The 2023 Deficit Is Projected To Total $1.5 Trillion. Here’s Why It Could Be Even Higher

Due to a structural imbalance between revenues and spending, the federal government continues to run large and growing budget deficits. For 2023, the Congressional Budget Office (CBO) estimated in May that the federal budget deficit will total $1.5 trillion — about $160 billion larger than in 2022. The increase in the deficit this year is mainly driven by higher interest costs, continued growth in spending on Social Security and Medicare, and lower individual income tax receipts. However, this year’s deficit may turn out to be even larger because individual income tax revenues in April were lower than CBO expected, but not accounted for in their latest projections.

Here is a closer look at the drivers of the growing gap between spending and revenues in 2023.

Spending in Many Areas Will Be Higher in 2023

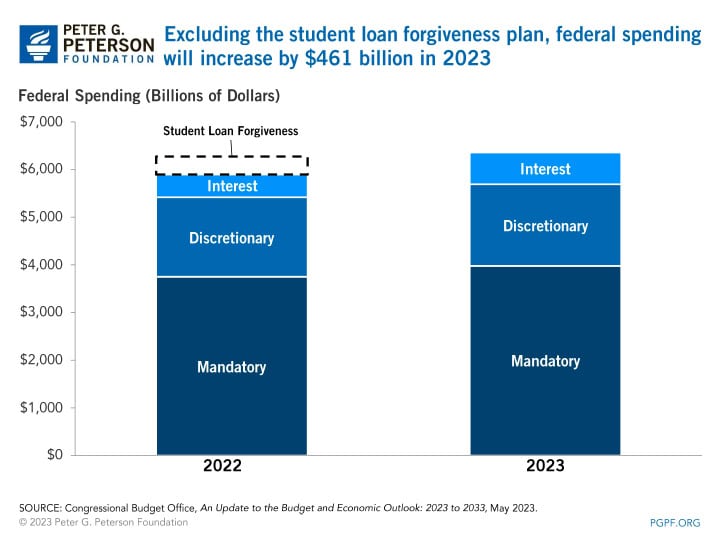

According to CBO, federal outlays in 2023 will total $6.4 trillion, $81 billion larger than last year. As a percent of gross domestic product (GDP), this year’s outlays will equal 24 percent of GDP, compared to 25 percent of GDP in 2022. The growth in the dollar amount results from a net increase in spending on a number of programs, as well as from higher interest costs. Some of the largest increases include:

- Interest Costs: The government’s interest payment on federal debt, which is primarily driven by the size of the debt held by the public and recent interest rates, is projected to total $663 billion (2.5 percent of GDP) in 2023, a 39 percent increase from the $476 billion recorded for last year. Much of the growth in interest costs is driven by higher interest rates, which have been raised 10 times since early 2022 by the Federal Reserve in response to high inflation.

- Social Security: Spending on Social Security is projected to increase by 11 percent from $1.2 to $1.3 trillion this year, largely due to the 8.7 percent cost-of-living adjustment (COLA) effective January 2023, the highest increase in four decades. In addition, the growing number of retirees and increasing life expectancy has increased outlays for the program.

- Spectrum Auctions: The Federal Communications Commission (FCC) occasionally conducts auctions of licenses for commercial use of electromagnetic spectrum, the receipts of which are recorded in the federal budget as negative outlays. While the FCC conducted several auctions in 2022 and generated $104 billion, FCC’s authority to conduct spectrum auctions has temporarily lapsed for the first time in March 2023. CBO estimates auction receipts to fall to $0.2 billion in 2023.

- Medicare: CBO estimates that Medicare outlays will rise from $747 billion in 2022 to $826 billion in 2023 (an increase of 10 percent) due to growth in the number of beneficiaries as well as rising costs for medical care. In addition, CBO expects recoupments from COVID-related accelerated and advance Medicare payments to providers to fall.

- Student Loans: Newly proposed modifications to income-driven repayment (IDR) plans for federal student loans would reduce loan payments for low- and middle-income borrowers. CBO estimates that the plan would increase federal outlays by nearly $71 billion in 2023.

The deficit of $1.4 trillion for 2022 included $379 billion related to the student loan forgiveness announced by the Biden Administration in August 2022. That plan, if implemented (it is currently under review at the Supreme Court), would reduce collections of principal and interest payments from borrowers in the future; the cost recorded last year represents the estimated present value of the total reduction in future collections of loan payments.

