At the end of May, the nonpartisan Congressional Budget Office (CBO) released new projections of the nation’s fiscal and economic outlook, their first report since July 2021. Here’s the good news: the nation’s budget deficit will improve this year due to waning federal support enacted in response to the pandemic and rising revenues from economic growth. Unfortunately, over the medium and long term, the country’s fiscal outlook remains on an unsustainable path. CBO’s report finds that over the next 10 years, the nation’s fiscal situation will face a number of significant challenges such as record levels of debt, the longest period of sustained deficits in nearly 100 years, and historic levels of interest payments.

Here are some of the most notable findings from CBO’s report:

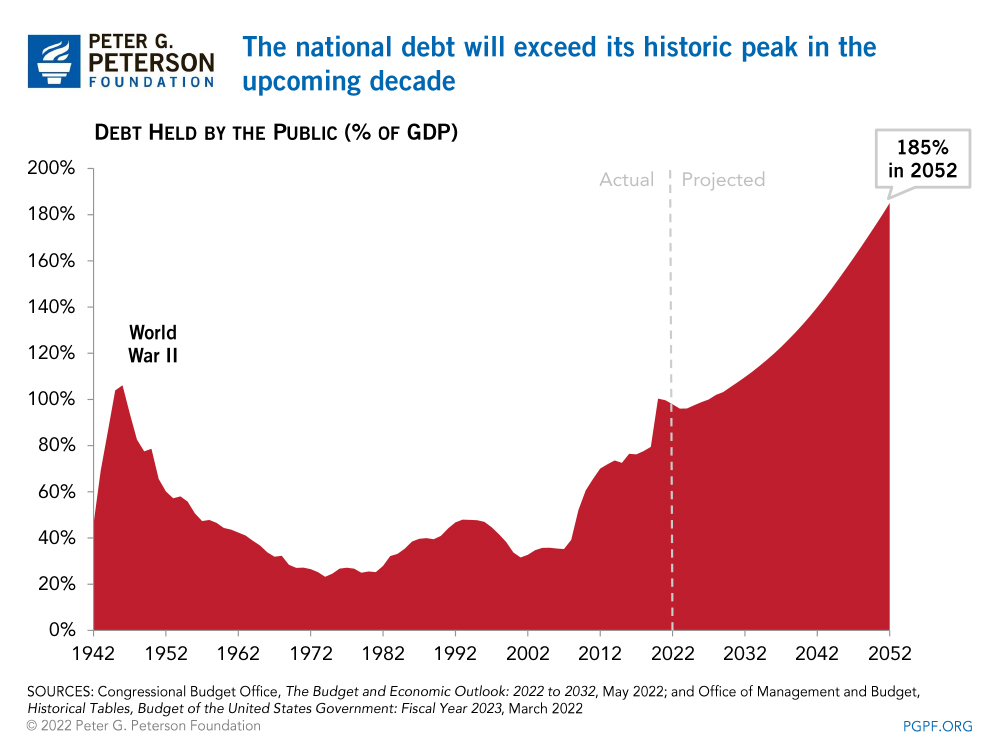

1. Debt relative to the size of the economy will be the highest in the nation’s history by 2031, reaching 107 percent of gross domestic product (GDP). At that level, it would be more than double the nation’s 50-year average. Federal debt would continue to climb in the following years, reaching 185 percent of GDP by 2052, if current policies generally remain the same.

