President’s Budget Would Reduce Deficits by Raising Taxes on the Wealthy and Corporations

Today, the Biden Administration released its budget for fiscal year 2025, calling for a reduction in federal deficits by $3.2 trillion over the next decade relative to current law. The budget includes policies that would increase revenues over the next 10 years — more than offsetting the proposed spending increases over that period. While this budget would be a step in the right direction for addressing the country’s fiscal trajectory, it does not adequately address the underlying structural imbalance that defines our fiscal outlook in the decades ahead.

Below are the key takeaways from the budget:

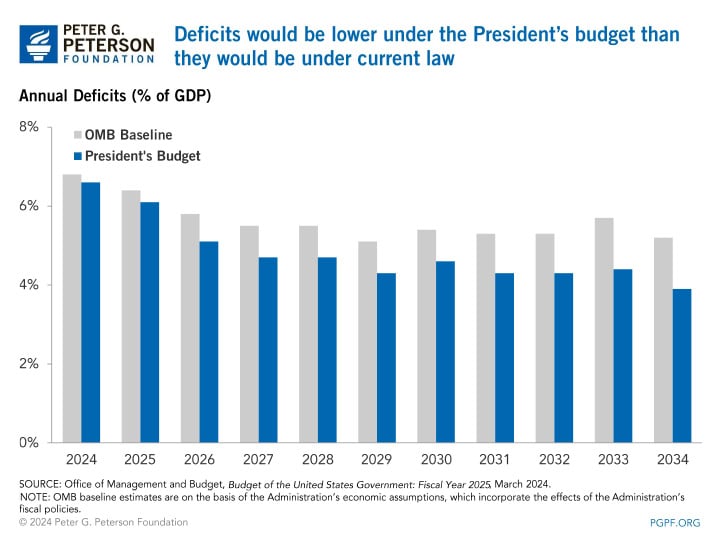

1. The President’s budget would reduce deficits by $3.2 trillion over the next decade, relative to current law. If the Administration’s budget were enacted, annual deficits would total $16.3 trillion over the next 10 years, less than the $19.5 trillion cumulative deficit the Administration projects under current law. As a percentage of gross domestic product (GDP), the deficit would drop from 6.3 percent of GDP in 2023 to 3.9 percent in 2034; however, those levels would remain above the 50-year average of 3.7 percent.

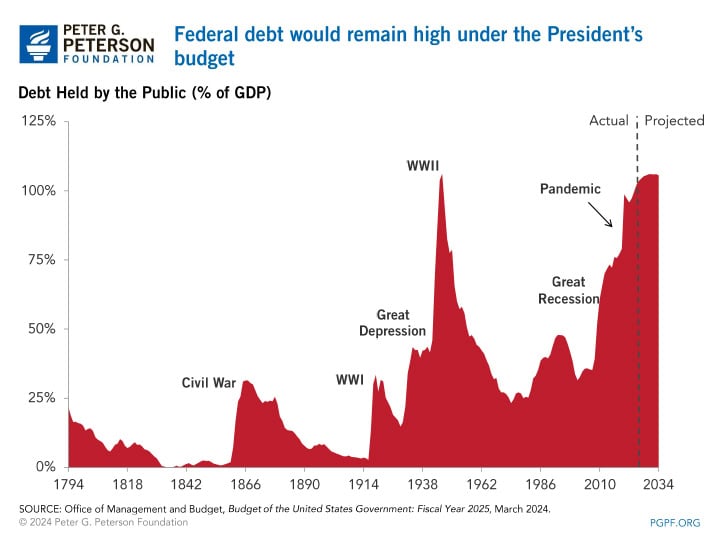

2. Despite a reduction in projected deficits, debt would rise under the President’s budget. While the Administration’s proposals would reduce deficits relative to current law, federal spending would still outpace revenues over the period — causing the national debt to grow, albeit at a slower rate. According to the Administration, debt held by the public would increase from 97.3 percent of GDP at the end of 2023 to nearly 106 percent in 2034 — barely below the historic high of 106.1 percent recorded in 1946.