Offsetting other increases, spending in certain areas is expected to fall in 2023, as a number of temporary provisions enacted in response to COVID-19 end. CBO anticipates that outlays for refundable tax credits will decline by $145 billion, to $107 billion in 2023, while federal funding provided to state, local, and tribal governments under the Coronavirus Relief Fund will fall from $106 billion in 2022 to $6 billion in 2023.

Individual Income Tax Revenues Will Be Lower This Year, but Other Revenue Sources Will Grow

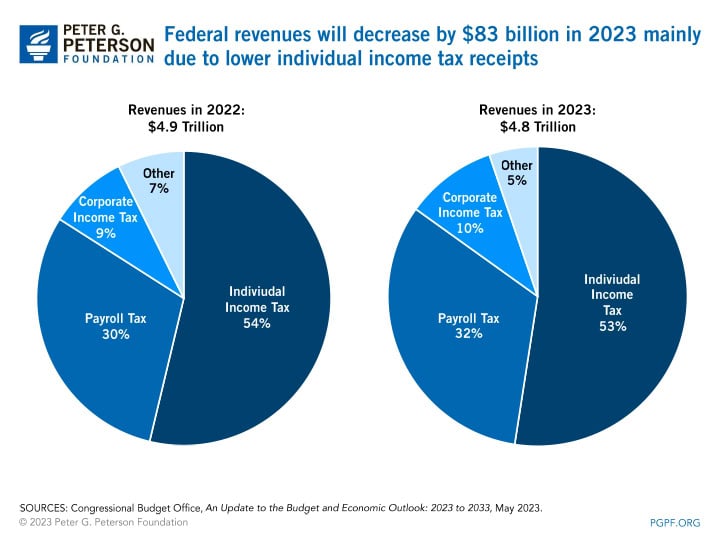

Revenues in 2023 are projected to total $4.8 trillion, or 18.4 percent of GDP. That amount is $83 billion smaller than the $4.9 trillion, or 19.6 percent of GDP, recorded for 2022. The decrease in revenues primarily stems from lower income tax receipts, while receipts from other sources are expected to increase slightly. The largest changes in revenues include:

- Individual Income Taxes: According to CBO’s projections in May, individual income tax receipts are expected to fall by 4 percent — from $2.6 trillion, or 10.5 percent of GDP, in 2022 to $2.5 trillion in 2023, or 9.6 percent of GDP. Revenues from individual income taxes were relatively high in 2022 because the government collected certain taxes that were deferred during the COVID-19 pandemic. In addition, high capital gains realizations and the spike in inflation likely contributed to a boost in revenues last year. However, CBO’s recent projections do not account for lower-than-expected collections of individual income tax receipts this April. Total collections of individual income taxes for 2023 could be well below the amount in CBO’s report.

- Payroll Taxes: Revenues from payroll taxes, which mostly fund Social Security and Medicare, are projected to rise 5 percent, from $1.5 trillion (5.9 percent of GDP) in 2022 to $1.6 trillion (6.0 percent of GDP) in 2023. The projected increase in payroll tax receipts is mainly due to an expected rise in workers’ earnings as a share of GDP.

- Corporate Income Taxes : CBO estimates that receipts from corporate income taxes in 2023 will total $475 billion, or 1.8 percent of GDP; that would be an 12 percent increase from the $425 billion (1.7 percent of GDP) recorded for last year. The increase mainly stems from certain provisions under the 2017 Tax Cuts and Jobs Act as well as the 2022 reconciliation act.

- Other Sources: Other sources of revenues — including estate and gift taxes, excise taxes, and customs duties — are projected to total $252 billion (1.0 percent of GDP) in 2023, which is 29 percent smaller than the $357 billion (1.4 percent of GDP) collected in 2022.

Conclusion

According to CBO, this year’s deficit will be about $160 billion larger than the deficit recorded for last year. Excluding student loan forgiveness, the deficit would be even higher. And if revenues for 2023 turn out to be lower than currently projected, this year’s deficit will grow noticeably larger. Any single year’s deficit is just a snapshot in time, but the trend of deficits rising annually, fueled by a structural mismatch of spending and revenues, is a clear indication that lawmakers must take action in order to establish a sustainable fiscal path for the nation.

Image credit: Photo by Chip Somodevilla /Getty Images

Further Reading

The Fed Held Its Target Range After Reducing the Short-Term Rate Three Meetings in a Row

High interest rates on U.S. Treasury securities increase the federal government’s borrowing costs.

How Does the United States’ Fiscal Position Compare to Other Countries’?

The United States has higher budget deficits and spends more on interest costs than its peers.

Top 10 Reasons Why the National Debt Matters

At $38 trillion and rising, the national debt threatens America’s economic future. Here are the top ten reasons why the national debt matters.