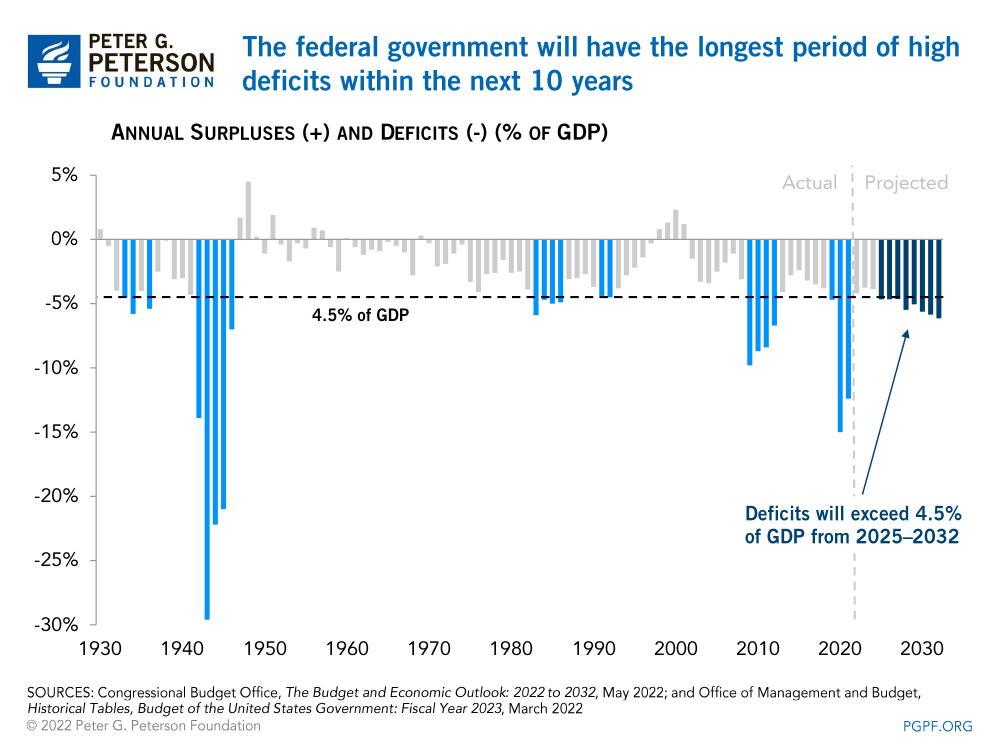

2. Within the next 10 years, the federal government will have the longest period of high deficits in recorded history. From 2025 through 2032 (and beyond), CBO projects that annual deficits will exceed 4.5 percent of GDP under current law. Deficits have not exceeded that ratio for more than five years in a row since such data started being collected in 1930. Those sustained budget deficits are primarily due to a structural mismatch between spending and revenues.

