From 2020 to 2022, the federal government enacted several pieces of legislation related to the COVID-19 pandemic. Now, as part of a deal to suspend the debt ceiling, policymakers are rescinding the remaining funding for COVID-19 relief as a means to reduce federal spending.

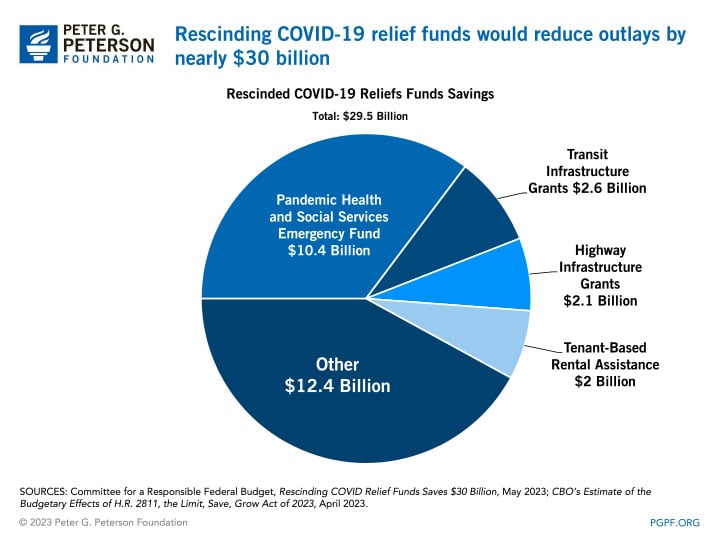

The Congressional Budget Office (CBO) estimates that rescinding the remaining $56 billion in funding from appropriations related to the pandemic would result in savings of $30 billion in outlays over the next few years. CBO’s estimate of savings reflects their assumption that some of the authority provided would never have been spent.

The CRFB estimates the largest savings would come from:

- Public Health and Social Services Emergency Fund ($10.4 billion) – funds intended for supporting health services, supplies, and other salaries and administrative expenses

- Transit Infrastructure Grants ($2.6 billion) – funds allocated to support transit capital investments

- Highway Infrastructure Grants ($2.1 billion) – federal funding allocated for highway infrastructure

- Tenant-Based Rental Assistance ($2.0 billion) – funds allocated for emergency rental assistance

The remaining balance is spread across over 50 accounts.

Image credit: Photo by George Frey/Getty Images

Further Reading

Budget Basics: The National Flood Insurance Program

The National Flood Insurance Program is run by the federal government to reduce the impact of flooding on private and public structures.

Why Did the Federal Government Get Involved in Student Loans?

Skyrocketing student debt has generated significant discussion about ways to improve the financing of higher education in the United States.

How Do Federal Student Loans Affect the National Debt?

Student debt held has been steadily increasing ever since the federal government switched to direct lending.