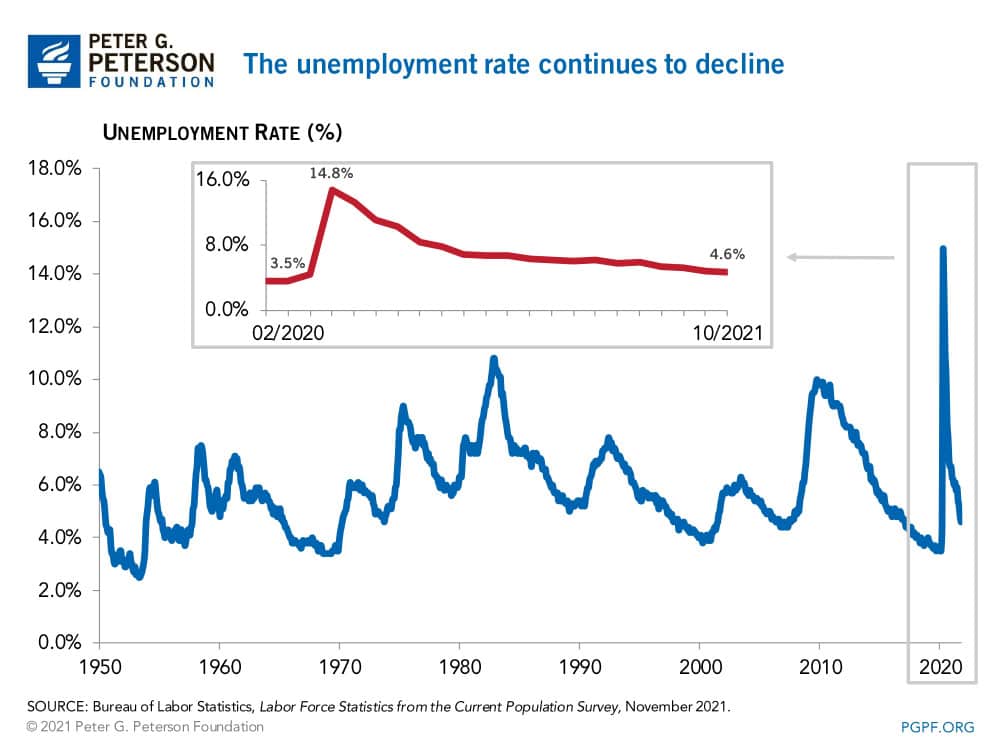

Today’s data from the Bureau of Labor Statistics (BLS) show that the economy added 531,000 jobs in October. That large number of job gains comes alongside a decrease in the unemployment rate — from 4.8 percent in September to 4.6 percent in October — which marks the fourth consecutive month that the unemployment rate declined.

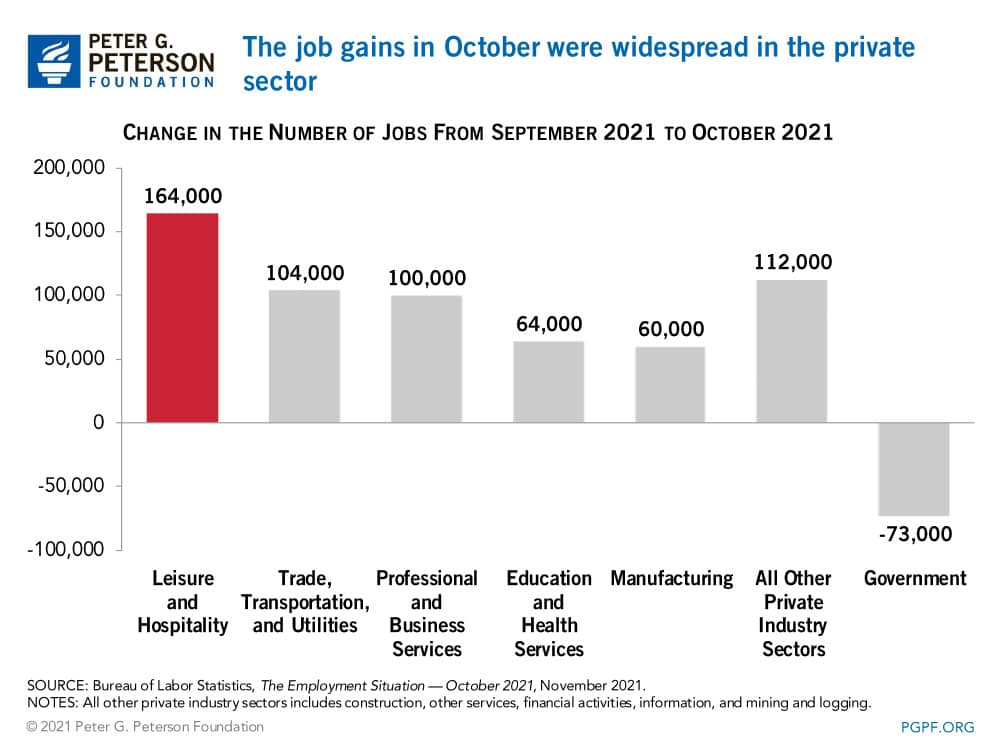

Job gains were widespread in the entire private sector, with the leisure and hospitality sector adding the most jobs. BLS notes that the only major industry sector with job losses in October was the government, which reflects pandemic-related distortions to seasonal hiring practices within public education.