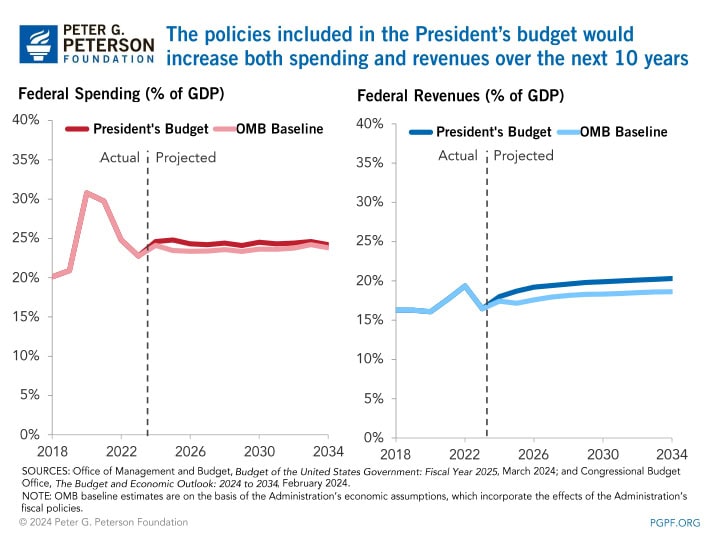

3. The President’s budget would significantly increase both federal revenues and spending. Under the Administration’s budget, federal revenues over the 10-year period would be $4.9 trillion higher than they would be under current law largely due to new or increased taxes. Spending under the President’s budget, meanwhile, would be $1.7 trillion larger over the 2025 to 2034 period than it would be under current law — most of which is due to increased spending on programs addressing child care, early learning, higher education, and housing. While federal outlays on Medicare would decrease by $260 billion under the President’s budget, spending on Social Security benefits would remain unchanged from current law.

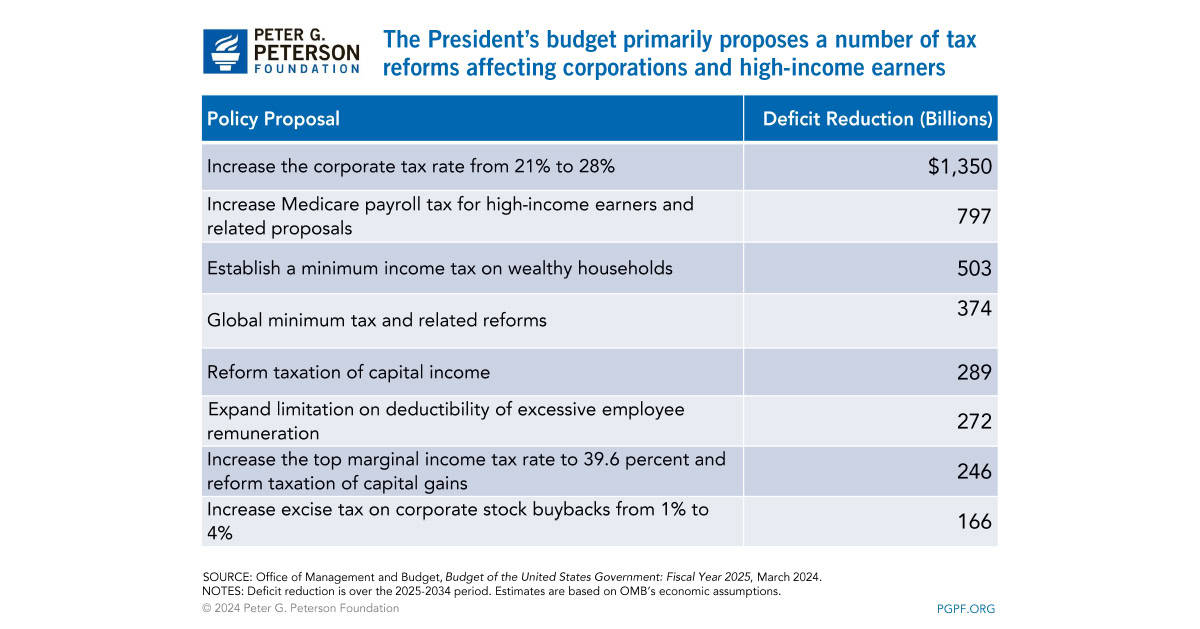

4. The President’s budget would increase revenues primarily by raising or establishing taxes on wealthy households and corporations. The Administration’s budget would raise the corporate tax rate and implement other changes to the corporate tax code; it would also increase tax rates for high-income households (those earning above $400,000 a year). As part of the Administration’s tax policy, they advocate for making some changes to the Medicare payroll tax, which they estimate would extend the solvency of the Hospital Insurance trust fund indefinitely.

