The federal government has enacted six pieces of legislation that provide relief to individuals and corporations that have been affected by the COVID-19 pandemic. To finance those provisions (which are estimated to cost $5.3 trillion), as well as to dampen the effects of the economic downturn, the Treasury Department has ramped up its borrowing. This blog provides additional detail on the accumulation of debt since the onset of the pandemic in 2020.

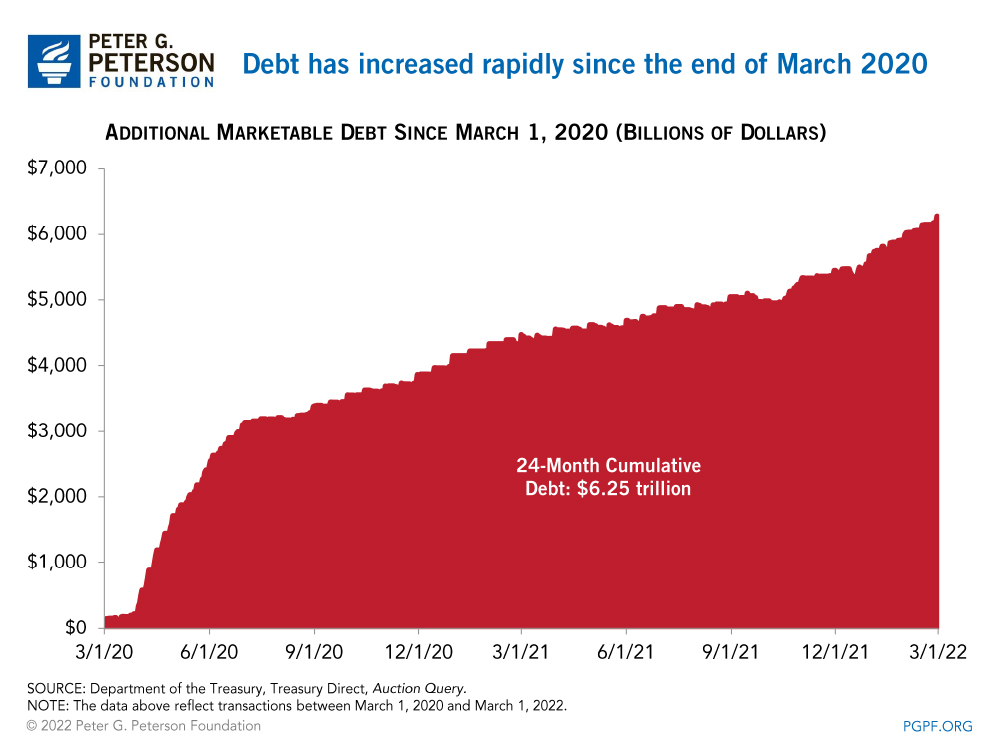

Since March 1, 2020, Treasury borrowing has risen by over $6 trillion. Most of that increase has occurred since March 30, 2020, which was just after the Coronavirus Aid, Relief, and Economic Security (CARES) Act, the largest piece of relief legislation to date, was enacted.

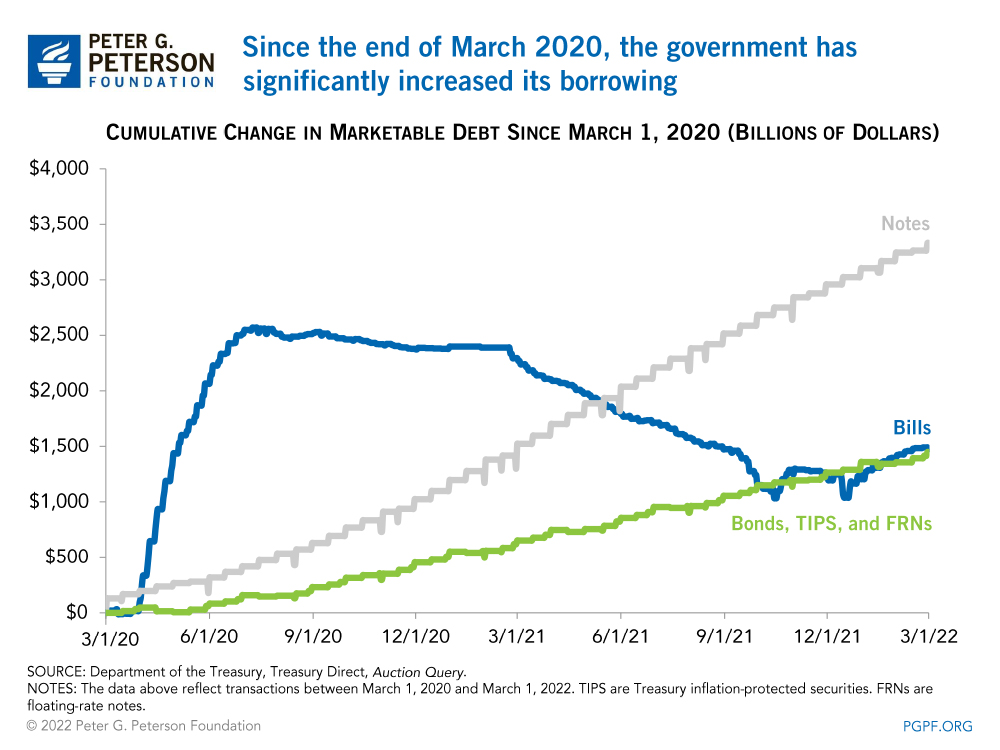

Treasury notes, which are issued with maturities from 2 to 10 years, account for 53 percent of the increase in debt since March 1, 2020. Treasury bills, which mature in one year or less, account for 24 percent of the increase. Treasury bonds, which mature after more than 10 years, along with Treasury inflation-protected securities and floating-rate notes, combine to account for the remaining 23 percent of the increase.

The government is paying very little interest on short-term securities as rates dropped when the extent of the pandemic became clear. For the 3-month bills that were issued on February 24, 2022, the government paid investors an interest rate of 0.4 percent. That is considerably lower than the 1.5 percent interest rate that was paid on the 3-month bills that were issued in January 2020. Interest rates also remain low on longer-term securities; the interest rate at the most recent auction of 10-year Treasury notes was 1.9 percent, about the same as the rate in January 2020.

Federal borrowing is projected to continue increasing in the months ahead. The Treasury anticipates that they will borrow $729 billion during the January – March 2022 quarter.

To support COVID-19 relief and recovery, the Treasury has been required to borrow substantial sums of money. Fortunately, they have been able to easily raise such funds at low interest rates; as the economy stabilizes, though, focus needs to return to the country’s underlying fiscal situation and paying for any new priorities that arise.

Image credit: Photo by iStock/Getty Images

Further Reading

Lawmakers are Running Out of Time to Fix Social Security

Without reform, Social Security could be depleted as early as 2032, with automatic cuts for beneficiaries.

Budget Basics: How Does Social Security Work?

Social Security is the largest single program in the federal budget and typically makes up one-fifth of total federal spending.

How Did the One Big Beautiful Bill Act Affect Federal Spending?

Overall, the OBBBA adds significantly to the nation’s debt, but the act contains net spending cuts that lessen that impact.