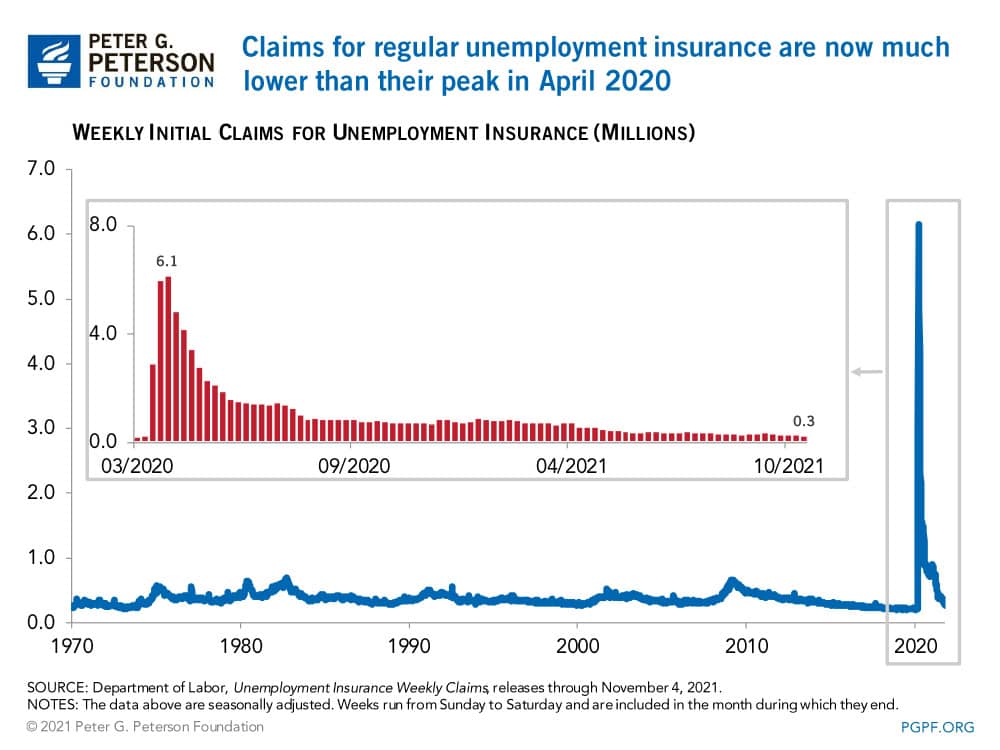

In addition to the large number of job gains, October also showed a decline in the number of weekly unemployment claims. The number of workers filing for unemployment compensation dropped from its peak of 6 million last April to 269,000 in the week that ended on October 30.

