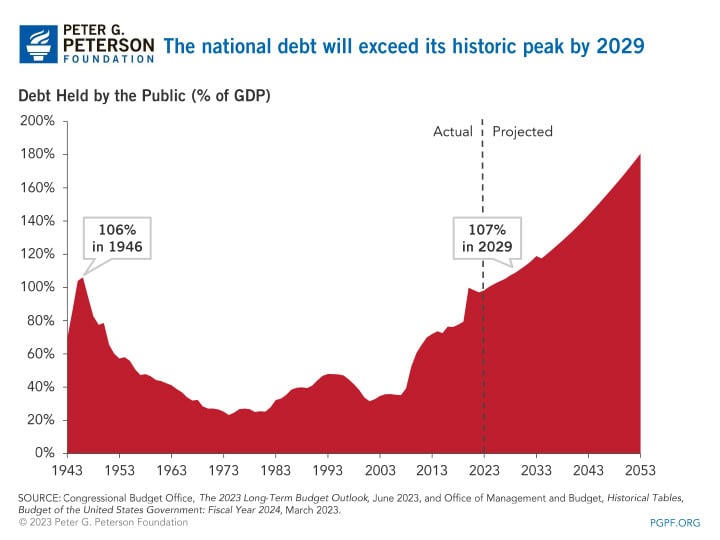

The United States is approaching record levels of debt. Debt held by the public totaled 97 percent of gross domestic product (GDP) at the end of 2022 and is on track to exceed its previous all-time high, which occurred just after World II, by 2029. Rapidly growing federal debt crowds out private investment, limits the government’s ability to respond to crises, and presents a burden on future generations. Due to a range of factors including strong economic growth, debt steadily decreased after World War II, falling to 23 percent of GDP in 1974. New research suggests that fiscal and economic policies adopted during and after the war also played a significant role in reducing the debt-to-GDP ratio. This blog looks at why the debt fell in the decades after World War II and why that scenario is unlikely to recur today.

Fiscal and Economic Policies Helped to Reduce Debt-to-GDP After 1946

A recent working paper from researchers Julien Acalin and Laurence Ball pointed to two key factors – in addition to economic expansion – that fueled the fall in the debt-to-GDP ratio after 1946: primary surpluses and interest rate distortions.

Primary Surpluses

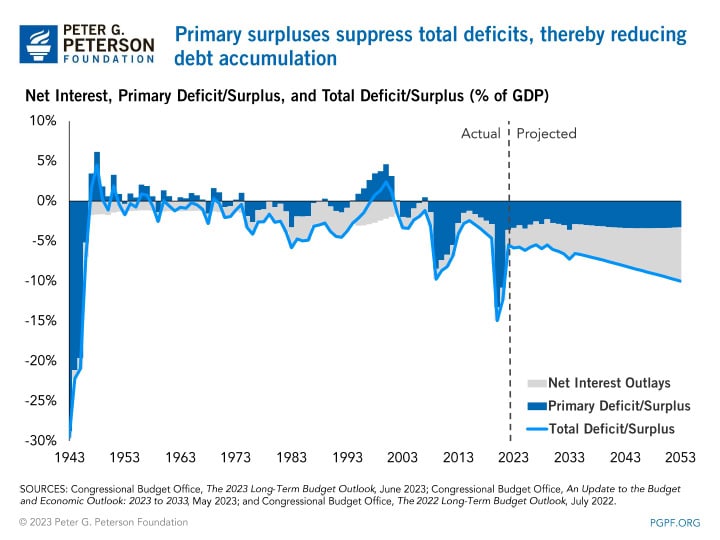

During World War II, the United States took on large budget deficits to finance the war, which accumulated into the largest debt-to-GDP ratio in U.S. history. However, spending dropped after the war, leading to significant primary surpluses (total revenues minus total noninterest spending). The federal government continued to record primary surpluses over most of the next three decades, averaging 0.9 percent of GDP from 1947 through 1974. Primary surpluses can offset some or all net interest costs, lowering total deficits or contributing to total surpluses.

Interest Rate Distortions

As cited by Acalin and Ball, the second factor that caused the debt-to-GDP ratio to fall after World War II was interest rate distortions resulting from economic policy implemented by the Federal Reserve from 1942 to 1951. In an effort to control the cost of financing the war debt, the Federal Reserve agreed to cap yields from Treasury bills and bonds. The caps kept the interest rate on government securities low during the period when the debt was being issued and initially rolling over. Further, because much of the issued debt matured over 10 to 30 years, the policy was outlived by its effects and, coupled with high inflation, produced real interest rates that were negative for many government securities.

Conclusion

For a few decades after World War II, the debt-to-GDP ratio decreased as a result of primary surpluses, interest rate distortions, and economic growth – all driven by fiscal and economic policy that restrained the national debt. Given current projections for large primary deficits, demographic trends, and Federal Reserve policy focusing on controlling inflation, the United States should not be expected to grow out of its debt simply through rapid growth of GDP. As a result, approaching an all-time high for the debt-to-GDP ratio should be a wakeup call for lawmakers, and there are many available policy solutions designed for the current fiscal and economic outlook.

Image credit: Photo by Mario Tama/Getty Images

Further Reading

The Fed Reduced the Short-Term Rate Again, but Interest Costs Remain High

High interest rates on U.S. Treasury securities increase the federal government’s borrowing costs.

What Types of Securities Does the Treasury Issue?

Let’s take a closer look at a few key characteristics of Treasury borrowing that can affect its budgetary cost.

Quarterly Treasury Refunding Statement: Borrowing Up Year Over Year

Key highlights from the most recent Quarterly Refunding include an increase in anticipated borrowing of $158 billion compared to the same period in the previous year.