Today, the Congressional Budget Office (CBO) released a preliminary assessment of America’s economic and fiscal outlook for 2020 and 2021, taking into account the effects of the coronavirus (COVID-19) pandemic and the legislative response to it. The new numbers demonstrate the severe economic damage and significant fiscal implications of this unprecedented crisis.

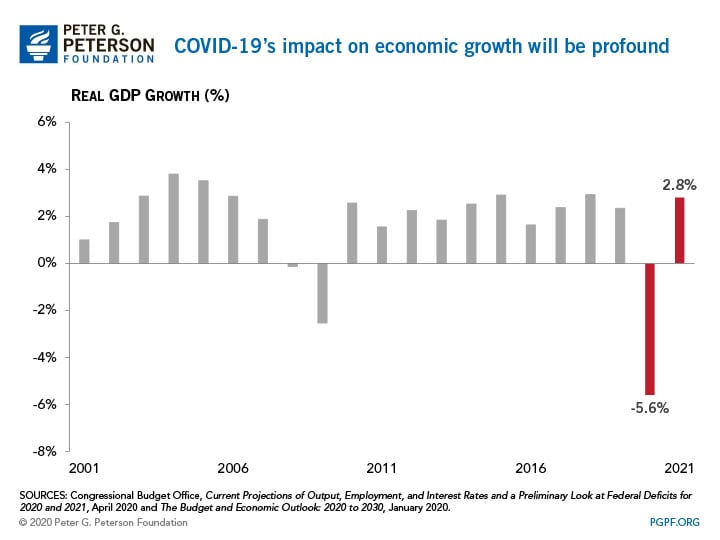

CBO anticipates that nominal gross domestic product (GDP) will drop from $21.2 trillion in 2019 to $20.4 trillion in 2020. Adjusting for inflation, real GDP in October-December 2020 would be 5.6 percent lower than the same period the year before. Just 3 months ago, CBO projected that real GDP would rise by 2.2 percent from the 4th quarter of 2019 to the 4th quarter of 2020. For 2021, CBO forecasts that the economy will grow by 2.8 percent, after adjusting for inflation.

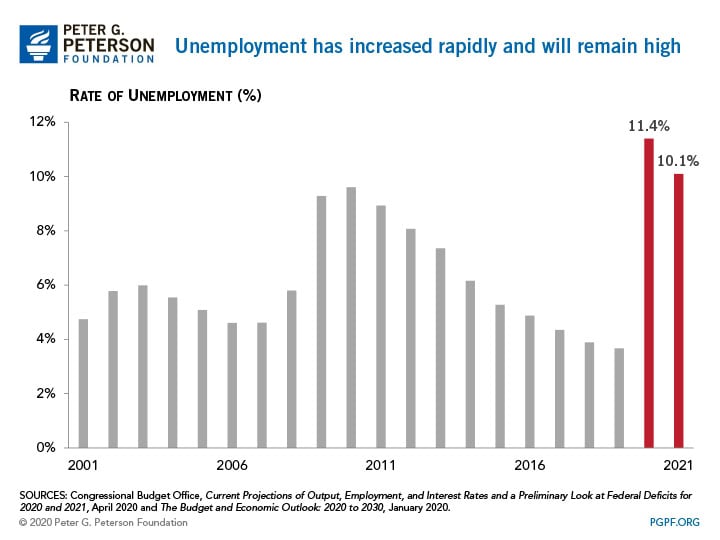

Unemployment is forecast to rise to 16 percent in the third quarter of this year; the country has never witnessed a rate that high since the Bureau of Labor Statistics began compiling statistics in 1948. For the full year, CBO estimates that the unemployment rate will average 11.4 percent in 2020 and only decline to 10.1 percent in 2021.