Ongoing Concerns

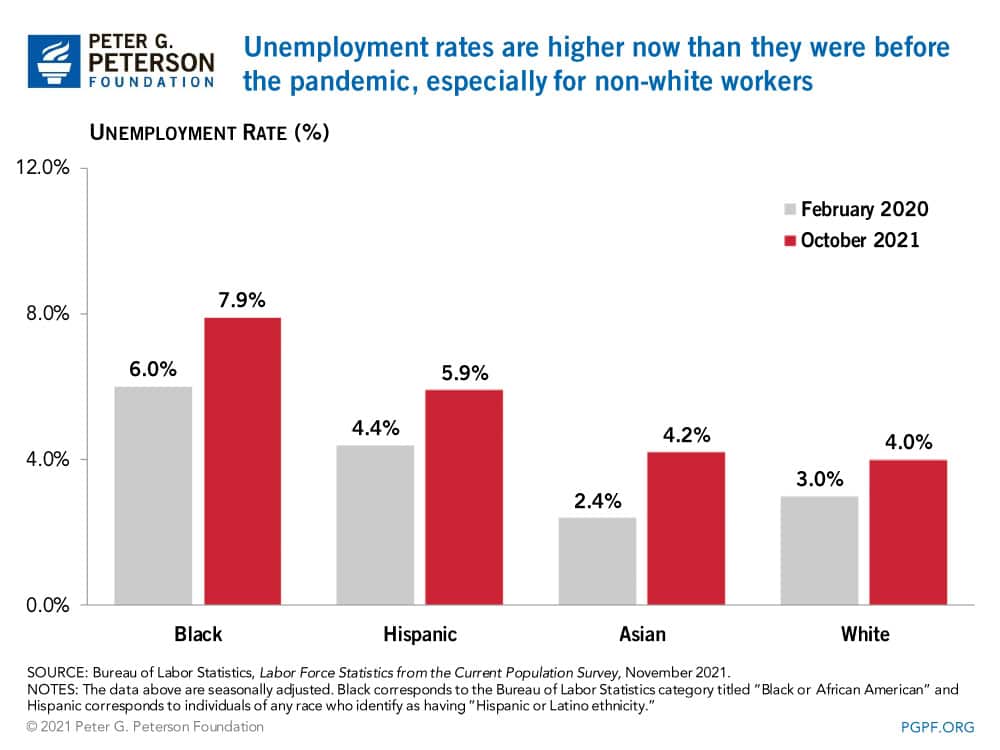

Despite the decline in the unemployment rate, the rate of unemployment remains higher than before the coronavirus (COVID-19) pandemic for all races. In October, Black, Hispanic, and Asian workers all exhibited rates of unemployment at least 1.5 percentage points above the levels that were recorded in February 2020. By contrast, the unemployment rate for white workers was just 1 percentage point higher than it was before the onset of the pandemic.

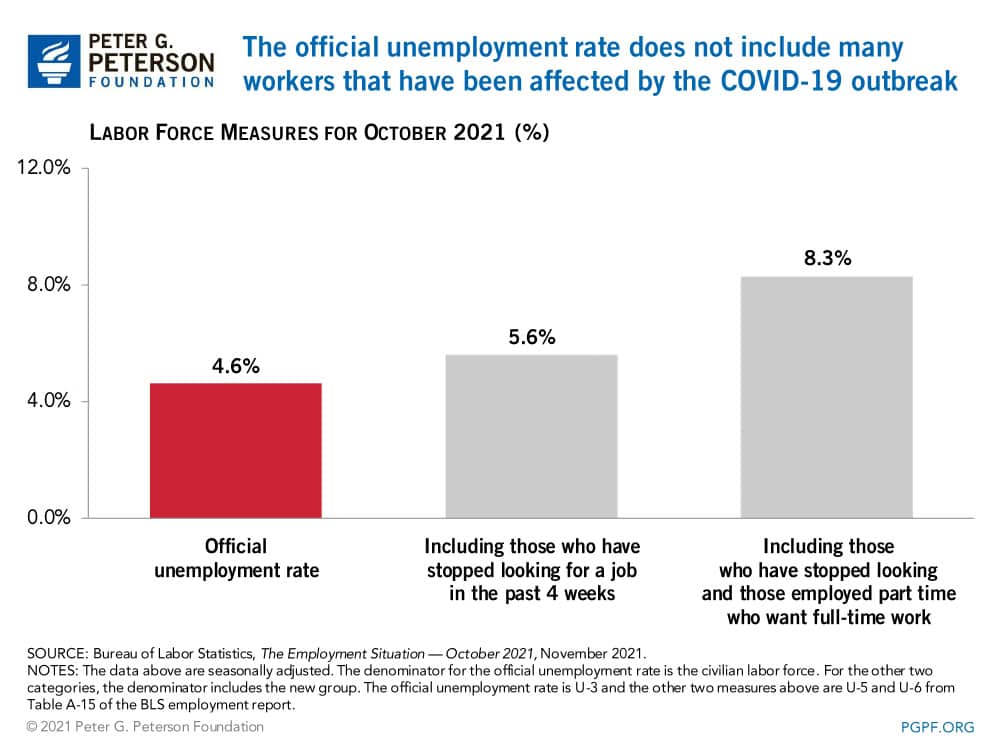

What’s more, standard unemployment rates do not capture all of the negative effects that the coronavirus pandemic is having on the labor market. For example, the overall unemployment rate would be 5.6 percent if it included people who had stopped looking for work during the past four weeks — the headline unemployment rate does not count those people as unemployed because they are considered outside of the labor force. Including the 4.4 million people that are working part time despite desiring full-time work would bring the rate to 8.3 percent. In other words, one in 12 American workers are currently affected by the ongoing downturn in the labor market.

A strong recovery in the labor market could have meaningful implications for the federal budget and the economy overall. For example, income and payroll tax receipts would be higher if more people were working. However, certain groups of workers are still struggling to find jobs and employers are having trouble filling positions, resulting in part from a mismatch between available jobs, skills, and location. Those factors indicate that much remains to be done.

Image credit: Photo by John Sommers II/Getty Images

Further Reading

What’s the Difference Between the Trade Deficit and Budget Deficit?

The terms “budget deficit” and “trade deficit” can be conflated, but they are distinct measurements of important fiscal and economic concepts.

The Fed Reduced the Short-Term Rate Again, but Interest Costs Remain High

High interest rates on U.S. Treasury securities increase the federal government’s borrowing costs.

What Types of Securities Does the Treasury Issue?

Learn about the different types of Treasury securities issued to the public as well as trends in interest rates and maturity terms.