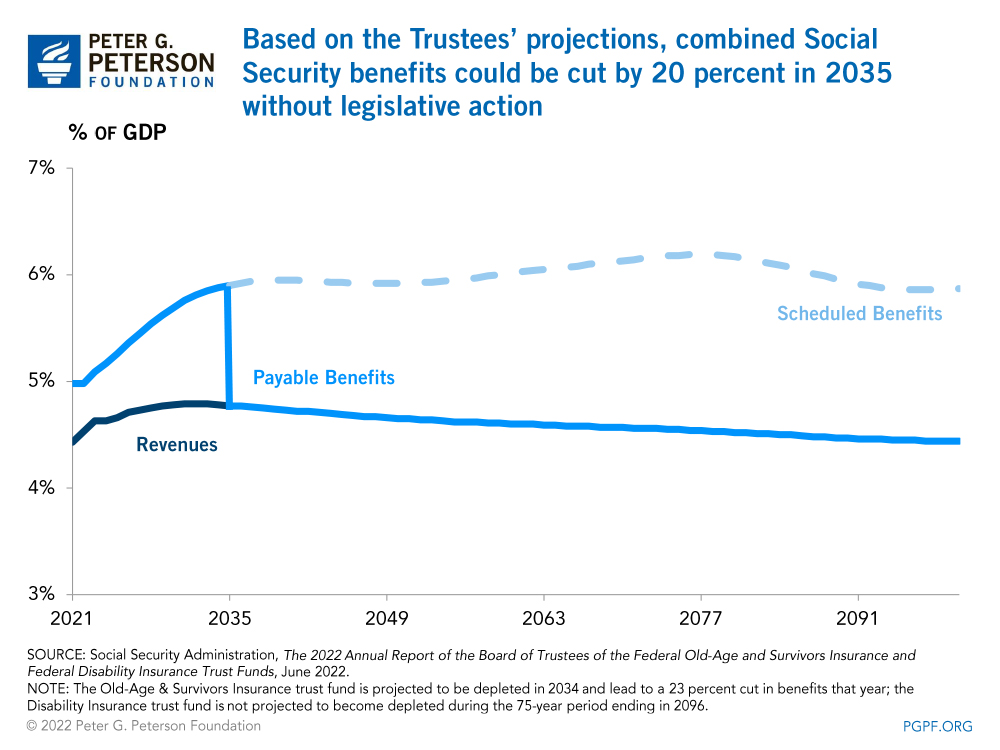

On June 2, the Social Security and Medicare Trustees released their annual reports, which show that these vital programs are on an unsustainable path. In 2022 and all later years, Social Security (the combination of retirement and disability programs) will spend more than it takes in and by 2035, the combined Social Security Trust Funds are projected to be depleted. Medicare’s Hospital Insurance (HI) Trust Fund will be depleted even sooner — in 2028 — although that date is two years later than reported last year, mostly because of higher projections of payroll tax revenues. Nevertheless, the aging of the population and increasing healthcare costs continue to put pressure on the programs and, without action, benefits in the future would be significantly reduced after the dates of depletion.

Below are five key takeaways from the reports.

1.The two Social Security Trust Funds combined would be exhausted in 2035, at which point all Social Security benefits could be cut by 20 percent. Viewed individually, the Old-Age & Survivors Insurance Trust Fund is projected to be depleted in 2034 and lead to a 23 percent cut in benefits that year; the Disability Insurance Trust Fund is not projected to become depleted during the 75-year period ending in 2096.