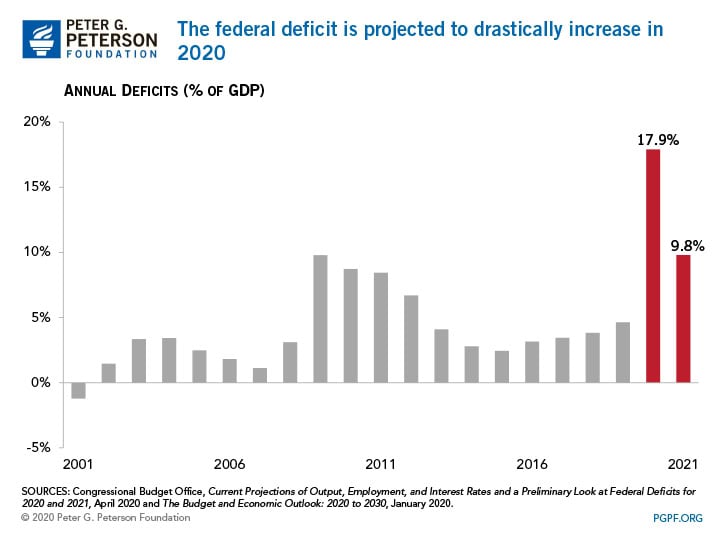

Those severe effects on the economy — and the legislative response to mitigate them — will have considerable effects on the budget. CBO projects that the deficit for fiscal year 2020 (which runs from October 1, 2019 to September 30, 2020) will total $3.7 trillion — more than twice as high as the previous peak of $1.5 trillion, which was reached at the height of the financial crisis in 2009. As a percentage of GDP, the deficit would be 17.9 percent, the highest since 1945. CBO projects that the deficit will decline to 9.8 percent of GDP in 2021, which would equal the ratio in 2009.

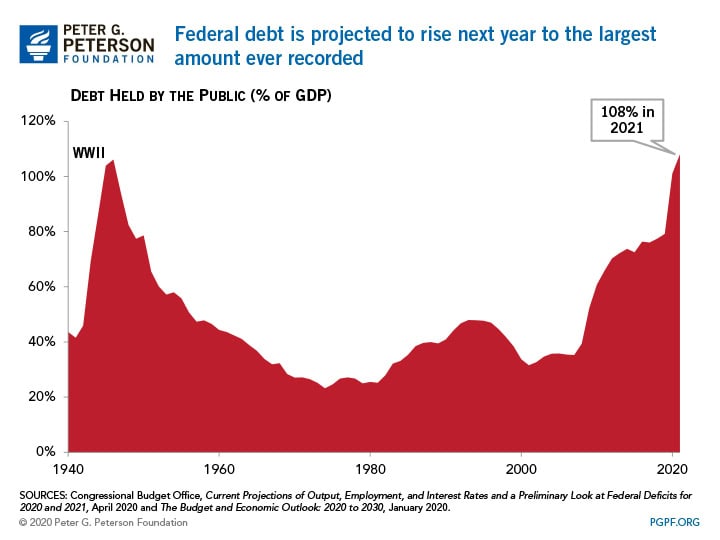

As a result of such high deficits, debt held by the public would exceed the size of the economy by the end of this fiscal year, reaching 101 percent of GDP. By the end of fiscal year 2021, debt would grow to 108 percent of GDP, exceeding the previous high ratio immediately after World War II.

CBO’s daunting outlook reveals the seriousness of the pandemic, and the need for a strong federal fiscal response to address this unprecedented emergency and help us recover on both the health and economic fronts. CBO’s projections also show that it will be a long road to recovery. When that recovery does take hold, addressing the country’s underlying fiscal situation will be a key issue for our future.

Photo by Getty Images

Further Reading

What’s the Difference Between the Trade Deficit and Budget Deficit?

The terms “budget deficit” and “trade deficit” can be conflated, but they are distinct measurements of important fiscal and economic concepts.

The Fed Reduced the Short-Term Rate Again, but Interest Costs Remain High

High interest rates on U.S. Treasury securities increase the federal government’s borrowing costs.

What Types of Securities Does the Treasury Issue?

Learn about the different types of Treasury securities issued to the public as well as trends in interest rates and maturity terms.