Programs to support children are a key component of the federal budget and represent a critical investment in the nation’s future. The latest Kids’ Share report from the Urban Institute provides a view of federal resources targeted to children, placing such spending in the larger context of the country’s budget. In 2023, federal resources dedicated to children totaled $694 billion — that support can help alleviate child poverty and support the development of the next generation of productive adults.

Here are the top six takeaways from the latest Kids’ Share report, with further detail below:

- Federal resources dedicated to children averaged $8,990 per child in 2023;

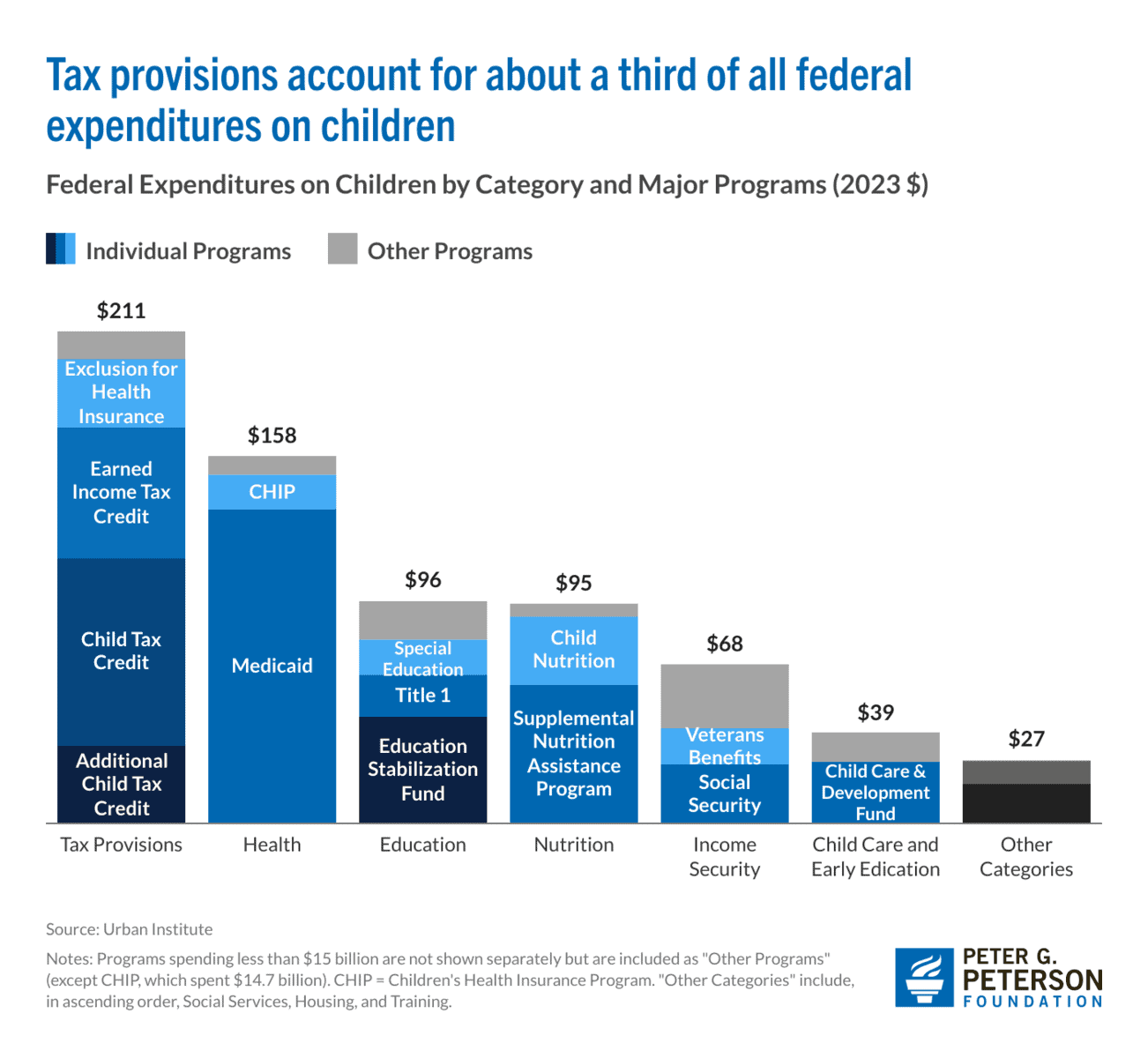

- Certain tax provisions account for about a third of all federal expenditures on children;

- Only 9 percent of the federal budget goes toward kids;

- The expiration of COVID-19 relief contributed to an increase in child poverty;

- Federal spending on children is projected to decline as a share of the budget; and

- The United States spends more on interest on the national debt than on children.

