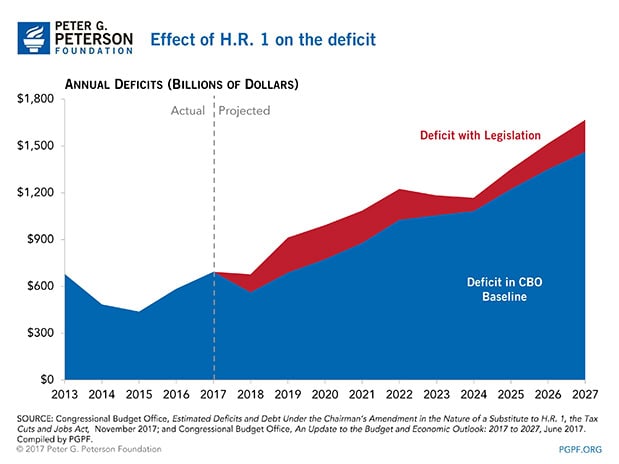

Recently, the House of Representatives released its proposed tax bill, which, according to an analysis of its major components by the Congressional Budget Office and the Joint Committee on Taxation, would add $1.4 trillion to our national debt over the next 10 years. Using that analysis and layering on the additional interest paid as a result of increased borrowing, deficits from 2018–2027 would total $11.8 trillion — $1.7 trillion higher than projected in CBO’s June 2017 baseline.

The bill as written would move up the date we return to trillion dollar deficits by two years, to 2020. And by 2027, federal debt held by the public would be closing in on 100 percent of gross domestic product, an increase of 6 percentage points compared to the baseline. Since 1790, our debt has never exceeded the size of the economy, except for a brief time during World War II.

Such figures illustrate the need to improve our fiscal outlook, not make it worse. Adding to the debt could harm the economy by crowding out public and private investment, reducing our fiscal flexibility, and lowering confidence and certainty. Lawmakers should use this valuable opportunity to improve our dangerous fiscal outlook with permanent, pro-growth tax reform that doesn’t worsen our fiscal outlook.

Further Reading

Should We Eliminate the Social Security Tax Cap?

There have been a number of proposals to increase, eliminate, or otherwise adjust the payroll tax cap as a way to shore up Social Security’s finances.

No Taxes on Tips Will Drive Deficits Higher

Here’s how this new, temporary deduction will affect federal revenues, budget deficits, and tax equity.

Three Reasons Why Assuming Sustained 3% Growth is a Budget Gimmick

GDP growth of 3 percent is significantly higher than independent, nonpartisan estimates and historically difficult to achieve.