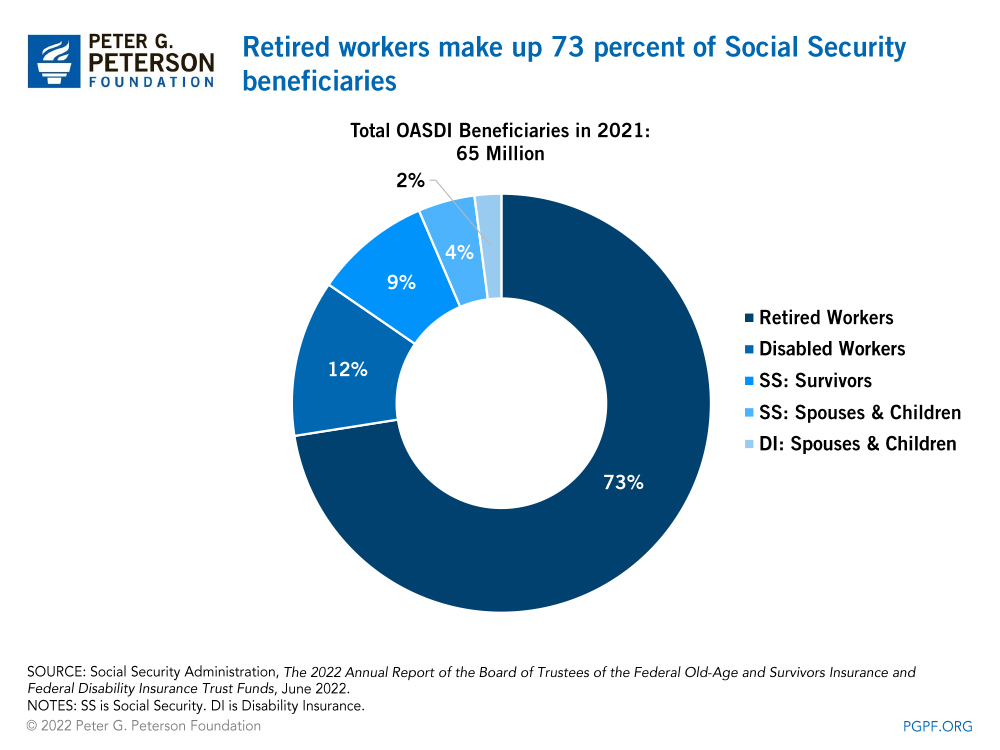

2. There are currently 65 million Social Security beneficiaries, 73 percent of whom are retired workers. Beneficiaries also include disabled workers, as well as survivors, spouses, and children of beneficiaries.

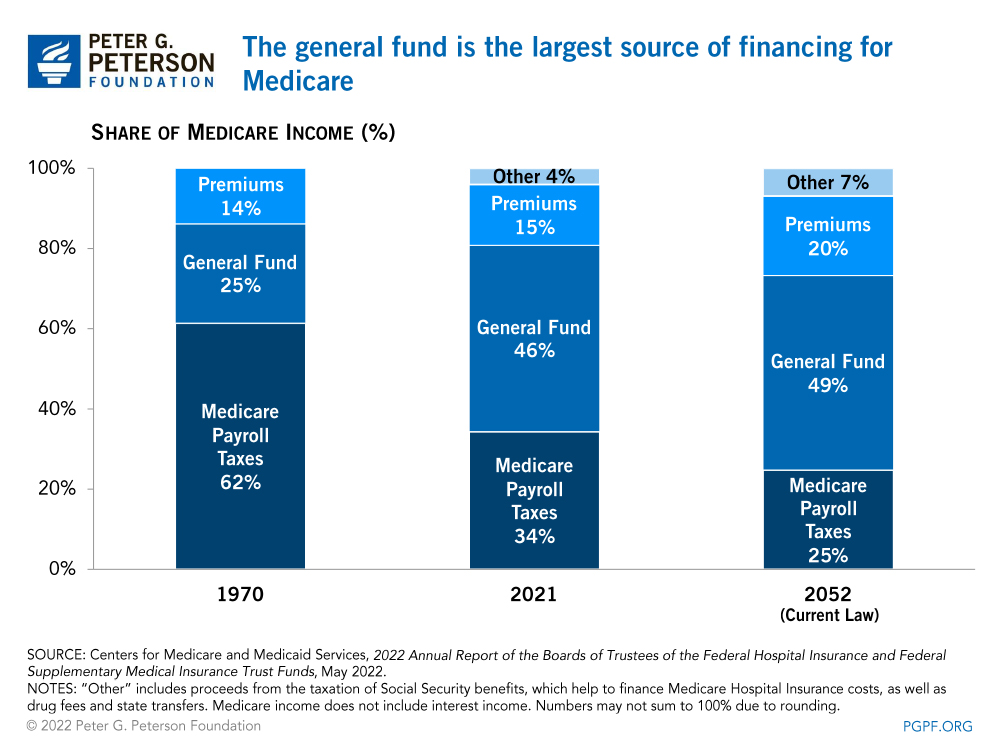

3. While Medicare is funded in part by payroll taxes, the largest source of financing currently comes from the federal government’s general fund. The share of Medicare financed by the general fund is projected to continue to grow, which would put pressure on the federal budget.

