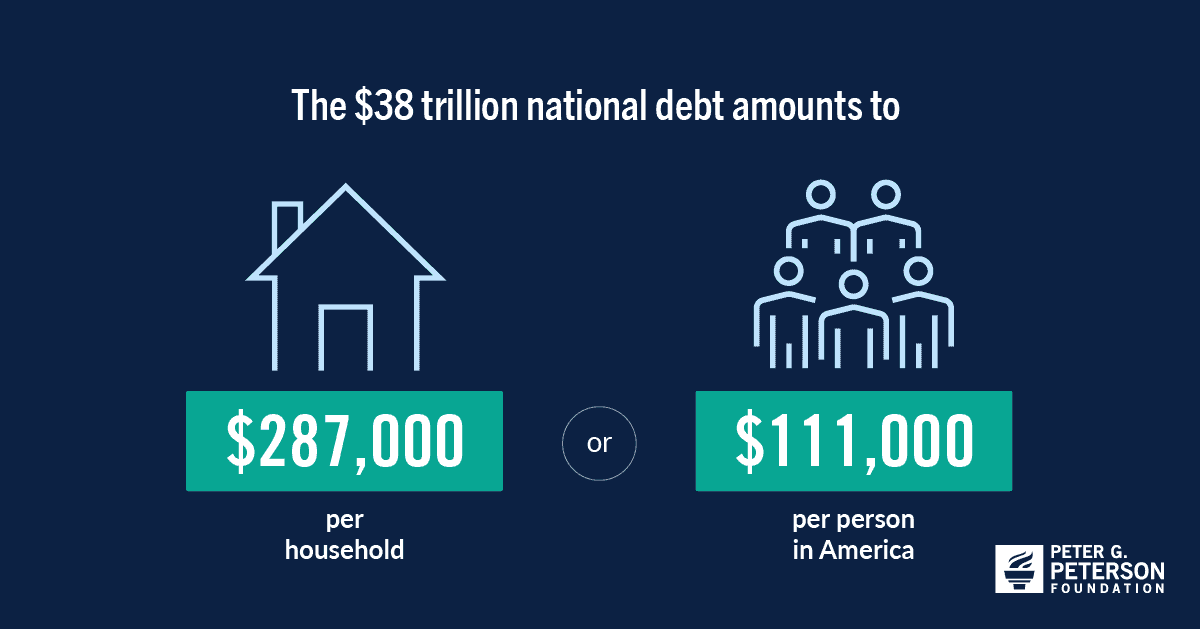

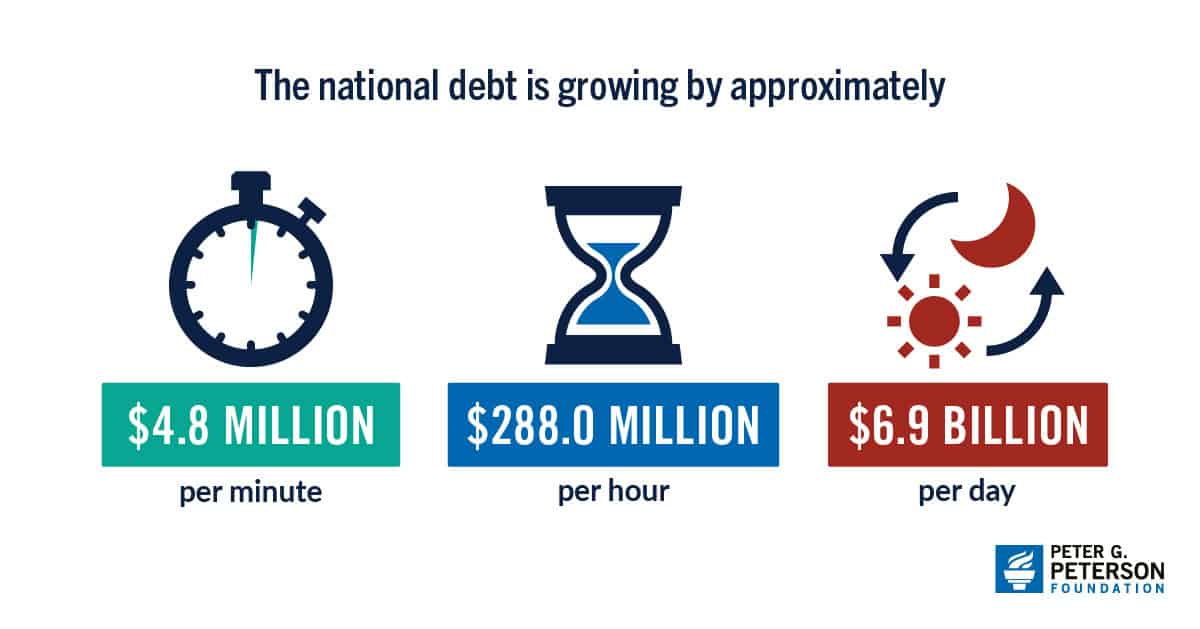

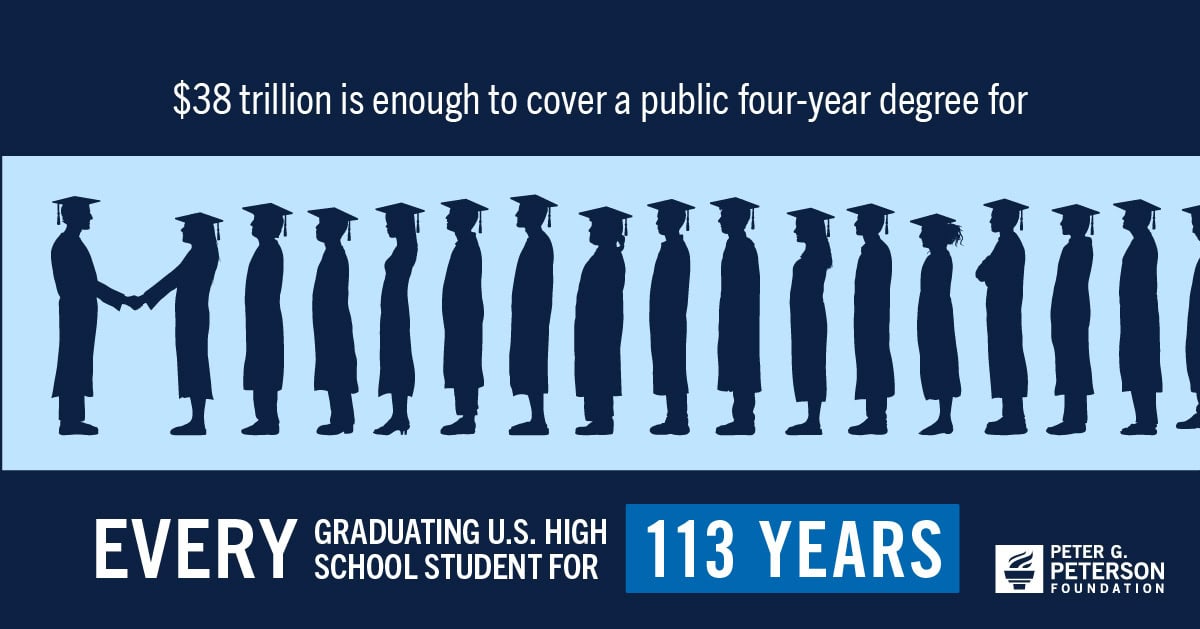

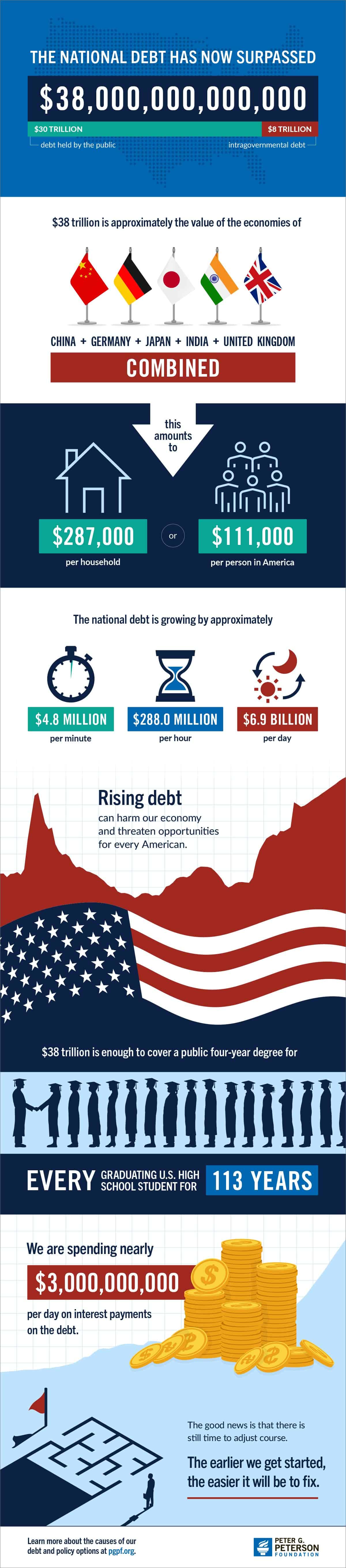

The gross federal debt of the United States has surpassed $38,000,000,000,000. Although the debt affects each of us, it may be difficult to put such a large number into perspective and fully understand its implications. The infographic below offers different ways of looking at the debt and its relationship to the economy, the budget, and American families.

America’s high and rising debt matters because it threatens our economic future. The COVID-19 pandemic rapidly accelerated our fiscal challenges, but we were already on an unsustainable path, with structural drivers that existed long before the pandemic. Putting our nation on a better fiscal path will help ensure a stronger and more resilient economy for the future.

Feel free to share this infographic on X.

Further Reading

What’s the Difference Between the Trade Deficit and Budget Deficit?

The terms “budget deficit” and “trade deficit” can be conflated, but they are distinct measurements of important fiscal and economic concepts.

The Federal Government Has Borrowed Trillions. Who Owns All that Debt?

Most federal debt is owed to domestic holders, but foreign ownership is much higher now than it was about 50 years ago.

The Fed Reduced the Short-Term Rate Again, but Interest Costs Remain High

High interest rates on U.S. Treasury securities increase the federal government’s borrowing costs.