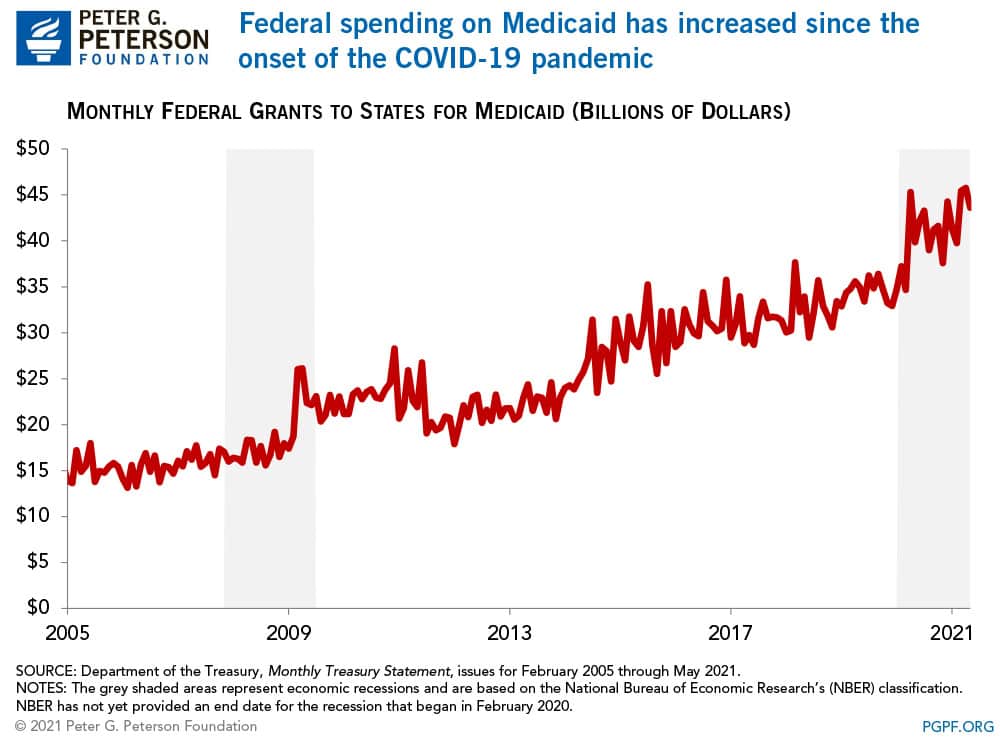

The coronavirus (COVID-19) pandemic has caused federal spending on Medicaid to rise sharply as millions of Americans have sought benefits under the program. Since April 2020, when the unemployment rate rose to a historic high, the government has spent an average of $42 billion per month — which significantly exceeds the average monthly outlays of $35 billion recorded in 2019. The rise in spending can be attributed to two factors that stem from the COVID-19 pandemic: growth in the number of Americans eligible for Medicaid as a result of job loss and recent legislation that has expanded both the program and the federal contribution to its cost.

Medicaid is a program financed jointly by federal and state governments that provides health insurance primarily to low-income individuals. By design, participation in the program tends to rise during economic downturns when people are laid off, lose health coverage, and see their incomes reduced. For example, Medicaid enrollment grew significantly during and after the Great Recession — at an average monthly rate of 7.0 percent between 2009 and 2010 — and slowed subsequently as the economy recovered. Spending on the program followed a similar trend; the annual rate of spending growth peaked at 7.6 percent in 2009 and slowed thereafter. More recently, enrollment increased significantly during the pandemic. Between February 2020 and January 2021, nearly 9.9 million individuals enrolled in coverage through Medicaid, an increase of 13.9 percent.

Legislative changes also boosted federal spending on Medicaid by increasing coverage and benefits, as well as providing additional financial support to states and healthcare providers. Some key provisions include:

- Increases in federal matching funds for Medicaid: The Families First Coronavirus Response Act (FFCRA) authorized an increase in Medicaid’s Federal Medical Assistance Percentage (FMAP), the proportion of spending for the program covered by the federal government. Before the outbreak, the FMAP varied by state, ranging from 50 to 76 percent; the FFCRA increased the federal contribution by 6.2 percentage points until the end of the public health emergency period. In addition, to incentivize states to adopt the expansion enabled by the Affordable Care Act, the American Rescue Plan also provides a temporary 5-percentage-point increase for states that newly expand the program.

- Expansion of coverage: States are required to provide full coverage of COVID-19 testing, vaccines, and treatment without cost-sharing for Medicaid enrollees. Legislation also enables states to cover those costs for uninsured individuals. The federal government will provide full funding for vaccines and their administration.

- Distribution of funds to providers: The Coronavirus Aid, Relief, and Economic Security Act and the Paycheck Protection Program and Health Care Enhancement Act together authorized $178 billion to support healthcare providers combatting COVID-19. Part of the disbursements have been made to certain eligible Medicaid providers and therefore contributed to the increase in federal outlays for the program. The American Rescue Plan also provides $8.5 billion of relief payments to rural Medicaid, CHIP, and Medicare providers.

Federal spending on Medicaid may continue at high levels relative to its historical average as individuals who experienced a loss of income enroll and remain in the program. As a part of the social safety net, Medicaid and other income security programs are designed to support more Americans in need when the economy contracts — as we have seen so far during the pandemic.

Image credit: Photo by Chris McGrath / Getty Images

Further Reading

Lawmakers are Running Out of Time to Fix Social Security

Without reform, Social Security could be depleted as early as 2032, with automatic cuts for beneficiaries.

Budget Basics: How Does Social Security Work?

Social Security is the largest single program in the federal budget and typically makes up one-fifth of total federal spending.

Quiz: How Much Do You Know About Healthcare in the United States?

The United States has one of the largest and most complex healthcare systems in the world. Take our healthcare quiz to see how much you know about the cost and quality of the U.S. healthcare system.