On March 27, Congress passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act, the third phase of legislation designed to lessen the economic impact of the COVID-19 pandemic.

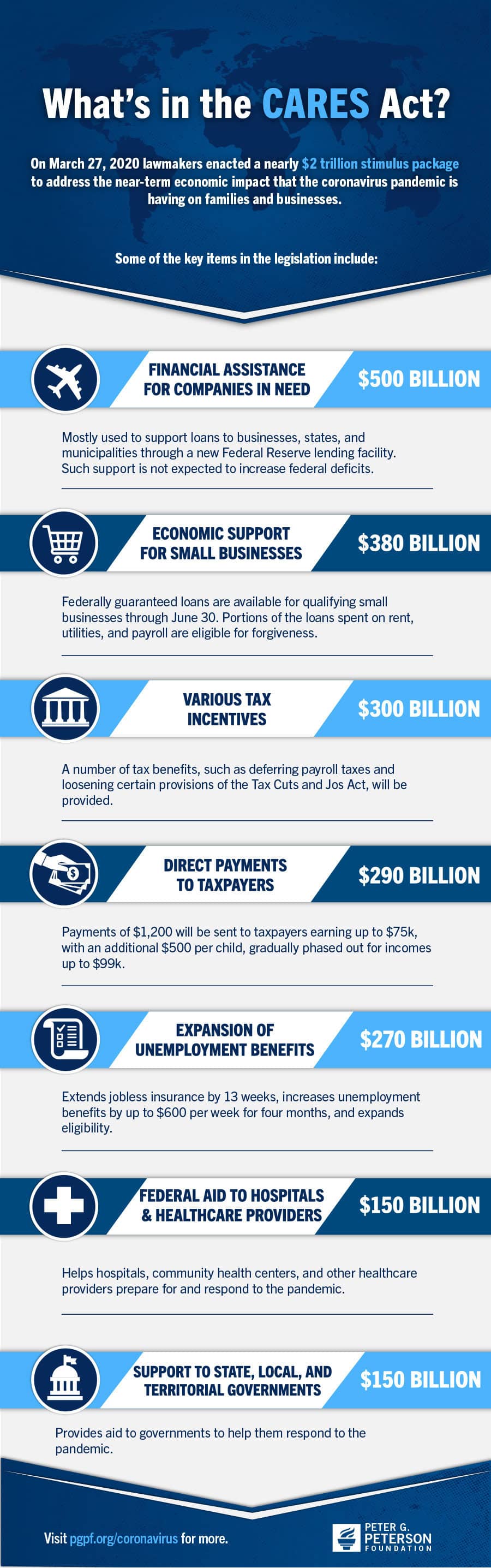

The largest emergency response bill in history, the CARES Act allocates nearly $2 trillion in emergency funding to provide relief to households, small and large businesses, states and municipalities, and healthcare providers, among others. Many commentators have noted that the CARES Act is better characterized as a relief bill, which addresses the more immediate fallout, than a stimulus plan, which would restore regular economic activity and is expected to roll out in subsequent phases.

This infographic breaks down the CARES Act to explain some key funding items in the legislation.

Further Reading

Should We Eliminate the Social Security Tax Cap?

There have been a number of proposals to increase, eliminate, or otherwise adjust the payroll tax cap as a way to shore up Social Security’s finances.

No Taxes on Tips Will Drive Deficits Higher

Here’s how this new, temporary deduction will affect federal revenues, budget deficits, and tax equity.

Three Reasons Why Assuming Sustained 3% Growth is a Budget Gimmick

GDP growth of 3 percent is significantly higher than independent, nonpartisan estimates and historically difficult to achieve.