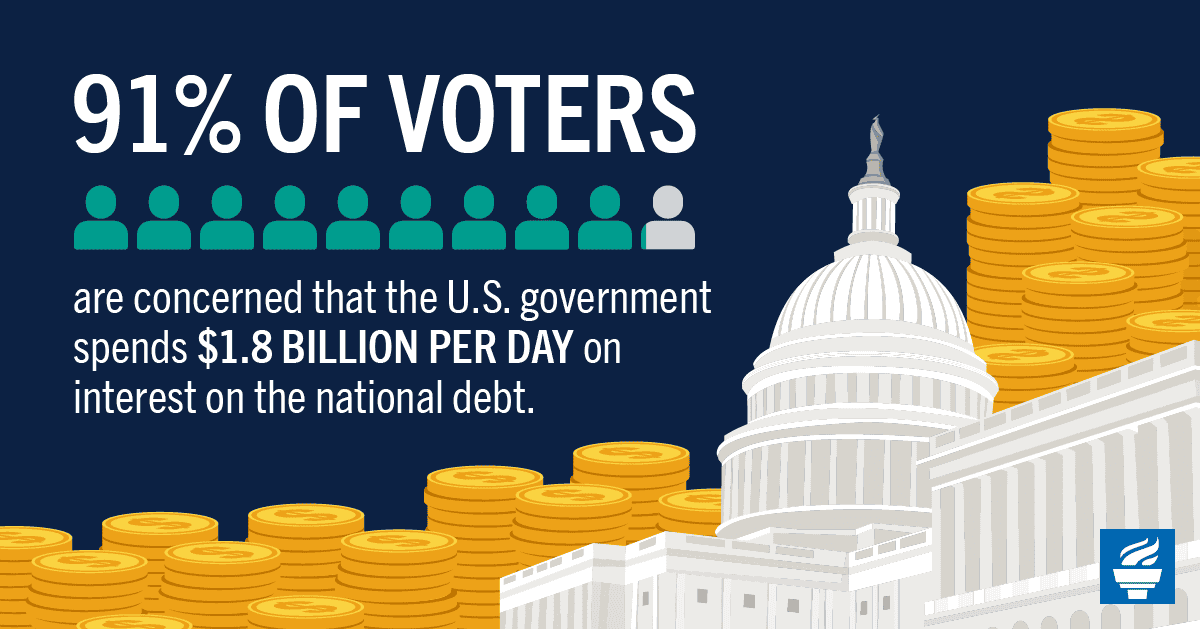

With U.S. Interest Costs Skyrocketing, Voters Overwhelmingly Call for Fiscal Commission

As a new House Speaker takes the helm and Congress faces another looming government shutdown deadline, U.S. voters are focused on big-picture fiscal challenges, including the growing burden of interest costs.

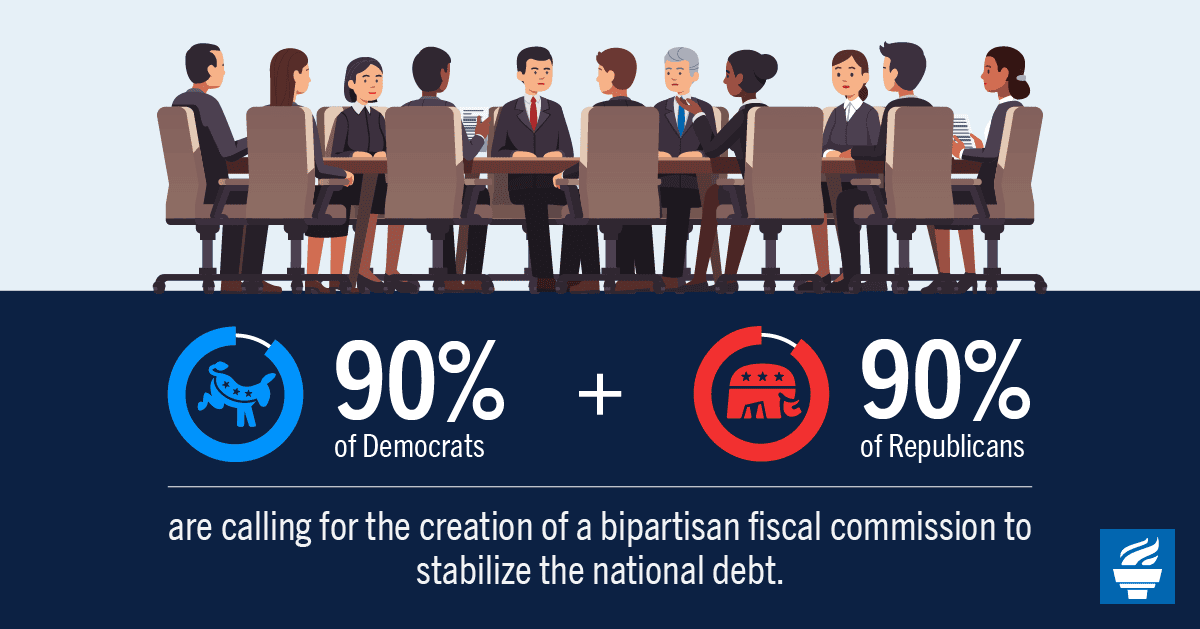

New polling by Democratic firm Global Strategy Group and Republican firm North Star Opinion Research shows that voters are deeply concerned about interest costs eating up more and more of the federal budget. Moreover, there is overwhelming bipartisan support for the creation of a dedicated commission to recommend fiscal solutions.

On Capitol Hill, as Congress has drifted from one fiscal crisis to the next, there is growing momentum for a dedicated process to tackle our debt with lawmakers on both sides of the aisle expressing support. Late last month, a bipartisan group of leaders introduced legislation to establish a commission to recommend a comprehensive package of spending and revenue reforms to stabilize our fiscal outlook.

Further Reading

What Is the National Debt Costing Us?

Programs that millions of Americans depend on and care about may be feeling a squeeze from interest costs on our high and rising national debt.

Interest Costs on the National Debt Are Reaching All-Time Highs

The most recent CBO projections confirm once again that America’s fiscal outlook is on an unsustainable path — increasingly driven by higher interest costs.

New Report: National Debt Outlook Gets Worse as Interest Costs Exceed $1 Trillion Annually

A new CBO report shows that the national debt outlook worsened from last year’s projections.