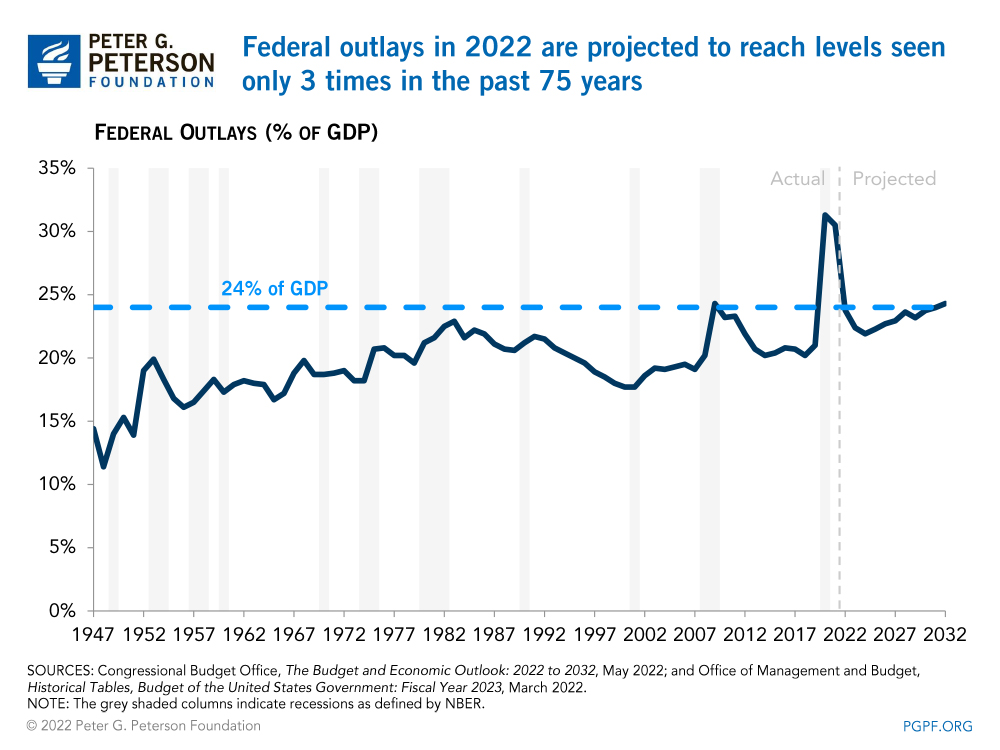

3. Despite waning support enacted in response to the pandemic, federal spending is projected to reach nearly 24 percent of GDP this year — a ratio that has been reached or exceeded only three times since 1946. Federal expenditures have previously met that threshold in 2009, during the Great Recession, and in 2020 and 2021, during the COVID-19 pandemic.

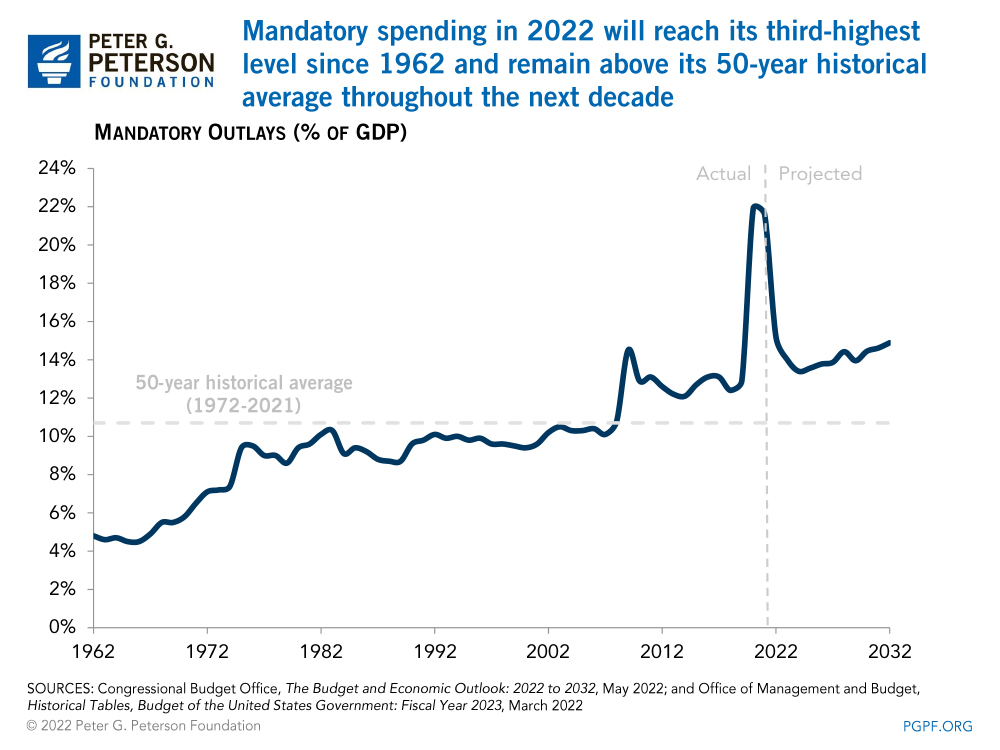

4. Spending on mandatory programs in 2022, relative to the size of the economy, will reach its third-highest level in recorded history. Spending on programs governed by permanent law (such as Social Security and Medicare) is projected to total 15.2 percent of GDP this year; the only other time such outlays exceeded that level was in 2020 and 2021, during the pandemic. Such outlays are projected to average 14.1 percent of GDP over the next decade, notably higher than their 50-year average of 10.7 percent.

