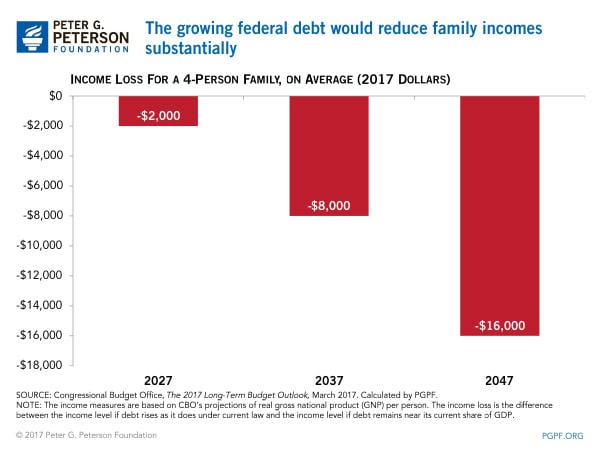

4. Rising debt will harm our economy and slow the growth of productivity and wages. On our current path, the annual average income loss for a 4-person family would be $16,000 by 2047.

The good news is that it’s not too late to adjust course, and the sooner we get started, the easier it will be to fix. To learn more about bipartisan policy options, visit our Solutions page.

Image credit: Photo by Chip Somodevilla/Getty Images

Further Reading

The Fed Reduced the Short-Term Rate Again, but Interest Costs Remain High

High interest rates on U.S. Treasury securities increase the federal government’s borrowing costs.

What Types of Securities Does the Treasury Issue?

Let’s take a closer look at a few key characteristics of Treasury borrowing that can affect its budgetary cost.

Quarterly Treasury Refunding Statement: Borrowing Up Year Over Year

Key highlights from the most recent Quarterly Refunding include an increase in anticipated borrowing of $158 billion compared to the same period in the previous year.