Federal Resources Dedicated to Children Totaled $8,990 per Child

Those expenditures consist of two major categories:

- Federal spending, which includes programs such as Medicaid as well as the refundable portions of tax credits such as the Child Tax Credit (CTC), averaged $7,340 per child. Such programs are treated as outlays in the federal budget.

- Tax reductions, which include the non-refundable portions of tax credits, averaged $1,650 per child. Such provisions reduce the amount of revenues collected by the federal government and therefore are not counted as federal spending.

The amount of federal resources dedicated to children decreased by $1,200 per child from 2022 primarily due to declines in COVID-19 relief measures that targeted children and families, such as the expanded CTC and Supplemental Nutrition Assistance Program (SNAP) benefits.

Tax Provisions Account for About a Third of All Federal Expenditures on Children

Tax provisions constituted 30 percent of all federal expenditures on children in 2023, the largest such category. Tax provisions that benefit children — primarily the CTC and the earned income tax credit — totaled $211 billion in 2022 (including $84 billion in refundable tax credits that are classified as spending).

Health programs — largely stemming from Medicaid and the Children’s Health Insurance Program (CHIP) — were the second largest category, comprising $158 billion, or 23 percent, of federal expenditures on children. Other major categories include:

- Nutrition programs, such as SNAP, totaled 14 percent;

- Education programs, such as the Education Stabilization Fund and Title I funding to schools with high percentages of children from low-income families, totaled 14 percent;

- Income security programs, such as Social Security survivors’ and dependents’ benefits, totaled 10 percent.

Other programs that benefit children — such as child care and early education, social services, housing, and training — received about 10 percent of federal expenditures on children.

Only 9 Percent of Federal Outlays Goes Toward Children

Federal spending on children (which excludes tax reductions) totaled $567 billion in 2023, or 9 percent of the federal budget. In comparison, 43 percent of outlays went towards health and retirement benefits for adults 18 years of age and older, 13 percent went towards defense spending, and 11 percent went to interest on the federal debt.

As COVID-19 Relief Expired, Child Poverty Increased

As a result of the expanded federal aid provided to children from pandemic relief, child poverty fell in 2020 and 2021 according to the supplemental poverty measure (SPM), which accounts for government programs designed to assist low-income families. Child poverty dropped from 12.6 percent in 2019 to 9.7 percent in 2020 and 5.2 percent in 2021. However, as federal aid for children waned, child poverty increased to pre-pandemic levels in 2022 and rose again in 2023 to 13.7 percent. Poverty rates for adults also fell during the pandemic but to a lesser extent.

Federal Spending on Children is Projected to Decline as a Share of the Budget

Since the early 2000s, federal spending on children as a portion of the budget has been around 10 percent. However, that share is projected to decline significantly over the next decade from 9 percent in 2023 to 6 percent by 2034, a 33 percent decline in the share of the budget devoted to children. The largest share of federal spending will continue to go towards the adult portions of Social Security, Medicare, and Medicaid — with such spending in those programs set to increase from 43 percent in 2023 to 48 percent by 2034.

The United States Spends More on Interest Payments on the National Debt than on Children

One of the most damaging effects of rising debt is growing interest costs, which makes it harder to invest in our nation’s future. In 2023, spending on interest payments totaled $658 billion — nearly $100 billion (14 percent) more than federal spending on children, and growing interest costs are expected to rapidly outpace spending on children over the next 10 years.

By 2034, the Congressional Budget Office projects that interest costs will increase to $1.7 trillion. That growth would crowd out spending on other national priorities including America’s children. The federal budget is a statement of the nation’s priorities, and the United States is on track to spend more on net interest costs than the next generation.

Conclusion

Government resources dedicated to children was bolstered by pandemic relief aid, but as that relief waned, federal expenditures on children decreased over the past two years. In the coming decade, the share of the federal budget devoted to children is projected to further decline as the share devoted to interest payments will rise. As the nation’s fiscal outlook continues on its unsustainable path, it is important that policymakers understand the way debt, deficits, and interest costs affect the federal government’s ability to invest in priorities, including the nation’s children.

Image credit: Karen Ducey/Getty Images

Further Reading

Budget Basics: How Does Social Security Work?

Social Security is the largest single program in the federal budget and typically makes up one-fifth of total federal spending.

Budget Basics: Unemployment Insurance Explained

The Unemployment Insurance program is a key counter-cyclical tool to help stabilize the economy and speed recovery during downturns or crises.

How Did the One Big Beautiful Bill Act Affect Federal Spending?

Overall, the OBBBA adds significantly to the nation’s debt, but the act contains net spending cuts that lessen that impact.