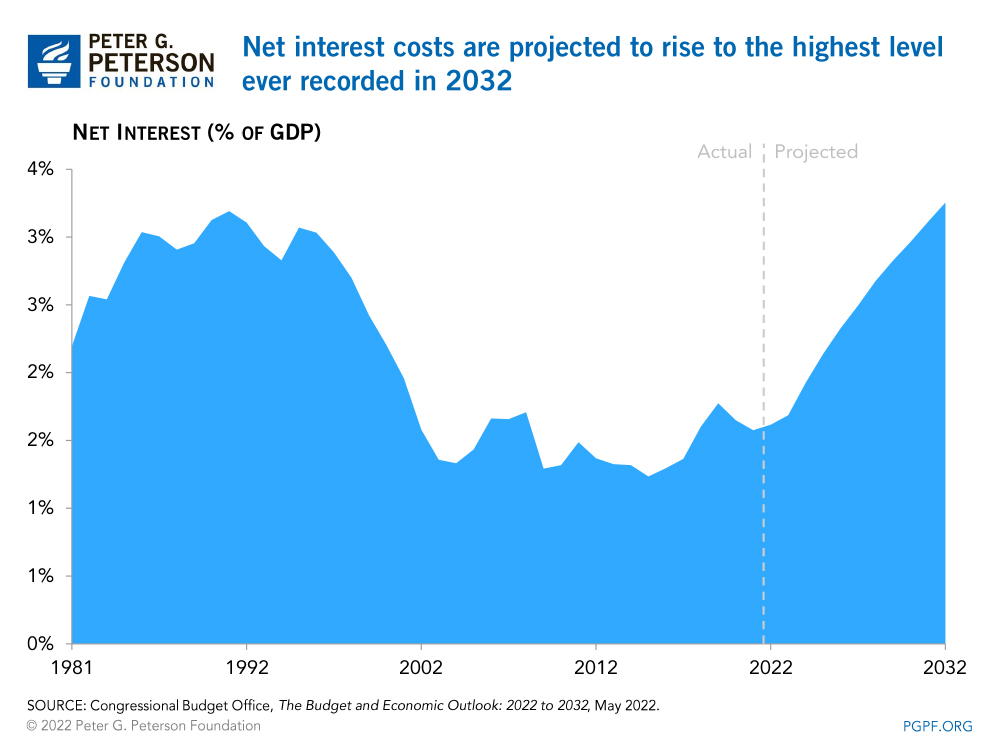

5. Interest costs on the national debt are projected to rise to the highest level ever recorded in 2032. Relative to the size of the economy, such costs would double over the next decade — rising from 1.6 percent of GDP in 2022 to 3.3 percent in 2032. In total, interest costs would be $8.1 trillion over the next decade, the highest amount in any 10-year period to date. That growth is largely due to rising interest rates and an accumulation of federal debt.

