Recent fiscal news makes clear that America has a dangerously unsustainable national debt outlook — and voters are calling on their leaders to take concrete actions to put us on a better path.

On September 15, the national debt surpassed $33 trillion for the first time, an unfortunate fiscal milestone. And on June 28, the Congressional Budget Office (CBO) released its latest Long-term Budget Outlook, which showed that the national debt will reach nearly twice the size of our economy over the next 30 years, with interest costs alone totaling $71 trillion.

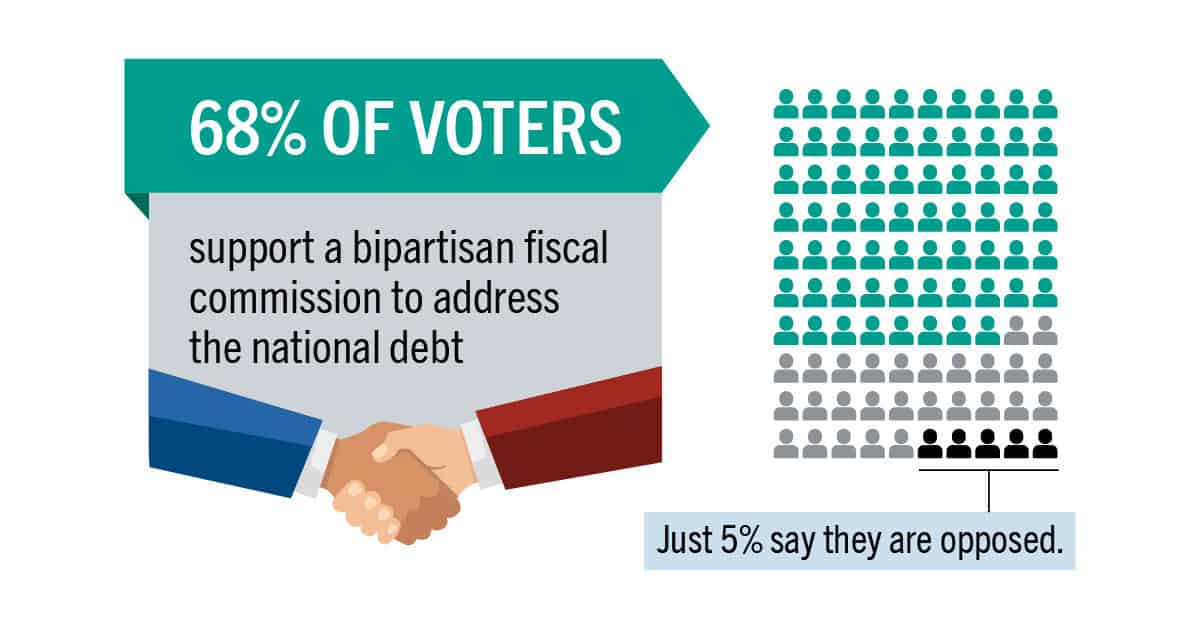

Given this troubling outlook, a strong majority of US voters support a bipartisan fiscal commission. Recent polling shows that more than 68% of voters, including 69% of Democrats and 67% of Republicans, support a fiscal commission process to recommend a comprehensive package of reforms to reduce our national debt, and only 5% of all voters are opposed.

A number of lawmakers, including leaders from both sides of the aisle, have also expressed interest in a fiscal commission — and the concept of a commission has been floated in a number of recent budget proposals.

As Peterson Foundation CEO Michael Peterson recently stated:

“Rather than drifting from one short-term crisis to the next, a commission would enable a more comprehensive process to address the structural drivers of the growing imbalance between spending and revenues. A successful commission would include ideas, input and sacrifices from both parties, and all areas of the budget should be on the table. While these issues are always politically challenging, the truth is that a wide majority of voters across party lines support a commission process to reduce the national debt.”

Image credit: Getty Images

Further Reading

Top 10 Reasons Why the National Debt Matters

At $38 trillion and rising, the national debt threatens America’s economic future. Here are the top ten reasons why the national debt matters.

What Is the National Debt Costing Us?

Programs that millions of Americans depend on and care about may be feeling a squeeze from interest costs on our high and rising national debt.

Interest Costs on the National Debt Are Reaching All-Time Highs

The most recent CBO projections confirm once again that America’s fiscal outlook is on an unsustainable path — increasingly driven by higher interest costs.