As lawmakers continue to explore policies to help the nation recover from the economic damage caused by the pandemic, a key part of the discussion is how stimulus checks should be structured and targeted for maximum effectiveness. Looking at recent spending and saving trends offers some clues.

In late December, the federal government enacted a second round of Economic Impact Payments in Division N of the Consolidated Appropriations Act, 2021. Also known as stimulus checks, such payments totaled $600 per person ($1,200 for married couples) plus another $600 per qualified child. As of January 29, about $135 billion of those payments had been sent out — reflecting about 80 percent of the estimated total cost of $164 billion.

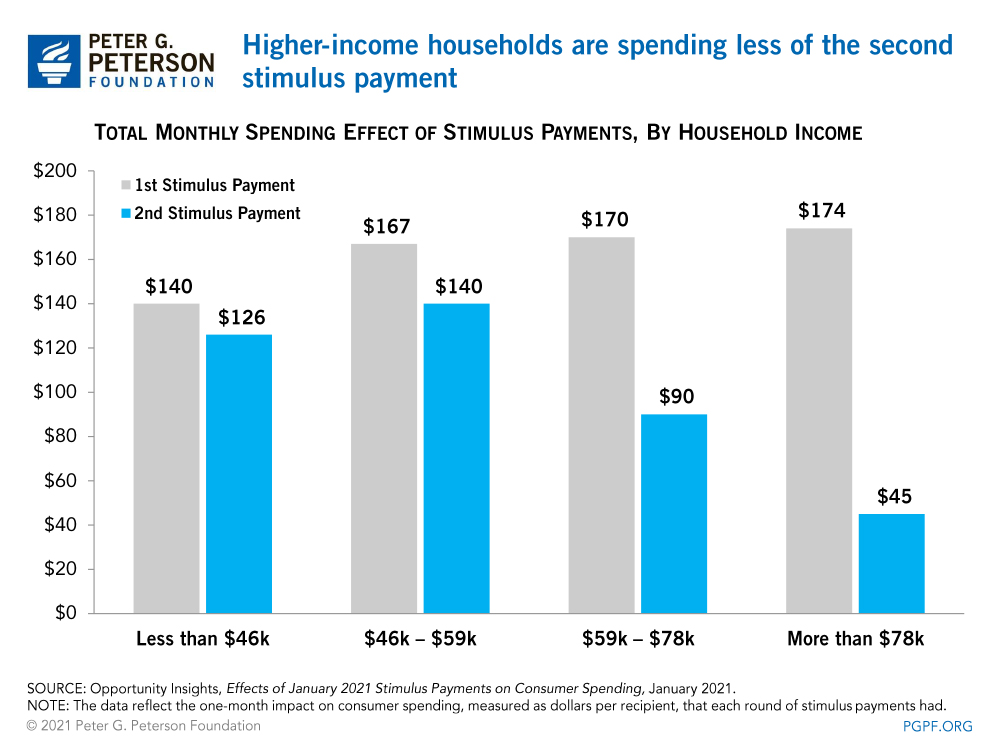

That second round of payments successfully boosted consumer spending among lower-income households but had little impact on consumer spending for higher-income groups, according to a recent analysis by Opportunity Insights. That research suggests that households earning less than $46,000 a year will spend $126 of each payment received within the first month that they receive it — contributing to an increase in consumer spending among that income group of nearly 8 percentage points. Higher-income households earning more than $78,000 annually, however, will only spend $45 of each payment over that same time period, contributing to a 0.2 percentage point increase in consumer spending among that group.

Those spending patterns for higher-income households were significantly lower than when they received the first round of payments — suggesting that such individuals may have recovered from the economic damage caused by the pandemic. As Congress and the President consider future legislation to mitigate the economic burden of COVID-19, such benefits and shortcomings of the program should be considered.

Image credit: Photo by Pool / Pool / Getty Images

Further Reading

Should We Eliminate the Social Security Tax Cap?

There have been a number of proposals to increase, eliminate, or otherwise adjust the payroll tax cap as a way to shore up Social Security’s finances.

No Taxes on Tips Will Drive Deficits Higher

Here’s how this new, temporary deduction will affect federal revenues, budget deficits, and tax equity.

Three Reasons Why Assuming Sustained 3% Growth is a Budget Gimmick

GDP growth of 3 percent is significantly higher than independent, nonpartisan estimates and historically difficult to achieve.