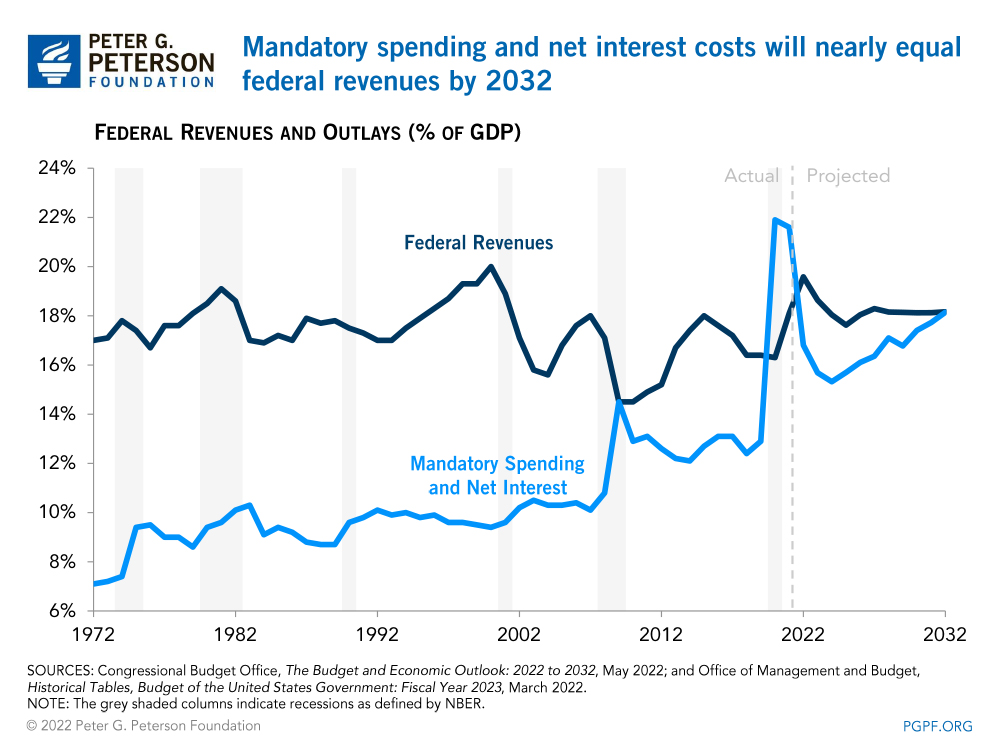

6. The combination of mandatory spending and net interest will equal nearly all revenues by 2032. The only time such spending has equaled or exceeded revenues was in 2009 during the Great Recession and 2020–2021 during the COVID-19 pandemic, both of which were during or immediately following economic downturns.

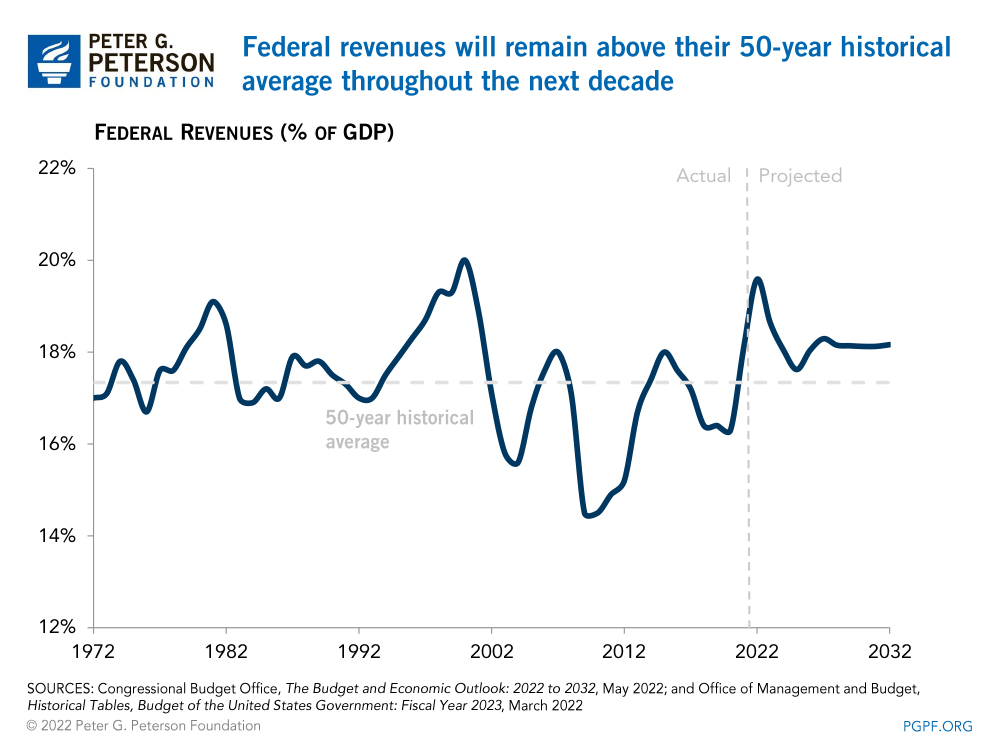

7. Total revenues will reach a 20-year high this year and remain above their 50-year average throughout the next decade. CBO projects that federal revenues in 2022 will rise by nearly $800 billion, or 19 percent, over last year — the largest percentage increase in nearly 40 years. Total revenues are projected to reach 19.6 percent of GDP this year, their highest level in two decades, and remain above their 50-year historical average of 17.3 percent throughout the next decade.