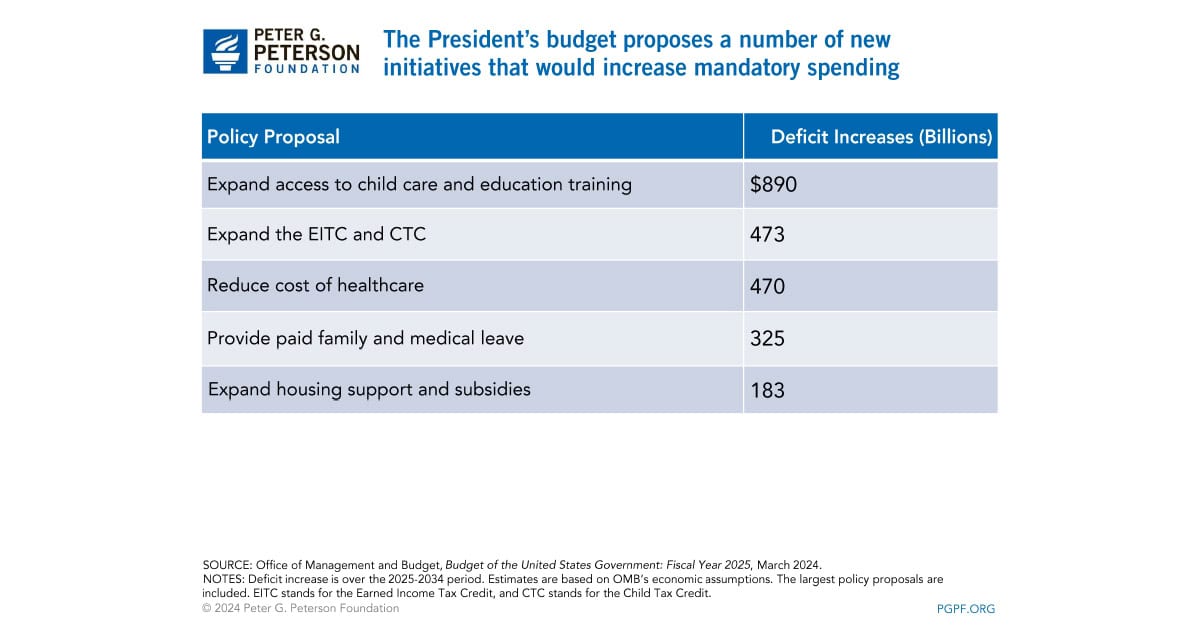

5. Under the President’s budget, mandatory spending would increase as a share of the economy. Over the 2025–2034 period, mandatory spending would be $2.5 trillion greater than under current law, rising from 13.9 percent of GDP in 2023 to 15.9 percent of GDP in 2034. In particular, the President’s budget would expand spending on child care and education, certain healthcare programs, and housing.

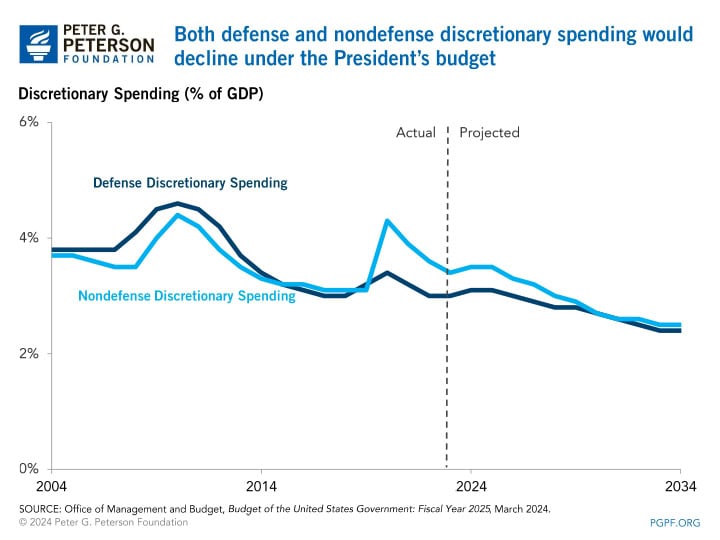

6. Discretionary spending — covering both defense and nondefense programs — would decrease as a share of the economy under the President’s budget. For 2025, the Administration’s budget requests an increase of nearly 1 percent in base funding for discretionary programs, which does not include funding for emergencies and certain other categories, compared to the levels enacted in 2023 (appropriations for 2024 have yet to be finalized). Budget authority for defense discretionary programs would increase by 4.3 percent, whereas nondefense discretionary programs would decrease by 3.4 percent. Over the 2025–2034 period, total discretionary spending would be $453 billion lower than under the Administration’s baseline. It would also be considerably lower as a share of GDP than it is today — falling from 6.4 percent of GDP in 2023 to 4.8 percent in 2034 under the President’s budget.