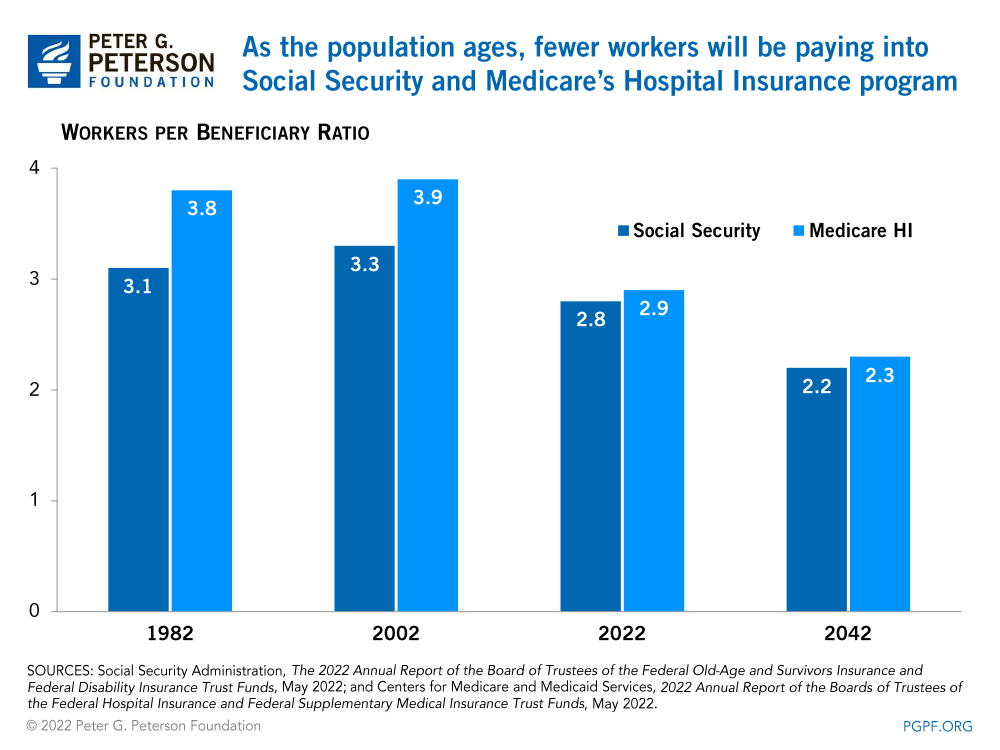

4. One of the major drivers of Medicare and Social Security costs is the aging of the population. For example, as the large baby boom generation retires, both Social Security and Medicare’s Hospital Insurance program will have fewer revenue-contributing workers for each beneficiary.

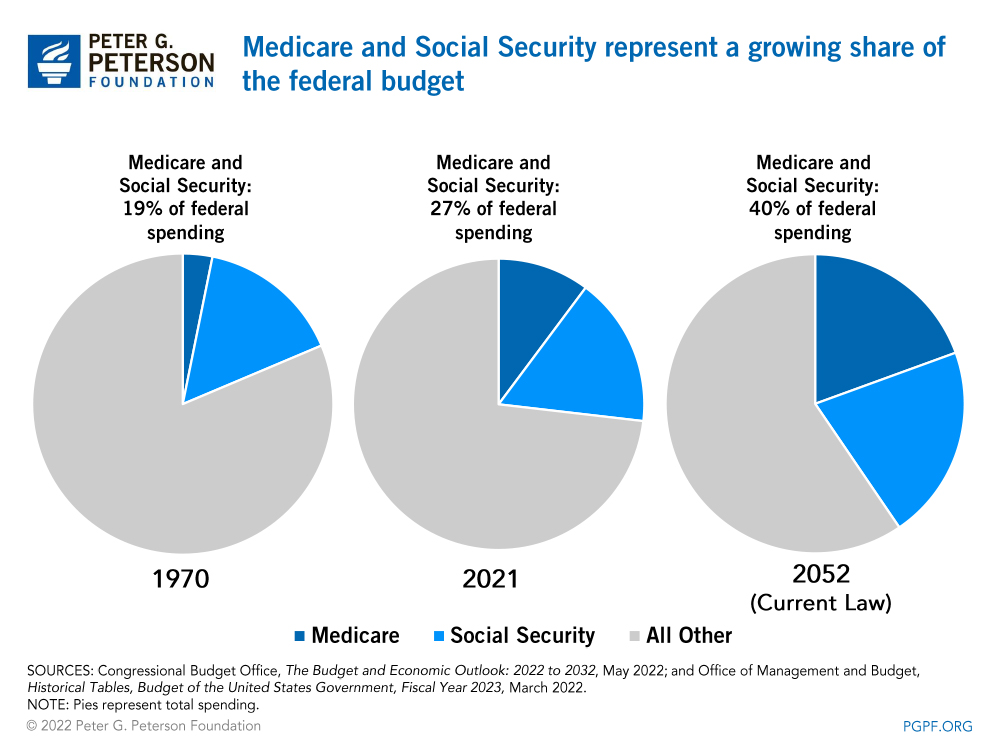

5. As the population ages and healthcare costs rise, Social Security and Medicare will take up an increasingly large portion of the federal budget. As those programs continue to grow, other spending, including important investments in areas such as education and infrastructure, could be crowded out.

Image credit: Getty Images

Further Reading

Lawmakers are Running Out of Time to Fix Social Security

Without reform, Social Security could be depleted as early as 2032, with automatic cuts for beneficiaries.

Budget Basics: How Does Social Security Work?

Social Security is the largest single program in the federal budget and typically makes up one-fifth of total federal spending.

Budget Basics: Unemployment Insurance Explained

The Unemployment Insurance program is a key counter-cyclical tool to help stabilize the economy and speed recovery during downturns or crises.