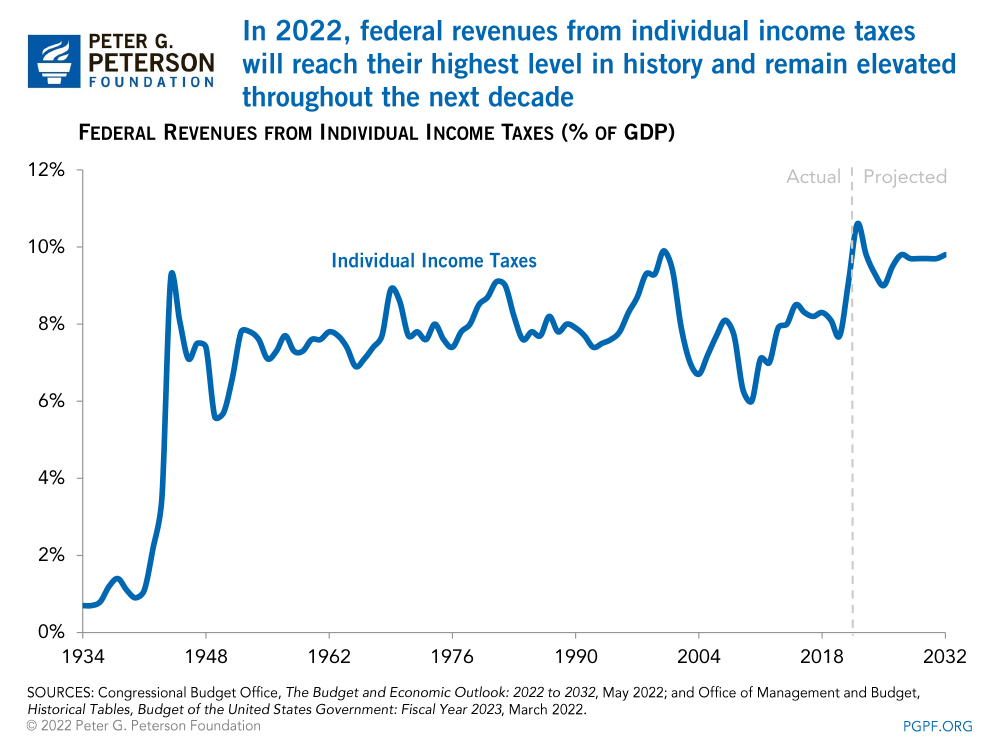

8. Collections of individual income taxes are driving current growth in revenues and are projected to reach their highest level in U.S. history, relative to the size of the economy. Driven by the economic recovery from the pandemic as well as the end of temporary provisions enacted in response to it, such payments of individual income taxes will climb from 9.1 percent of GDP in 2021 to 10.6 percent in 2022. Furthermore, CBO projects that revenues from individual income taxes will average 9.6 percent of GDP over the following 10 years — notably higher than the 8.0 percent average over the past 50 years.

While record-high revenues are certainly a welcome trend, they nevertheless continue to be significantly outpaced by federal spending. The pandemic accelerated existing fiscal challenges, and it is clear that as we emerge from its wake, we remain on an unsustainable path. Without reform, the structural mismatch between federal spending and revenues, along with the nation’s rising interest burden, will continue to strain the fiscal picture and limit economic potential. Policymakers should focus on addressing the key drivers of the nation’s debt to help build a strong foundation for future economic growth.

Image credit: Photo by Getty Images/iStockphoto

Further Reading

The Fed Reduced the Short-Term Rate Again, but Interest Costs Remain High

High interest rates on U.S. Treasury securities increase the federal government’s borrowing costs.

What Types of Securities Does the Treasury Issue?

Let’s take a closer look at a few key characteristics of Treasury borrowing that can affect its budgetary cost.

Quarterly Treasury Refunding Statement: Borrowing Up Year Over Year

Key highlights from the most recent Quarterly Refunding include an increase in anticipated borrowing of $158 billion compared to the same period in the previous year.