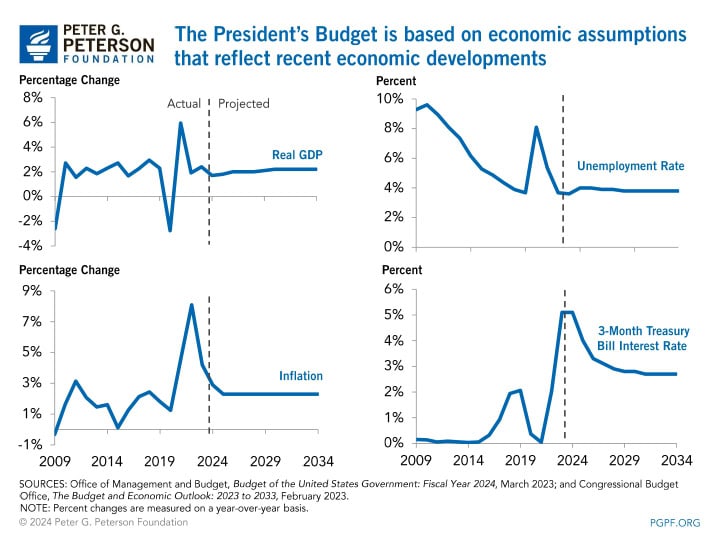

7. The President’s budget assumes that inflation and interest rates will fall. The Administration’s budget, which is based on its economic assumptions formulated in November 2023, assumes that interest rates and inflation will moderate over the coming decade. For example, the Administration assumes that interest rates for 3-month Treasury securities over the next few years will recede from the current level of 5.5 percent and settle at 2.7 percent by 2031. The Administration also expects that the 10-year Treasury rate will decrease from 4.1 percent now to 3.7 percent by the end of the period. The President’s budget assumes inflation will continue to moderate, falling from 4.2 percent in 2023 to 2.9 percent in 2024 before stabilizing around 2.3 percent over the next decade. Overall, the Administration’s economic forecast is somewhat more favorable than the recent projections from the Congressional Budget Office (CBO).

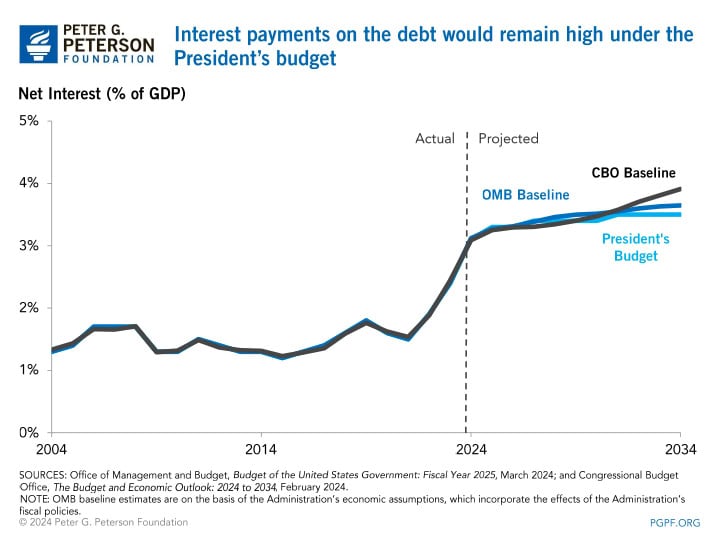

8. Interest payments on the national debt would still be high under the President’s budget. Under the President’s budget, net interest costs would rise from $658 billion, or 2.4 percent of GDP in 2023, to $1.5 trillion, or 3.5 percent of GDP, in 2034; such costs would total $12.2 trillion over the next decade.

President Biden deserves credit for putting forward a budget that reduces deficits by $3.2 trillion over the next decade. However, as remaining deficits are projected to total over $16 trillion during that timeframe, the budget is not sufficient to solve the country’s fiscal challenges. As Foundation CEO Michael Peterson put it, “We need to do more to reform the fundamental structural factors that are driving our growing debt.” A more comprehensive budget proposal would fully address those drivers of debt. As budget season gets underway, the President and Congress should work together to establish priorities that support inclusive economic growth and put America on a more solid fiscal foundation.

Image credit: Photo by Getty Images

Further Reading

What Is the National Debt Costing Us?

Programs that millions of Americans depend on and care about may be feeling a squeeze from interest costs on our high and rising national debt.

Interest Costs on the National Debt Are Reaching All-Time Highs

The most recent CBO projections confirm once again that America’s fiscal outlook is on an unsustainable path — increasingly driven by higher interest costs.

New Report: National Debt Outlook Gets Worse as Interest Costs Exceed $1 Trillion Annually

A new CBO report shows that the national debt outlook worsened from last year’s projections.